10 Best Forex Brokers Accepting Credit Cards

The 10 best Forex brokers accepting credit cards revealed. We have explored and tested several prominent Forex brokers to identify the 10 best.

10 Best Forex Brokers Accepting Credit Cards (2026)

- FP Markets – Overall, The Best Forex Broker Accepting Credit Cards

- Pepperstone – Ultra-tight spreads and fast execution speeds

- AvaTrade – Access to various trading platforms

- eToro – Strong emphasis on social trading

- Plus500 – Intuitive and easy-to-navigate platform

- Axi – Competitive spreads and reliable execution

- IG – Numerous payment methods, including Credit Cards

- Exness – Strong focus on customer support

- Tickmill – Advanced trading tools and educational resources

- OANDA – Variety of payment methods such as Credit/debit cards and e-wallets

Top 10 Forex Brokers (Globally)

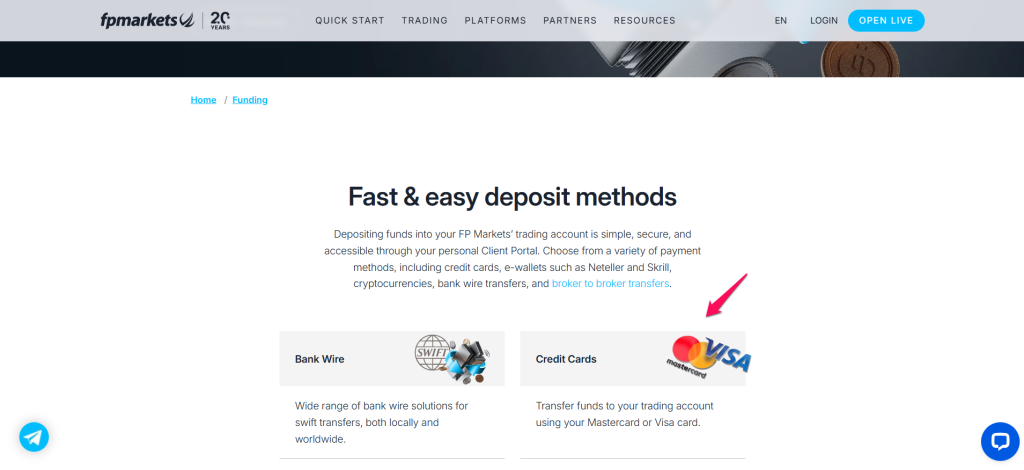

1. FP Markets

FP Markets is a regulated forex and CFD broker that accepts credit cards for deposits and withdrawals. It offers low spreads from 0.0 pips, fast execution, and supports MetaTrader 4, MetaTrader 5, and cTrader platforms.

Frequently Asked Questions

Does FP Markets offer MetaTrader platforms?

Yes, FP Markets extensively supports MetaTrader platforms. They offer both MetaTrader 4 and MetaTrader 5, available as desktop applications, web traders, and mobile apps for iOS and Android. This provides traders with powerful tools for charting, analysis, and automated trading.

Can I use a credit card to deposit funds?

Yes, FP Markets accepts credit and debit cards, specifically Visa and Mastercard, for depositing funds. Deposits made via credit/debit card are typically processed instantly, allowing you to fund your trading account quickly and securely.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and Trusted | IRESS Platform Has Higher Costs |

| Tight Spreads from 0.0 pips | Limited Educational Tools |

| Multiple Platforms | Regional Restrictions |

| Accepts Credit Cards | No Proprietary Platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FP Markets is an authorized and well-regulated forex and CFD broker offering competitive spreads, multiple platforms, and fast execution. It’s a solid choice for traders seeking reliability, though platform fees and regional limitations may apply.

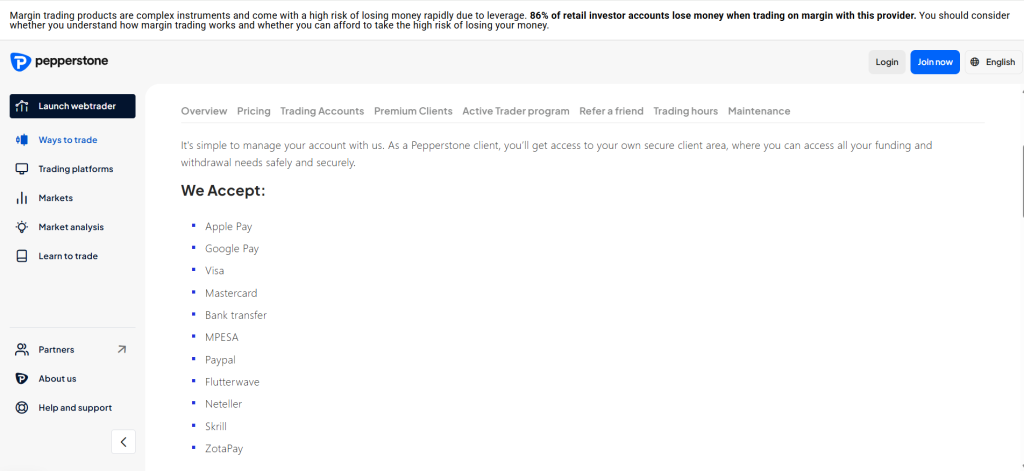

2. Pepperstone

Pepperstone is a globally regulated forex and CFD broker that accepts credit cards for deposits and withdrawals. It offers low spreads from 0.0 pips, fast execution, and supports MetaTrader 4, MetaTrader 5, and cTrader platforms.

Frequently Asked Questions

Does Pepperstone accept credit cards?

Yes, Pepperstone readily accepts credit and debit cards, specifically Visa and Mastercard, for funding your trading account. These deposits are typically processed instantly, allowing for quick access to trading. They also support other methods like bank transfers and various e-wallets.

Is Pepperstone good for beginners?

Yes, Pepperstone is considered a good choice for beginners. They offer competitive fees, strong regulation, user-friendly platforms like MT4 and cTrader, and a helpful demo account for risk-free practice. Their “Standard” account is also designed to be simpler for new traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Globally Regulated | Limited Research Tools |

| Tight Spreads from 0.0 pips | No Proprietary Platform |

| Accepts Credit Cards | Inactivity Fees |

| Multiple Trading Platforms | Crypto Availability Varies |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legit and globally regulated forex and CFD broker known for tight spreads, fast execution, and reliable platforms. It’s ideal for both beginners and experienced traders, though it offers somewhat limited research tools.

3. AvaTrade

AvaTrade is a regulated forex and CFD broker that accepts credit cards for deposits and withdrawals. It offers user-friendly platforms, fixed and floating spreads, and supports MT4, MT5, and AvaTradeGO—making it suitable for traders of all levels.

Frequently Asked Questions

How long do withdrawals take by card method?

AvaTrade aims to process all withdrawal requests within 1 business day. However, the time it takes for funds to reflect in your account varies by method. Credit Card withdrawals can take up to 5 business days.

What is the minimum deposit requirement?

AvaTrade’s minimum deposit requirement is typically $100 (or equivalent in EUR, GBP, AUD) for most account types, including standard and Islamic accounts. This applies to deposits made via credit card, wire transfer, or e-wallets.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | Inactivity Fees |

| Diverse Trading Platforms | Wider Spreads Compared to ECN Brokers |

| Commission-Free Trading | No Stock or Crypto Ownership |

| Islamic Account Available | Slow Withdrawal Processing for Some Methods |

| Local Support in Multiple Countries | Demo Account May Not Reflect Live Spreads |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legal, well-regulated broker offering diverse platforms, commission-free trading, and strong risk management tools. It suits beginners and intermediate traders, though spreads are wider and inactivity fees may apply.

Top 3 Forex Brokers Accepting Credit Cards – FP Markets vs Pepperstone vs AvaTrade

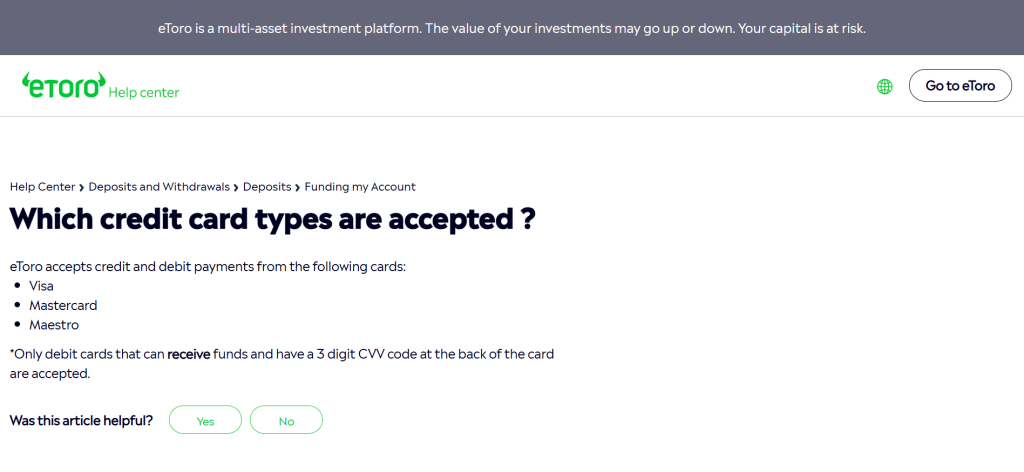

4. eToro

eToro Accepts credit cards (Visa, Mastercard, Maestro) for instant deposits. Minimum deposit of USD 50. No deposit fees from eToro, but card issuers may charge.

Frequently Asked Questions

Does eToro accept credit cards?

Yes, eToro accepts credit and debit cards, including Visa, Mastercard, and Maestro, for deposits. However, be aware that withdrawals to credit/debit cards can take longer, potentially up to 10 business days for the funds to reflect in your account.

Does eToro offer a demo account?

Yes, eToro offers a free demo account, which they refer to as a “Virtual Portfolio.” It comes with $100,000 in virtual funds, allowing users to practice trading and explore the platform’s features, including copy trading, in a risk-free environment using real-time market data.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated & Legal | Higher Spreads on CFDs |

| User-Friendly Platform | Limited Charting Tools |

| Social & Copy Trading | No MetaTrader Support |

| Accepts Credit Cards | Overnight Fees on CFDs |

| Free Demo Account | Withdrawal Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a legal and regulated platform ideal for beginners, offering commission-free stock trading and copy trading features. While spreads are higher on CFDs, they provide a secure, user-friendly environment for global traders.

5. Plus500

Plus500 accepts credit cards (Visa/Mastercard) with no deposit fees; spreads from ~0.6 pips; no commissions. Offers leveraged CFDs across 2,000+ instruments.

Frequently Asked Questions

Does Plus500 accept credit cards?

Yes, Plus500 accepts credit and debit cards, specifically Visa and Mastercard, for depositing funds. These deposits are generally processed instantly. However, regional limitations may apply, so it’s always best to confirm the available methods within your Plus500 trading platform.

What trading platforms are available?

Plus500 primarily offers its own proprietary WebTrader platform, accessible via web browser and dedicated mobile apps (iOS and Android). This platform is known for its user-friendly interface and simplicity. While it’s powerful for CFD trading, it doesn’t support third-party platforms like MetaTrader 4 or 5.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Wide Range of CFDs | Inactivity Fee |

| No Commissions | Limited Research & Educational Tools |

| User-Friendly Platform | Overnight Fees |

| Accepts Credit Cards | Withdrawal Limits |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is an authorized CFD broker regulated by top global authorities. It offers commission-free trading, a user-friendly platform, and strong fund protection, making it a solid choice for beginner to intermediate traders.

6. Axi

Axi accepts Visa/Mastercard credit card deposits instantly with a low USD 5. The broker offers competitive spreads (from 0.0–0.9 pips), commission-free or low‑commission accounts, high leverage up to 1000:1, and strong client protections including fund segregation and negative balance coverage.

Frequently Asked Questions

Does Axi accept credit cards?

Yes, Axi accepts credit and debit cards, including Visa and Mastercard, for deposits. These payments are generally processed instantly, allowing funds to appear in your trading account almost immediately. They also support other methods like bank transfers and e-wallets.

Is copy trading available on Axi?

Yes, Axi offers copy trading through its dedicated Axi Copy Trading app, available for both iOS and Android. This allows users to connect their MT4 accounts and automatically replicate the trades of experienced traders, filterable by various performance metrics.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Trusted & Regulated | Limited CFD Range |

| Low Minimum Deposit | No MetaTrader 5 (MT5) |

| Accepts Credit Cards | No Proprietary Platform |

| Tight Spreads | Limited Educational Tools |

| MetaTrader 4 Support | Regional Restrictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a registered and regulated broker offering low spreads, MT4 support, and flexible funding options, including credit cards. It’s well-suited for forex traders, though it lacks MT5 and a wide CFD selection.

7. IG

IG accepts credit cards (Visa and Mastercard) for fast deposits, with small card fees (~0.5–1%). The broker is authorized by top-tier regulators like the FCA (UK), ASIC (Australia), and FSCA (South Africa).

Frequently Asked Questions

Does IG offer demo accounts?

Yes, IG offers unlimited demo accounts that are ideal for both beginners and experienced traders. You can practice trading with virtual funds on their award-winning platform, access educational content, and test strategies without any financial risk.

What is the minimum deposit required to start trading with IG?

IG has no minimum deposit requirement to open a live trading account. This means you can start with any amount you’re comfortable with. However, certain payment methods like card payments may have a minimum transaction amount (e.g., USD 50).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly regulated across multiple jurisdictions | Limited leverage |

| Multiple advanced trading platforms | No copy trading or social trading |

| Low spreads | Inactivity fee |

| Strong educational tools | Limited product offering |

| Negative balance protection | Commissions apply for share CFDs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legit and highly regulated broker offering access to thousands of markets, strong platforms, and solid investor protection. While fees and leverage vary, its global credibility and trading tools make it a trusted choice.

8. Exness

Exness supports popular trading platforms like MetaTrader 4, MetaTrader 5, and its own Exness Terminal. Leverage can reach up to 1:2000 or even unlimited, depending on the account balance and region. The broker accepts credit cards, including Visa and MasterCard, with instant deposits and no deposit fees.

Frequently Asked Questions

Does Exness offer a demo account?

Yes, Exness provides demo accounts that are automatically created upon registration, alongside a real account. These demo accounts offer virtual funds and simulate real market conditions, making them ideal for practicing strategies and familiarizing yourself with the platform risk-free.

Can I use credit cards for deposits and withdrawals?

Yes, Exness allows both deposits and withdrawals using credit and debit cards, including Visa and Mastercard. Deposits are typically instant, while withdrawals usually take 1 business day to process from Exness’s side.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple jurisdictions | Commissions apply on Raw/Zero accounts |

| Low minimum deposit | Does not offer copy trading or social trading natively |

| Tight spreads | Product range limited to CFDs only |

| Instant deposits and withdrawals, including credit cards | No bonuses or promotions |

| Free demo account for MT4 and MT5 | No educational webinars |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legal and well-regulated broker offering competitive spreads, flexible leverage, and fast transactions. With support for MT4/MT5 and low entry barriers, it’s suitable for both beginners and experienced CFD traders globally.

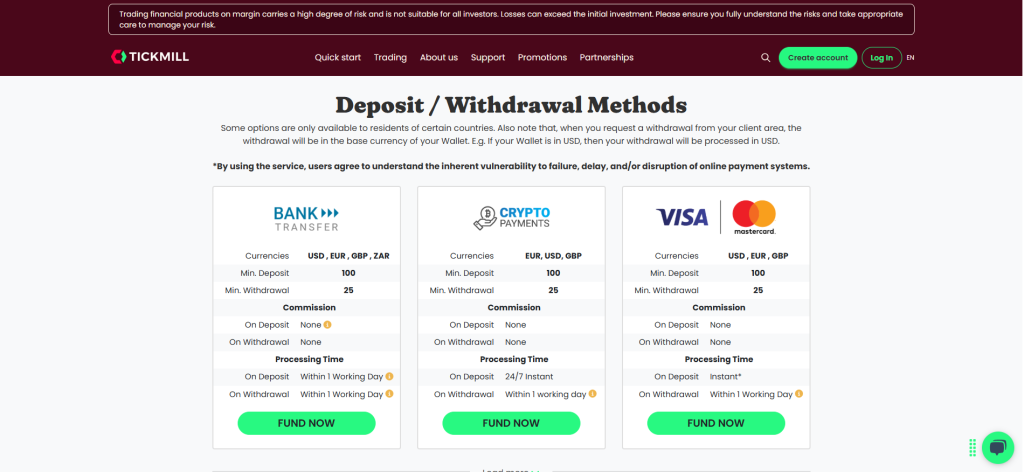

9. Tickmill

Tickmill provides access to over 600 CFDs including forex, indices, commodities, bonds, and crypto. Traders can use MetaTrader 4, MetaTrader 5, Tickmill WebTrader, or the Tickmill Trader app. The broker accepts credit card deposits via Visa and MasterCard, with instant processing and no deposit fees.

Frequently Asked Questions

What is the minimum deposit required at Tickmill?

Tickmill requires a minimum deposit of USD 100 for all account types, including Classic and Raw accounts. While they do offer a $30 Welcome Account with no initial deposit, to fully activate a live trading account, $100 is the standard minimum.

Does Tickmill accept credit card deposits?

Yes, Tickmill readily accepts credit and debit card deposits, including Visa and Mastercard. These transactions are typically processed instantly, allowing for immediate funding of your trading account. Tickmill also states they do not charge fees for deposits.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by top-tier authorities | Limited product range |

| Low minimum deposit | No built-in copy or social trading platform |

| Tight spreads | Commissions apply on Raw and VIP accounts |

| Supports MT4, MT5 | Fewer educational tools |

| Accepts credit card payments with instant processing | Does not offer bonuses or promotions in regulated regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is an approved and trusted broker offering low spreads, fast execution, and strong regulation. With support for MT4/MT5, credit card funding, and swap-free accounts, it’s ideal for both new and experienced traders.

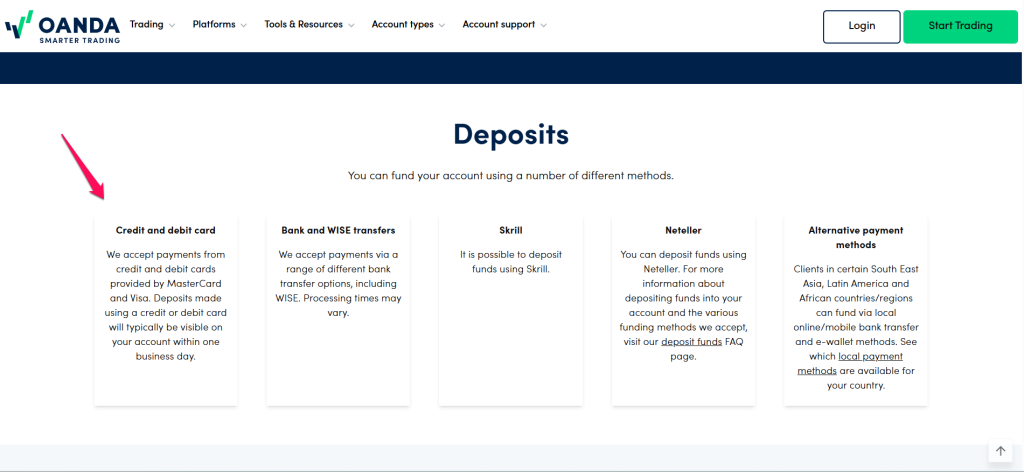

10. OANDA

OANDA accepts credit card deposits via Visa and MasterCard, with secure processing and no deposit fees. It also offers negative balance protection, segregated client funds, and a strong reputation for transparency and reliability.

Frequently Asked Questions

What is the minimum deposit to open an account with OANDA?

OANDA has no minimum deposit requirement to open or maintain a trading account. While you’ll need funds to open positions, you can deposit any amount to start. Certain payment methods might have their transaction minimums.

What trading platforms does OANDA support?

OANDA supports a diverse range of trading platforms, including their proprietary OANDA Web and Mobile platforms, which offer intuitive interfaces and advanced charting. Additionally, they provide access to popular third-party platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple top-tier authorities | Limited cryptocurrency CFD offerings |

| No minimum deposit | Limited product range |

| User-friendly proprietary trading platform | No fixed spreads |

| Supports MetaTrader 4 (MT4) | Leverage capped |

| Negative balance protection | No guaranteed stop loss orders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a well-registered broker known for its strong regulation, user-friendly platforms, and transparent pricing. While spreads may be higher, its safety measures and wide instrument range make it a reliable choice for traders.

How do Credit Card Payments work in Forex Trading?

Credit card payments in forex trading work as a convenient method for traders to deposit funds into their trading accounts. Here’s a quick breakdown of how it typically works:

- Account Funding: You choose to deposit money into your forex broker account using your credit card (Visa, MasterCard, etc.).

- Payment Processing: The broker’s payment processor handles the transaction securely. The amount is charged to your credit card and credited to your trading account, usually instantly or within a few minutes.

- Trading: Once funds are in your account, you can start trading forex and CFDs.

- Withdrawals: Withdrawals are often processed back to your credit card first (up to the amount deposited). Any profits are usually withdrawn via bank transfer or other methods, depending on the broker’s policy.

- Fees and Limits: Some brokers or credit card companies may charge fees for deposits or currency conversion. There may also be limits on deposit amounts.

- Security: Forex brokers use encryption and secure gateways to protect your credit card information during transactions.

Using a credit card is popular for its speed and ease, but be mindful of fees and the risk of trading on borrowed money.

Criteria for Choosing a Forex Broker Accepting Credit Cards

| Criteria | Description | Importance |

| Regulation | The broker should be licensed and regulated by reputable authorities to ensure safety and compliance. | ⭐⭐⭐⭐⭐ |

| Deposit & Withdrawal Options | Availability of credit card deposits and easy, fast withdrawals with minimal fees. | ⭐⭐⭐⭐⭐ |

| Transaction Fees | Fees charged for credit card deposits or withdrawals, including currency conversion costs. | ⭐⭐⭐⭐☆ |

| Processing Speed | How quickly credit card deposits and withdrawals are processed, ideally instant or within minutes. | ⭐⭐⭐⭐⭐ |

| Security Measures | Use of encryption and secure payment gateways to protect your credit card data. | ⭐⭐⭐⭐⭐ |

| Account Types | Variety of accounts available that support credit card payments, including minimum deposit requirements. | ⭐⭐⭐☆☆ |

| Customer Support | Availability and responsiveness of support for payment related queries and issues. | ⭐⭐⭐⭐☆ |

| Accepted Card Brands | Support for major credit card brands like Visa, MasterCard, etc. | ⭐⭐⭐⭐☆ |

| Transparency | Clear disclosure of payment policies, fees, and terms for credit card transactions. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | User feedback regarding payment reliability and broker’s trustworthiness with credit card deposits. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers Accepting Credit Cards – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From fees to deposit and withdrawal speed, we provide straightforward answers to help you understand credit card payments and choose the right broker confidently.

Q: Are there fees for credit card deposits or withdrawals at forex brokers? – LeilaPips

A: Many forex brokers offer fee-free credit card deposits and withdrawals. However, your card issuer or bank might charge fees for international transactions, currency conversion, or if they classify the deposit as a cash advance. Always check with both your broker and your card provider.

Q: How fast are credit card deposits and withdrawals processed? – Scott_Scalp

A: Credit card deposits with forex brokers are usually instant. However, withdrawals take longer. While brokers often process withdrawal requests within 1-2 business days, it can take an additional 1 to 5 business days for the funds to reflect in your credit card statement.

Q: Can I use someone else’s credit card for my broker account? – Riya_Trader

A: No, almost all regulated forex brokers do not allow third-party deposits, including using someone else’s credit card. Due to strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, the name on the deposit method must exactly match the name on the trading account.

Q: What information do I need to provide to make a credit card deposit? – Musa_Kenya

A: To make a credit card deposit with a forex broker, you’ll typically need to provide the card number, expiry date (month/year), CVV/CVC (3 or 4-digit security code) from the back of the card, and the cardholder’s full name and billing address.

Q: Can I withdraw more than I’ve deposited by card? – USDdreamer

A: Generally, yes, but with a specific process. Due to Anti-Money Laundering (AML) regulations, brokers typically require you to withdraw the initial deposited amount back to the same credit card. Any profits made beyond that original deposit can then usually be withdrawn via a different method.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fast Deposits | High Fees |

| Widely Accepted | Cash Advance Fees |

| Secure Transactions | Debt Risk |

| Easy Chargebacks | Withdrawal Limits |

| No Currency Restrictions | Card Declines |

| Good for Small Traders | Not Ideal for Large Transfers |

You Might also Like:

- FP Markets Review

- Pepperstone Review

- AvaTrade Review

- eToro Review

- Plus500 Review

- Axi Review

- IG Review

- Exness Review

- Tickmill Review

- OANDA Review

In Conclusion

Forex brokers accepting credit cards offer fast and convenient deposits, ideal for quick market access. However, users must be cautious of potential fees, debt risks, and withdrawal restrictions. Always trade responsibly.

Faq

Using a credit card with a regulated online forex broker is generally safe. Reputable brokers employ strong security measures like encryption (SSL/TLS), two-factor authentication (2FA), and segregated client funds. Credit card companies also offer fraud protection.

Forex brokers most commonly accept Visa and Mastercard for credit and debit card deposits and withdrawals. Some may also support Maestro. Other brands like American Express or Discover are less universally accepted but can be available with certain brokers.

If your credit card is declined by a broker, first double-check all entered card details (number, expiry, CVV, billing address) for errors. If correct, contact your bank or card issuer to inquire about the decline.

Yes, there is a significant risk of accumulating debt when using credit cards for trading. If your trades result in losses, you’ll still be obligated to repay the credit card company, often with high interest rates, regardless of your trading outcomes.

Yes, forex brokers typically impose minimum and maximum limits for credit card deposits and withdrawals. Minimum deposits can range from $0-$100 USD, while maximums vary greatly, from a few thousand to tens of thousands per transaction or per month.