Signs of Weakness in EUR/USD As ECB Signals Rate Cuts

The Euro to Dollar rate was on a steady uptrend for a month, gaining almost 3 cents. But, it is showing weakness as ECB rate cut comments...

The Euro to Dollar rate was on a steady uptrend for a month, gaining almost 3 cents. But, it is showing weakness as the ECB rate cut comments keep increasing, with the German economy going through a difficult time. The Euro failed to reach 1.10 against the USD and sellers were testing 1.09 yesterday, after dovish comments from European Central Bank members. The bullish momentum was quite straightforward for this forex pair, but now it seems like the sellers have the upper hand, as the 20 SMA (gray) turns from support into resistance on the H4 chart for EUR/USD .

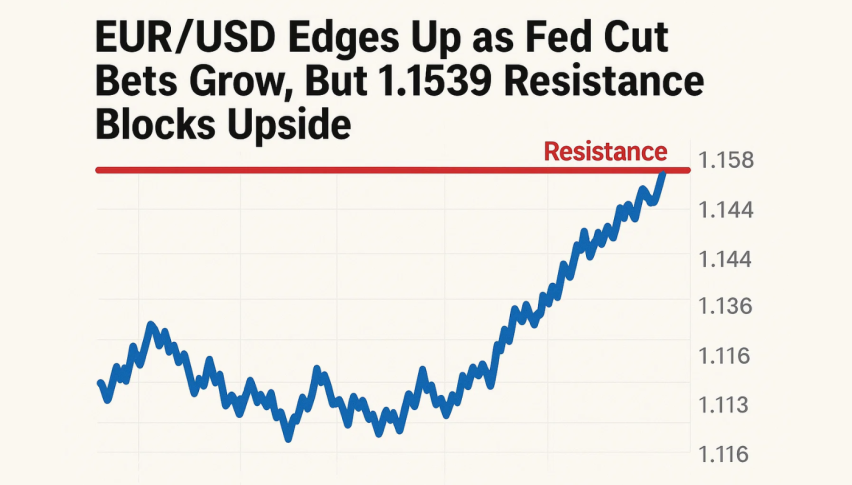

EUR/USD H4 Chart – The 20 SMA Has Turned into Resistance

Insights of the ECB Forecasts from Bank of France Governor and ECB Governing Council Member, Francois Villeroy de Galhau

- Full-year 2024 GDP growth forecast: Villeroy de Galhau revised the forecast down to 0.8% from the previous estimate of 0.9%.

- Inflation forecasts: He anticipates HIPC (Harmonized Index of Consumer Prices) inflation to be 2.5% for 2024, followed by 1.7% in both 2025 and 2026.

- Interest rate policy: Villeroy de Galhau stated that there is broad agreement within the European Central Bank (ECB) to commence lowering interest rates in the spring, indicating confidence in the effectiveness of measures taken to combat inflation.

- Independence from the Fed: He emphasized that the ECB can independently adjust interest rates, regardless of actions taken by the Federal Reserve.

- Pragmatism in rate policy: Villeroy de Galhau highlighted that the ECB can adopt a pragmatic approach to its rate policy, suggesting flexibility in decision-making to address economic challenges effectively.

This was bearish for the Euro, but helped the European stock markets, with the major European stock indices all ending higher. The German DAX and French CAC closed at new all-time highs. The final data showed the German DAX index up by 1.23% at 17965 points, the French CAC up 0.4% at 8087 points, while Spain’s Ibex up 0.61% at 10388.91 points, and Italy’s FTSE MIB up 1.27% at 33739.72 points.

German February CPI released by Destatis – 12 March 2024

- Final CPI (Consumer Price Index) increased by 2.5% year-on-year (y/y) in February, consistent with the preliminary estimate. However, it is lower than the previous month’s reading of +2.9%.

- HICP (Harmonized Index of Consumer Prices), a measure used for European Union comparisons, also rose by 2.7% year-on-year, matching the preliminary estimate. This figure is lower than the prior month’s reading of +3.1%.

- Core annual inflation, which excludes volatile items such as food and energy, remained stable at 3.4%. This rate of core inflation is similar to that observed in January, indicating persistent price pressures beyond volatile components

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account