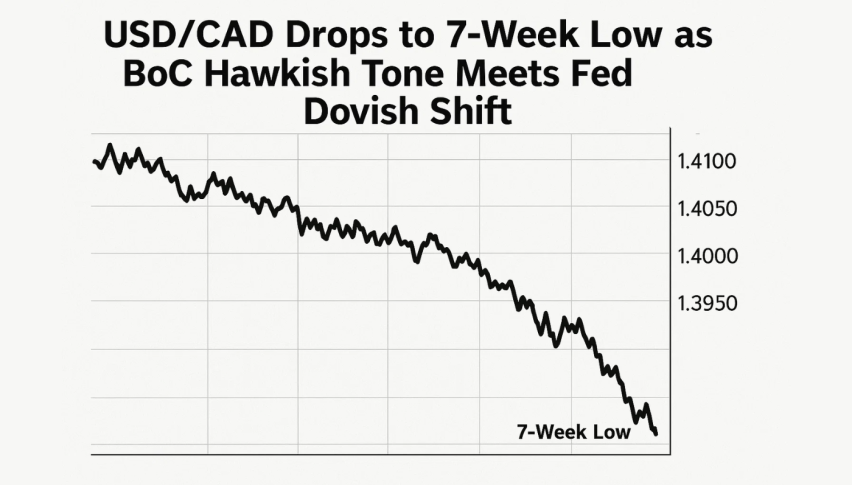

The CAD Jumps After Bank Of Canada Hikes Interest Rates by 0.50%

USD/CAD has lost around 1 cent after the Bank of Canada hiked interest rates by 50bps, increasing them to 1%

Bank of Canada increased interest rates by 50bps today, taking them to 1.00%. Most major central banks have turned hawkish and have increased interest rates by 0.25% at least, with the Bank of England hiking them by 0.65% so far.

Usually higher interest rates are to prevent high inflation which comes from the excessive flow of cash when the economy is running hot, but in this case inflation is coming due to the spike in prices, some of which are speculative and some from sanctions on Russia. However, this helped the CAD, reversing USD/CAD lower.

Bank of Canada interest rate decision on April 13, 2022

- Bank of Canada hikes rates by 50 basis points to 1.00%

- Previous meeting rate was 0.50%

- Maturing Government of Canada bonds on the Bank’s balance sheet will no longer be replaced starting April 25

- “The Governing Council judges that interest rates will need to rise further”

- “The timing and pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.”

- Supply disruptions and increases in commodity prices are primary drivers of the upwardly-revised outlook for inflation

- Core measures of inflation have all moved higher as price pressures broaden

- There is an increasing risk that expectations of elevated inflation could become entrenched

Forecasts:

- BOC expects 3.5% GDP growth this year vs 4.0% in January

- Sees 2023 GDP at 2.5% vs 3.5% in January

- Sees 2024 GDP at 3.25%

- Expects 5.3% inflation in 2022 vs 4.2% in Jan

- Expects 2023 inflation at 2.8% vs 2.3% in Jan

- Sees 2024 inflation at 2.1%

USD/CAD was trading at 1.2670 ahead of the release and after a quick move lower it’s at 1.2605 now. There’s no guidance here on the pace and size of upcoming rate hikes so we will have to wait for the press conference for more details at 11 am ET. So far, everything is in line with estimates.

- We need higher rates and the economy can handle them

- Reiterates that the BOC will act forcefully if need be

- Canadian should expect rates to continue to rise towards more neutral settings, the current estimate is that is between 2-3%

- If demand responds quickly to higher rates and inflationary pressures moderate, it may be appropriate to pause hikes once we get closer to the neutral rate

- On the other hand, we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation to target

- The impact of Russia-Ukraine war on Canada is likely to be small

- Businesses indicated they will need to raise wages to attract workers

- Exports are picking up

- We are concerned about the broadening of inflation in Canada

- Canadians should expect rates in a neutral setting, between 2-3%

- We have an inflation target, not an interest rate target

I believe the comment on ‘forceful’ is a hint of another 50 bps hike in June. USD/CAD has slipped on the comments but it comes at the same time as an improvement in the broad risk trade and a dip in the US dollar.

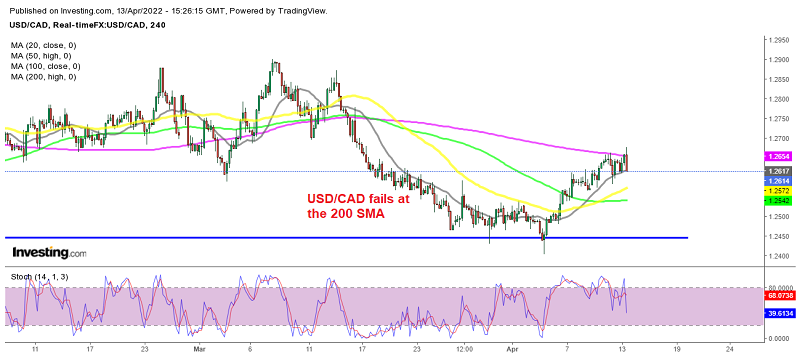

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account