The 10 Best Decentralized Crypto Exchanges

We have listed the 10 Best Decentralized Crypto Exchanges for trading a variety of digital assets, including Bitcoin, Ethereum, and stablecoins. These exchanges offer enhanced privacy, full user control of funds, and transparent blockchain-based operations, ensuring both beginners and experienced traders can trade cryptocurrencies securely and efficiently.

10 Best Decentralized Crypto Exchanges (2026)

- PancakeSwap – Overall, The Best Decentralized Crypt Exchange

- Uniswap – Automated Market Maker (AMM) model

- Orca – User-first approach

- Fluid – Unified liquidity layer

- Aerodrome SlipStream – High capital efficiency

- Curve Finance – Low-slippage trading for stable assets

- Jupiter – Wide range of DeFi tools

- DODO – Proprietary Proactive Market Maker (PMM)

- Bancor – Single-sided liquidity provision

- Loopring – zkRollup technology

Top 10 Forex Brokers (Globally)

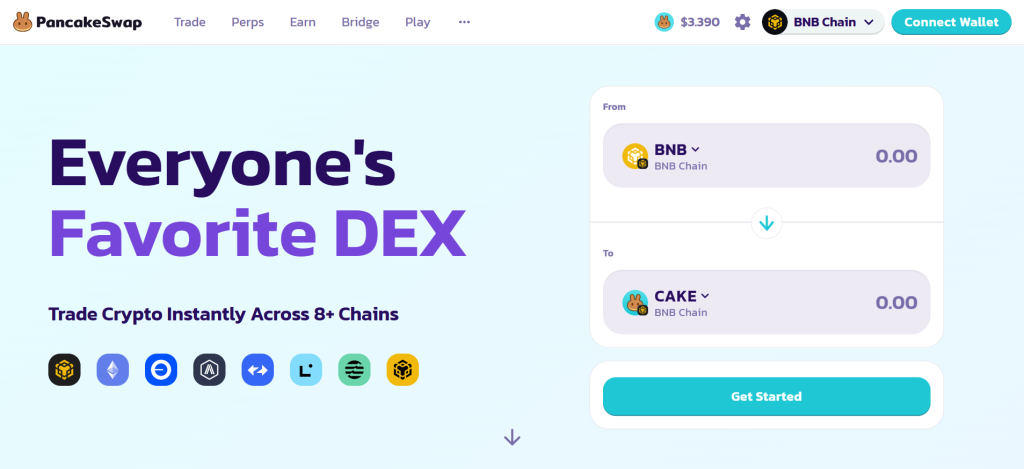

1. PancakeSwap

PancakeSwap is a leading decentralized crypto exchange (DEX) built on the Binance Smart Chain (BSC). It allows users to trade cryptocurrencies directly from their wallets without intermediaries, offering features like token swaps, liquidity pools, yield farming, and staking with low fees and fast transaction speeds.

| Platform | PancakeSwap |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| Blockchain | Built on Binance Smart Chain (BSC) |

| Trading Method | Automated Market Maker (AMM) model |

| User Control | Full control of funds via non-custodial wallets |

| Supported Tokens | BEP-20 tokens on BSC |

| Liquidity Pools | Users can provide liquidity and earn fees |

| Yield Farming | Earn rewards by staking LP tokens |

| Staking (Syrup Pools) | Stake CAKE tokens to earn additional crypto |

| Native Token | CAKE |

| Transaction Fees | Low fees compared to centralized exchanges |

| Speed | Fast transactions powered by BSC |

| Security | Smart contract-based, audited by third parties |

| Cross-Chain Swaps | Supported through integrations with bridges |

| Launchpad (IFO) | Access to new project tokens via Initial Farm Offerings |

| Community Governance | CAKE holders can vote on protocol decisions |

Frequently Asked Questions

Is PancakeSwap safe to use?

PancakeSwap is generally considered safe due to regular third-party security audits (e.g., CertiK, Slowmist). However, as a Decentralized Exchange (DEX), it still carries inherent risks like impermanent loss and smart contract vulnerabilities.

Do I need an account to trade on PancakeSwap?

No, you do not need an account on PancakeSwap. As a Decentralized Exchange (DEX), you only need a compatible crypto wallet (like MetaMask or Trust Wallet) to connect directly and execute trades.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low transaction fees on Binance Smart Chain | Limited to BEP-20 tokens (BSC network) |

| Full user control over funds (non-custodial) | Exposure to smart contract risks |

| High liquidity and large trading volume | Complex for complete beginners |

| Multiple earning options (staking, farming, IFOs) | Price slippage in low liquidity pairs |

| Fast and efficient transaction processing | No customer support like centralized exchanges |

Our Insights

PancakeSwap is an authorized decentralized crypto exchange offering fast, low-cost trading and multiple earning opportunities. With its non-custodial design and Binance Smart Chain efficiency, it provides traders secure, transparent, and user-controlled access to the crypto market.

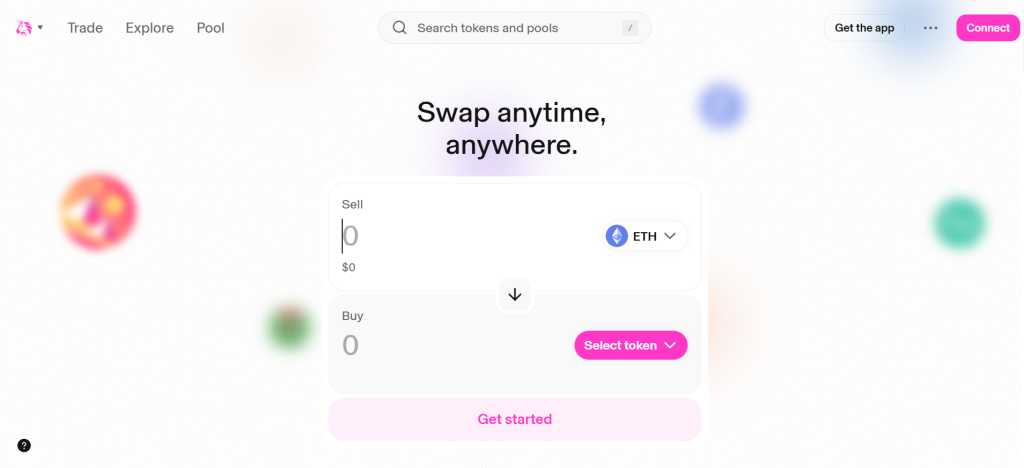

2. Uniswap

Uniswap is a popular decentralized crypto exchange (DEX) built on the Ethereum blockchain. It enables users to swap ERC-20 tokens directly from their wallets using an automated market maker (AMM) model, offering secure, transparent, and permissionless cryptocurrency trading without intermediaries.

| Platform | Uniswap |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| Blockchain | Built on the Ethereum network |

| Trading Method | Automated Market Maker (AMM) model |

| User Control | Non-custodial - users retain full control of their funds |

| Supported Tokens | ERC-20 tokens |

| Liquidity Pools | Users can provide liquidity and earn trading fees |

| Native Token | UNI |

| Governance | UNI token holders can vote on protocol updates |

| Transaction Fees | Determined by liquidity pools; paid in ETH |

| Cross-Chain Compatibility | Available on multiple networks (Ethereum, Arbitrum, Optimism, Polygon, and Base) |

| Security | Open-source smart contracts audited by authorized firms |

| Speed | Dependent on Ethereum network performance |

| Interface | Simple, user-friendly Web3 interface |

| Integration | Compatible with major wallets like MetaMask and Coinbase Wallet |

| Transparency | All transactions recorded on the blockchain for public verification |

Frequently Asked Questions

Do I need to register to use Uniswap?

No, you don’t need to register or create an account to use the main Uniswap exchange for swapping tokens. As a Decentralized Exchange (DEX), you only need to connect a compatible crypto wallet (like MetaMask) to trade.

What is Uniswap?

Uniswap is a decentralized exchange (DEX) protocol built on Ethereum. It uses an Automated Market Maker (AMM) system and liquidity pools to enable peer-to-peer cryptocurrency swaps without a central intermediary.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and trusted decentralized trading platform | High gas fees on Ethereum mainnet |

| Full user control over funds (non-custodial) | Slippage during volatile market conditions |

| Transparent, open source smart contracts | Potential exposure to smart contract risks |

| Supports a wide range of ERC-20 tokens | No centralized customer support |

| Governance through UNI token holders | Requires understanding of DeFi tools |

Our Insights

Uniswap is a legit and authorized decentralized crypto exchange offering secure, transparent, and user-controlled token trading. With its open-source protocol and governance features, it empowers traders to exchange ERC-20 assets confidently across multiple blockchain networks.

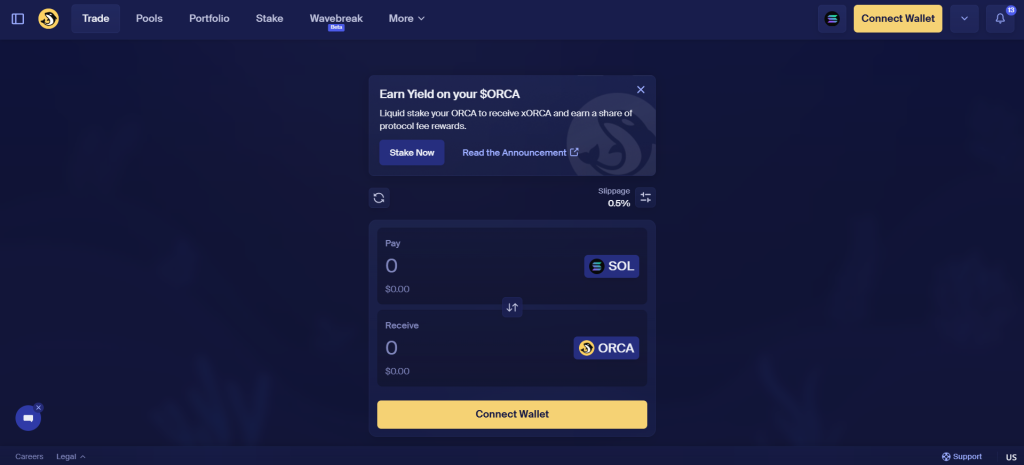

3. Orca

Orca is a user-friendly decentralized crypto exchange (DEX) built on the Solana blockchain. It enables fast, low-cost token swaps and liquidity provision through an automated market maker (AMM) model, offering secure, transparent, and eco-efficient decentralized trading without intermediaries.

| Platform | Orca |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| Blockchain | Built on the Solana network |

| Trading Method | Automated Market Maker (AMM) model |

| User Control | Non-custodial - users maintain full control of their funds |

| Supported Tokens | SPL tokens on the Solana blockchain |

| Liquidity Pools | Users can add liquidity and earn a share of trading fees |

| Native Token | ORCA |

| Transaction Fees | Extremely low fees powered by Solana’s scalability |

| Transaction Speed | High-speed transactions with low latency |

| Security | Protected by authorized smart contracts and audits |

| Interface | Clean, beginner friendly design with intuitive features |

| Sustainability | Energy-efficient due to Solana’s proof-of stake system |

| Integration | Compatible with major Solana wallets (Phantom, Solflare) |

| Yield Farming | Offers additional rewards for liquidity providers |

| Governance | Community-driven through ORCA token voting mechanisms |

Frequently Asked Questions

What is Orca?

Orca is a leading, user-friendly decentralized exchange (DEX) on the Solana blockchain. It uses an Automated Market Maker (AMM) system, including concentrated liquidity “Whirlpools,” to enable fast, low-cost token swaps and provide yield-earning opportunities.

Is Orca safe to use?

Security firms consider Orca one of Solana’s more reliable DEXs, as it has undergone audits and maintains a record with no protocol security breaches to date. However, like all DeFi, it carries risks such as smart contract vulnerabilities and impermanent loss for liquidity providers.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and legit decentralized exchange on Solana | Limited to SPL tokens on Solana |

| Ultra-low transaction fees and fast execution | Smaller liquidity compared to major DEXs |

| Simple, beginner friendly interface | Potential smart contract vulnerabilities |

| Energy-efficient blockchain technology | No centralized customer support |

| Transparent and community-governed platform | Requires a Solana compatible wallet |

Our Insights

Orca, a decentralized exchange (DEX), builds on the Solana blockchain to provide fast, low-cost, and eco-friendly token swaps. With its legit operations, audited smart contracts, and user-focused design, it provides a secure and transparent DeFi trading experience.

Top 3 Decentralized Crypto Exchanges – PancakeSwap vs Uniswap vs Orca

| Platform | PancakeSwap | Uniswap | Orca |

| Exchange Type | Decentralized Crypto Exchange(DEX) | Decentralized Crypto Exchange(DEX) | Decentralized Crypto Exchange(DEX) |

| Blockchain | Binance Smart Chain (BSC) | Ethereum (also Arbitrum, Optimism, Polygon, Base) | Solana |

| Trading Model | Automated Market Maker (AMM) | Automated Market Maker (AMM) | Automated Market Maker (AMM) |

| Native Token | CAKE | UNI | ORCA |

| Supported Tokens | BEP-20 tokens | ERC-20 tokens | SPL tokens |

| User Control | Non-custodial (full control of funds) | Non-custodial (full control of funds) | Non-custodial (full control of funds) |

| Transaction Fees | Very low (BSC network) | Higher (Ethereum gas fees) | Extremely low (Solana network) |

| Transaction Speed | Fast | Moderate (depends on Ethereum network) | Very fast |

| Liquidity Pools | Yes | Yes | Yes |

| Governance | CAKE holders vote on proposals | UNI holders vote on protocol updates | ORCA holders participate in community governance |

| Cross-Chain Compatibility | Supported via bridges | Multi-chain support (EVM networks) | Primarily Solana-based |

| Security | Audited and authorized smart contracts | Audited and authorized smart contracts | Audited and approved smart contracts |

| Ease of Use | Beginner-friendly | Moderate (more advanced DeFi features) | Very beginner-friendly |

| Earning Options | Staking, farming, IFOs | Liquidity provision, governance rewards | Liquidity mining, yield farming |

| Eco-Efficiency | Moderate | Energy-intensive (Ethereum PoS improved it) | Highly energy-efficient |

| Best For | Traders seeking low fees and yield opportunities | DeFi users focused on Ethereum-based assets | Solana traders seeking speed and low costs |

4. Fluid

Fluid is a modern decentralized finance (DeFi) protocol combining lending, borrowing, and a DEX (decentralized exchange) in one unified liquidity layer. It runs across multiple blockchains (Ethereum, Arbitrum, Base, Polygon) to maximize capital efficiency and minimize friction for users executing swaps or borrowing.

| Platform | Fluid |

| Exchange Type | Decentralized Crypto Exchange (DEX) and DeFi Liquidity Protocol |

| Blockchain Compatibility | Multi-chain (Ethereum, Arbitrum, Base, Polygon, and others) |

| Core Functionality | Combines trading, lending, and borrowing in one platform |

| Trading Model | Automated liquidity aggregation for efficient swaps |

| Liquidity Layer | Unified liquidity pool across multiple blockchains |

| User Control | Non-custodial - users maintain full control of their assets |

| Supported Assets | Various tokens across supported blockchains |

| Native Token | FLUID |

| Transaction Fees | Low fees with optimized routing for best execution prices |

| Speed | Fast transaction execution across multiple networks |

| Security | Protected by audited smart contracts and decentralized governance |

| Governance | FLUID token holders participate in decision making |

| Capital Efficiency | Unified liquidity reduces fragmentation and improves yield |

| Cross-Chain Swaps | Enables token swaps between multiple networks seamlessly |

| Integration | Compatible with major DeFi wallets and protocols |

| Transparency | All transactions recorded on public blockchains for verification |

| Eco-Efficiency | Operates on proof-of stake chains for lower energy use |

Frequently Asked Questions

Is Fluid safe to use?

Fluid’s security depends on which platform you mean. Fluid (FLUID), a DeFi protocol, uses structural safety at its base layer and has been audited. However, all DeFi carries inherent risks like smart contract vulnerabilities and impermanent loss.

Do I need an account to trade on Fluid?

As a Decentralized Exchange (DEX), Fluid does not require an account or registration. You trade directly by connecting a compatible Web3 wallet, like MetaMask, which holds and manages your funds.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and legit decentralized DeFi platform | Relatively new platform with limited adoption |

| Multi-chain support for wider token access | Complexity for beginners in DeFi |

| Unified liquidity layer enhances efficiency | Smart contract risks remain possible |

| Low transaction fees and fast execution | No centralized customer support |

| Combines trading, lending, and borrowing features | Dependence on connected blockchain performance |

Our Insights

Fluid is a registered decentralized crypto exchange offering multi-chain liquidity, fast swaps, and integrated DeFi services. With audited smart contracts and non-custodial technology, it delivers a secure, transparent, and efficient trading experience for modern crypto users.

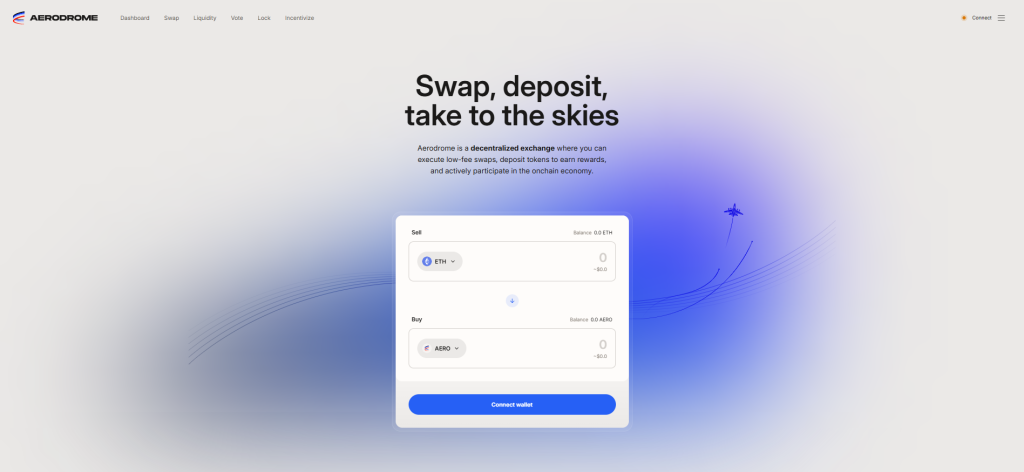

5. Aerodrome SlipStream

Aerodrome’s SlipStream is a DEX on the Base network that uses concentrated liquidity pools to offer better pricing and less slippage. Users can swap tokens, provide liquidity, and earn rewards through its veAERO governance model.

| Platform | Aerodrome SlipStream |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| Blockchain | Built on the Base network |

| Trading Model | Automated Market Maker (AMM) with concentrated liquidity (Slipstream pools) |

| User Control | Non-custodial - users retain full control of their assets |

| Core Functionality | Token swaps, liquidity provision, and governance participation |

| Liquidity Pools | Slipstream concentrated liquidity pools for efficient trading |

| Native Token | AERO |

| Governance Model | veAERO system allows users to vote and earn rewards |

| Transaction Fees | Low fees powered by the Base network |

| Transaction Speed | Fast, scalable transactions due to Base’s Layer-2 architecture |

| Security | Smart contracts audited and registered for safety |

| Integration | Compatible with major wallets like MetaMask and Coinbase Wallet |

| Rewards System | Liquidity providers and veAERO holders earn incentives |

| Transparency | On-chain governance and publicly verifiable transactions |

| Eco-Efficiency | Energy-efficient operation through Base’s Layer-2 infrastructure |

| Best For | Traders seeking low fees, fast execution, and efficient liquidity management |

Frequently Asked Questions

Do I need an account to use Aerodrome Slipstream?

No, Aerodrome Slipstream is a Decentralized Exchange (DEX). You do not need to create an account. You simply connect a compatible Web3 wallet, such as MetaMask, to use the platform.

What is Aerodrome Slipstream?

Aerodrome SlipStream is a Decentralized Exchange (DEX) on the Base network. It uses concentrated liquidity pools, based on a Uniswap V3 model, to maximize capital efficiency, reduce trading slippage, and optimize returns for liquidity providers.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized decentralized exchange on the Base network | Limited to Base network assets |

| Concentrated liquidity Slipstream pools reduce slippage | Smaller liquidity compared to major DEXs |

| Low transaction fees and high speed | Complex for complete beginners |

| Transparent governance via veAERO token model | Smart contract risks still apply |

| Secure smart contracts audited for safety | No centralized customer support |

Our Insights

Aerodrome Slipstream is an authorized decentralized crypto exchange on the Base network, featuring advanced Slipstream liquidity pools for efficient, low-cost trading. With audited contracts and fast transactions, it delivers secure, transparent, and community-driven DeFi trading.

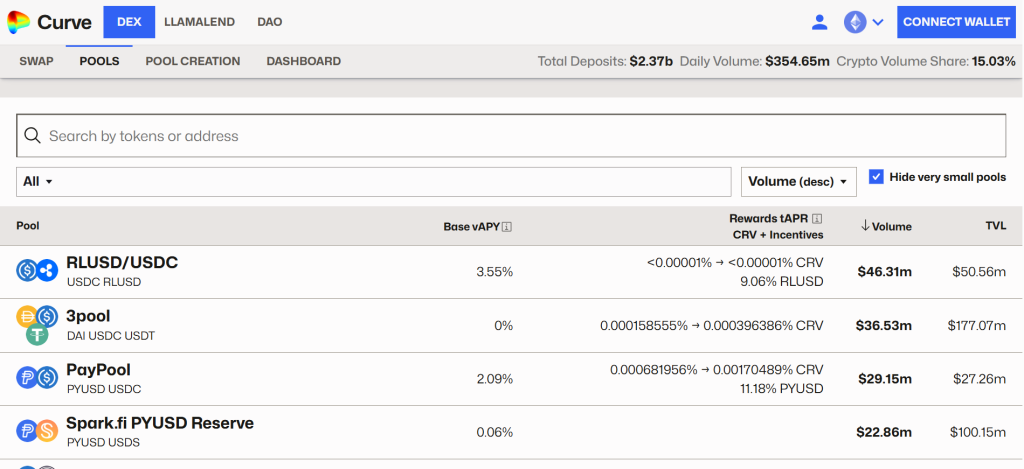

6. Curve Finance

Curve Finance is a DEX specializing in swapping stablecoins and pegged assets (like wrapped tokens). It operates on Ethereum and other compatible blockchains, using a unique AMM algorithm to provide extremely low-slippage trades, efficient fees, and governance powered by its CRV token.

| Platform | Curve Finance |

| Exchange Type | Decentralized Crypto Exchange (DEX) focused on stablecoins and pegged assets |

| Blockchain Support | Operates on Ethereum and multiple EVM compatible networks, including Arbitrum, Optimism, Polygon, Fantom, and Avalanche |

| Trading Model | Uses a specialized AMM algorithm (StableSwap) designed for low-slippage stable asset trading |

| Supported Assets | Stablecoins (USDC, USDT, DAI), wrapped tokens, and liquid staking derivatives |

| Native Token | CRV |

| Governance Model | veCRV system allows users to lock CRV for voting rights and boosted rewards |

| Liquidity Pools | Stable pools, factory pools, and meta-pools for efficient swaps between similar assets |

| Transaction Fees | Very low fees optimized for stable asset pairs |

| Liquidity Provider Rewards | Users earn trading fees, CRV incentives, and boosted returns with veCRV locking |

| Stablecoin Innovation | Features its own over collateralized stablecoin, crvUSD, with the LLAMMA algorithm for smooth liquidations |

| User Control | Non-custodial - users retain full control of their funds |

| Security | Smart contracts audited and authorized by third party security firms |

| Transparency | DAO-based governance and fully on-chain transactions |

| Cross-Chain Compatibility | Supports multiple EVM networks for broad accessibility |

| Best For | Traders and liquidity providers focused on stable, low-risk, and low-slippage swaps |

Frequently Asked Questions

What is Curve Finance?

Curve Finance is a Decentralized Exchange (DEX) focused on swapping stablecoins and pegged assets with extremely low slippage. It uses a specialized AMM on Ethereum and other chains, with the CRV token governing the protocol and rewarding liquidity providers.

Is Curve Finance safe to use?

Curve Finance is a heavily audited DeFi protocol, but like all decentralized exchanges, it carries smart contract risk and impermanent loss risk. It has also faced DNS hijacking attacks. Exercise caution; your funds are non-custodial.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and trusted platform for stablecoin trading | Complex for complete beginners in DeFi |

| Very low fees and minimal slippage | Limited mainly to stablecoins and pegged assets |

| Advanced liquidity pools for optimized trading | Dependent on Ethereum network for base operations (gas fees) |

| Governance via veCRV voting and incentives | Smart contract risks remain possible |

| Multi-chain support for Ethereum and EVM-compatible networks | No centralized customer support |

Our Insights

Curve Finance is a legit and authorized decentralized crypto exchange offering secure, low-slippage stablecoin trading. With audited smart contracts, veCRV governance, and efficient liquidity pools, it provides reliable, transparent, and user-controlled DeFi operations.

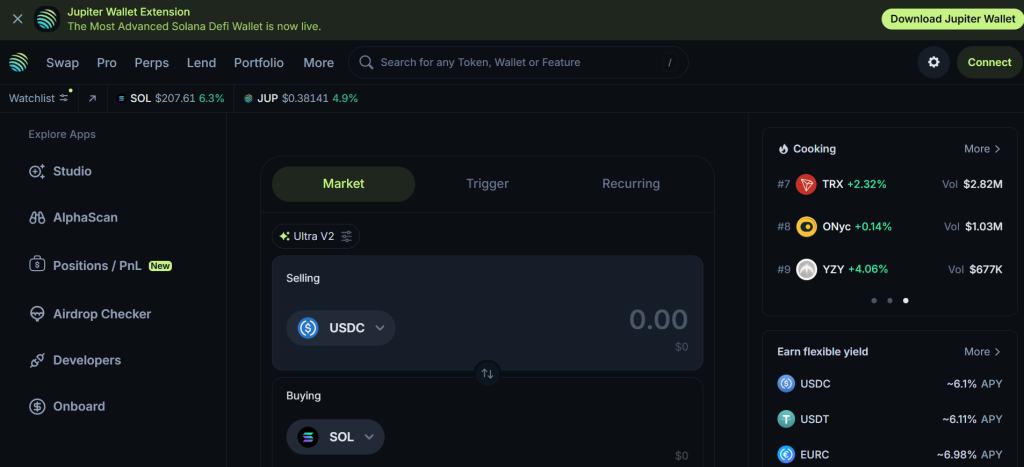

7. Jupiter

Jupiter is a decentralized crypto exchange aggregator built on the Solana blockchain. It sources liquidity from multiple decentralized exchanges (DEXs) to provide users with the best possible token swap rates. Jupiter offers features such as limit orders, dollar-cost averaging (DCA), and a launchpad for new projects.

The platform aims to make decentralized finance (DeFi) more accessible and efficient for users on the Solana network.

| Platform | Jupiter |

| Exchange Type | Decentralized Exchange (DEX) Aggregator on the Solana blockchain |

| Liquidity Aggregation | Sources liquidity from over 20 Solana-based DEXs to provide optimal swap rates |

| Token Swap | Facilitates seamless token swaps with minimal slippage |

| Limit Orders | Allows users to set specific price points for token purchases or sales, executing trades automatically when conditions are met |

| Dollar-Cost Averaging (DCA) | Enables automated, periodic token purchases to mitigate market volatility |

| Launchpad | Provides a platform for launching new projects on Solana, featuring DAO voting and community governance |

| Jupiter Terminal | An open-source, lightweight version of Jupiter that links in HTML, allowing easy integration of swap functionality into web applications |

| Perpetual Trading | Offers feature-rich perpetual trading on Solana, including limit orders and gasless transactions |

| Native Token | JUP |

| Governance Model | Community-driven governance through the JUP token |

| Transaction Fees | Low fees optimized for efficient trading |

| Security | Utilizes smart contracts and decentralized protocols to ensure secure transactions |

| Cross-Chain Swaps | Facilitates token swaps across multiple Solana-based networks |

| Integration | Compatible with major wallets like Phantom and Sollet |

| Transparency | All transactions are recorded on the Solana blockchain, ensuring transparency |

| User Control | Non-custodial platform where users maintain full control over their assets |

Frequently Asked Questions

Is Jupiter safe to use?

Jupiter is generally safe as a non-custodial DEX aggregator on Solana, meaning you control your funds. It has a good track record and undergoes audits. However, like all DeFi, it carries smart contract risk and risks from phishing/impersonation attacks.

Do I need an account to trade on Jupiter?

No, Jupiter is a decentralized exchange (DEX) aggregator on Solana. You only need to connect a compatible crypto wallet (like Phantom or Solflare) to trade; you do not need to register or create an account with Jupiter.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and reliable Solana-based DEX aggregator | Limited primarily to Solana-based assets |

| Optimizes liquidity across multiple DEXs for best rates | Complex features may challenge beginners |

| Supports limit orders and dollar-cost averaging (DCA) | Dependent on Solana network performance |

| Low fees and fast transactions on Solana | Smart contract risks remain possible |

| Community governance via JUP token | No centralized customer support |

Our Insights

Jupiter is a legit decentralized crypto exchange aggregator on Solana, offering optimized token swaps, low fees, and advanced features like limit orders and DCA. With non-custodial wallets, it ensures secure and efficient DeFi trading.

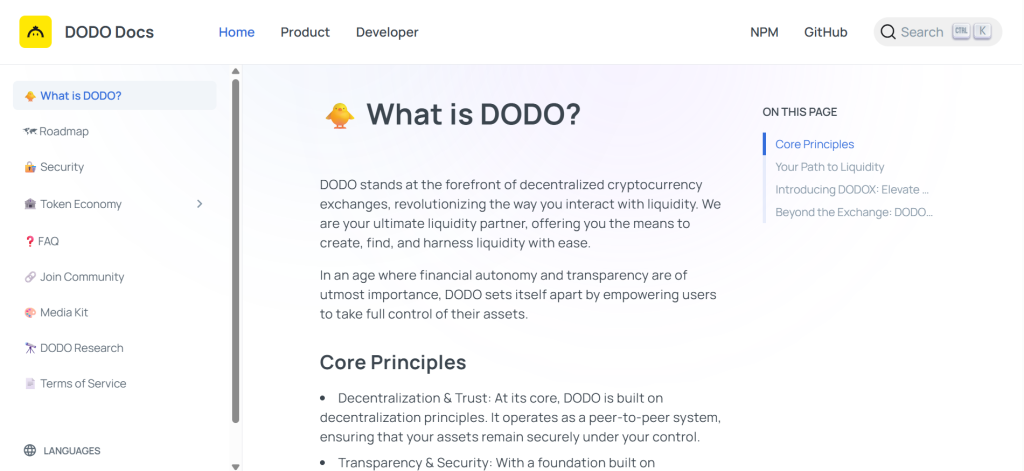

8. DODO

DODO is a decentralized crypto exchange (DEX) and liquidity protocol built on Ethereum and multiple blockchain networks. It uses a Proactive Market Maker (PMM) algorithm to provide low-slippage token swaps, deep liquidity, and capital efficiency.

DODO also offers decentralized fundraising, liquidity mining, and governance through its native DODO token.

| Platform | DODO |

| Exchange Type | Decentralized Crypto Exchange(DEX) |

| Proactive Market Maker (PMM) | DODO’s unique algorithm for liquidity provision, an alternative to traditional AMM. |

| Low Slippage Trading | Optimized pricing mechanism reduces price impact for large trades. |

| Liquidity Mining | Users can provide liquidity and earn rewards in DODO or other tokens. |

| Cross-Chain Compatibility | Supports multiple blockchains like Ethereum, Binance Smart Chain, and Polygon. |

| Crowdpooling | A decentralized fundraising mechanism for new projects. |

| Gas Efficiency | Optimized smart contracts to reduce transaction costs. |

| NFT Trading & DeFi Integrations | Supports NFT swaps and integration with DeFi protocols |

Frequently Asked Questions

Does DODO support multiple blockchains?

Yes, DODO is a multi-chain decentralized exchange (DEX). It has deployed its protocol across numerous leading blockchains, including Ethereum, BNB Chain, Polygon, and Avalanche, to offer cross-chain trading capabilities.

What is DODO?

DODO is a decentralized exchange (DEX) and on-chain liquidity provider. It uses a unique Proactive Market Maker (PMM) algorithm to offer highly capital-efficient liquidity, reduced slippage, and supports multi-chain asset trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Capital-efficient liquidity via Proactive Market Maker (PMM) | Smart contract risks, as with all DeFi platforms |

| Low slippage, even for large trades | Not fully regulated; legal protections vary by region |

| Cross-chain support for Ethereum, BSC, and Polygon | Limited mainstream adoption compared to giants like Uniswap |

| Decentralized and user-controlled funds | Gas fees may still be high on certain blockchains |

| Supports liquidity mining and NFT integrations | Advanced features can be confusing for beginners |

Our Insights

DODO offers a legally innovative decentralized trading experience with low slippage and capital-efficient liquidity. While cross-chain support and unique features stand out, users should remain aware of regional legal protections and DeFi risks.

9. Bancor

Bancor is a decentralized crypto exchange (DEX) that allows users to trade tokens directly from their wallets without intermediaries. It uses an automated market maker (AMM) to provide liquidity efficiently, reduce slippage, and enable token swaps across multiple networks.

Bancor also offers staking and impermanent loss protection for liquidity providers.

| Platform | Bancor |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| Automated Market Maker (AMM) | Bancor’s liquidity protocol automatically sets token prices. |

| Impermanent Loss Protection | Protects liquidity providers from temporary losses due to price volatility. |

| Staking & Liquidity Mining | Users can stake tokens or provide liquidity to earn rewards. |

| Cross-Chain Support | Supports multiple networks, including Ethereum and Polygon. |

| Single-Sided Liquidity | Users can provide liquidity with only one token. |

| Governance & Voting | Token holders can participate in protocol decisions. |

| Low Slippage Trading | Optimized AMM algorithm reduces price impact for large trades. |

Frequently Asked Questions

Is trading on Bancor safe?

Bancor, a DEX, has undergone security audits and offers features like Impermanent Loss Protection. However, like all DeFi, it carries risks, including potential smart contract vulnerabilities and past security incidents, so due diligence is essential.

Can I earn rewards on Bancor?

Yes, you can earn rewards on Bancor. Rewards are primarily earned by providing liquidity to its pools, allowing you to collect a share of the trading fees. Additional BNT rewards may also be available.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Decentralized trading with full control over funds | Smart contract risks remain despite safeguards |

| Impermanent loss protection for liquidity providers | Not fully regulated; legal protections vary by jurisdiction |

| Single-sided liquidity provision simplifies participation | Gas fees may be high on certain networks |

| Cross-chain support increases flexibility | Limited adoption compared to major DEXs like Uniswap |

| Low slippage trading due to AMM optimization | Advanced features can be confusing for beginners |

Our Insights

Bancor provides a legally innovative decentralized trading platform with impermanent loss protection and low-slippage swaps. Its cross-chain support and staking options enhance usability, though users should remain aware of smart contract risks and regional legal considerations.

10. Loopring

Loopring enables fast and low-cost token trading on Ethereum by using its decentralized crypto exchange (DEX) protocol with zkRollup technology. It combines the security of a decentralized platform with high scalability, reduced gas fees, and non-custodial trading, allowing users to retain full control of their funds while providing liquidity and staking opportunities.

| Platform | Loopring |

| Exchange Type | Decentralized Crypto Exchange (DEX) |

| zkRollup Technology | Layer-2 scaling solution on Ethereum that batches transactions. |

| High Scalability | Can process thousands of trades per second. |

| Low Gas Fees | Optimized transaction batching minimizes costs. |

| Liquidity Pools | Supports token liquidity provision and trading. |

| Staking & Rewards | Users can stake LRC (Loopring token) for incentives. |

| Non-Custodial Trading | All trades occur directly from user wallets. |

| Cross-Asset Swaps | Supports swaps between multiple Ethereum-based tokens |

Frequently Asked Questions

What is Loopring?

Loopring is a decentralized Layer 2 protocol built on Ethereum. It uses zkRollup technology to enable fast, low-cost trading and payments while maintaining Ethereum’s security. Its native token is LRC.

Is Loopring legally safe to use?

Loopring, as an open-source decentralized protocol, is not legally banned. However, crypto regulations vary by country, and users must ensure their specific activities and location comply with all local laws regarding cryptocurrencies and DeFi.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Non-custodial trading with full user control | Smart contract risks remain despite Layer-2 security |

| Low gas fees due to zkRollup Layer-2 technology | Legal protections vary by jurisdiction |

| High-speed and scalable transactions | Limited adoption |

| Supports staking and liquidity rewards | Advanced Layer-2 concepts may confuse beginners |

| Enables cross-asset token swaps efficiently | Reliant on Ethereum’s network for security and settlement |

Our Insights

Loopring provides a legally innovative decentralized trading platform with low fees, high-speed transactions, and staking opportunities. While its Layer-2 technology improves efficiency, users should remain aware of smart contract risks and regional legal considerations.

What are Decentralized Crypto Exchanges?

Decentralized crypto exchanges (DEXs) are blockchain-based platforms that let users trade cryptocurrencies directly without intermediaries. Using smart contracts, DEXs ensure secure, transparent, and non-custodial trading where users retain full control of their funds and private keys.

Criteria for Choosing Decentralized Crypto Exchanges

| Criteria | Description | Importance |

| Security | The strength of smart contracts, audits, and overall platform safety to protect user funds. | ⭐⭐⭐⭐⭐ |

| Liquidity | The amount of available assets for trading, which affects slippage and trade execution speed. | ⭐⭐⭐⭐☆ |

| User Control | Ensures users maintain control over their private keys and funds at all times. | ⭐⭐⭐⭐⭐ |

| Transaction Fees | Costs of trading and gas fees for executing transactions on the blockchain. | ⭐⭐⭐⭐☆ |

| Ease of Use | How user-friendly the interface and trading experience are, especially for beginners. | ⭐⭐⭐☆☆ |

| Supported Assets | Variety of cryptocurrencies and tokens available for trading. | ⭐⭐⭐⭐☆ |

| Cross-Chain Compatibility | Ability to trade across multiple blockchains like Ethereum, BSC, or Polygon. | ⭐⭐⭐☆☆ |

| Reputation | The platform’s track record, community trust, and reliability in the DeFi space. | ⭐⭐⭐⭐⭐ |

| Customer Support & Documentation | Availability of helpful resources, FAQs, and active community support. | ⭐⭐⭐☆☆ |

| Regulatory Compliance | The platform’s adherence to legal frameworks where applicable. | ⭐⭐⭐☆☆ |

Top 10 Best Crypto Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From security to transaction fees, we provide straightforward answers to help you understand Decentralized Crypto Exchanges.

Q: How do decentralized exchanges (DEXs) ensure security compared to centralized exchanges? – Jason M.

A: DEXs ensure security because they are non-custodial; users maintain control of their private keys and funds. Trades use automated smart contracts, removing the single-point-of-failure risk inherent in a centralized exchange holding all assets.

Q: Are transaction fees on DEXs generally higher or lower than on centralized exchanges? – Amir K.

A: DEX trading fees themselves are often lower than CEX fees. However, DEX users must also pay variable network (gas) fees for on-chain transactions, which can become prohibitively high and make the total cost much higher than a CEX.

Q: What are the main differences between order book DEXs and automated market maker (AMM) DEXs? – Sophia L.

A: Order book DEXs match buy/sell orders directly, like traditional exchanges. AMM DEXs use liquidity pools and a mathematical algorithm to automatically set asset prices for instant token swaps.

Pros and Cons

| ✓ Pros | ✕ Cons |

| User Control | Complex Interface |

| Enhanced Security | Limited Liquidity |

| Privacy | No Customer Support |

| Transparency | Smart Contract Risks |

| Global Accessibility | Legal Uncertainty |

You Might also Like:

- FP Markets Review

- HFM Review

- Pepperstone Review

- FXCM Review

- Eightcap Review

- Octa Review

- Tickmill Review

- InstaForex Review

- IG Review

- AvaTrade Review

In Conclusion

Decentralized crypto exchanges offer a legal, secure, and transparent way to trade while maintaining full control of funds. However, users should remain cautious of smart contract risks, limited support, and varying legal protections across regions.

Faq

The legality of DEXs is complex and varies globally. In many places, they operate in an unregulated or grey area. Some regulators are attempting to apply existing laws, especially anti-money laundering (AML), to decentralized finance (DeFi).

Typically, no. Most Decentralized Exchanges (DEXs) don’t require you to register or pass KYC (Know Your Customer) identity checks; you just connect your crypto wallet to trade.

Yes, absolutely. You can lose money on a DEX due to market volatility, smart contract bugs or exploits, providing liquidity and incurring impermanent loss, and human error like sending funds to the wrong address.

Blockchains supporting DEXs include major networks like Ethereum, Solana, BNB Chain, Polygon, Arbitrum, and Avalanche. Many other layer-1 and layer-2 chains also host decentralized exchanges.

Liquidity in a DEX refers to the availability of crypto assets, typically in liquidity pools, that users can trade against. High liquidity ensures trades are executed quickly at fair market prices with minimal slippage.

Yes, you can. The primary way is to become a liquidity provider by depositing tokens into a pool. You then earn rewards from trading fees and sometimes extra incentives via yield farming or staking.

Automated Market Makers (AMMs) are smart contracts on decentralized exchanges (DEXs) that use a mathematical formula to price crypto assets within liquidity pools, eliminating the need for traditional buyer/seller order books.

Beginners can use DEXs, but they are generally more complex than centralized exchanges. DEXs require you to manage your own crypto wallet and understand concepts like network fees (gas) and smart contract interactions. Start slow and research thoroughly.