10 Best Forex Brokers with Big Accounts

We have listed the 10 Best Forex Brokers with Big Accounts for trading with large or high-value. These brokers offer deep liquidity, tight spreads, strong regulation, and advanced trading platforms, ensuring that professional and institutional traders can manage substantial investments securely and efficiently.

10 Best Forex Brokers with Big Accounts (2026)

- MultiBank Group – Overall, The Best Forex Broker with Big Accounts

- AvaTrade – Proprietary risk management tool, AvaProtect

- Exness – Exceptionally low trading costs

- XM – Comprehensive educational resources

- FOREX.com – Wide array of powerful trading platforms

- Pepperstone – Competitive pricing, and swift trade execution

- FP Markets – Award-winning trading platforms like MT4, MT5, and Iress

- HFM – Multi-asset forex and commodities broker

- IG – Vast selection of financial products, platforms, and trading services

- Interactive Brokers – Trading platforms like the customizable Trader Workstation (TWS)

Top 10 Forex Brokers (Globally)

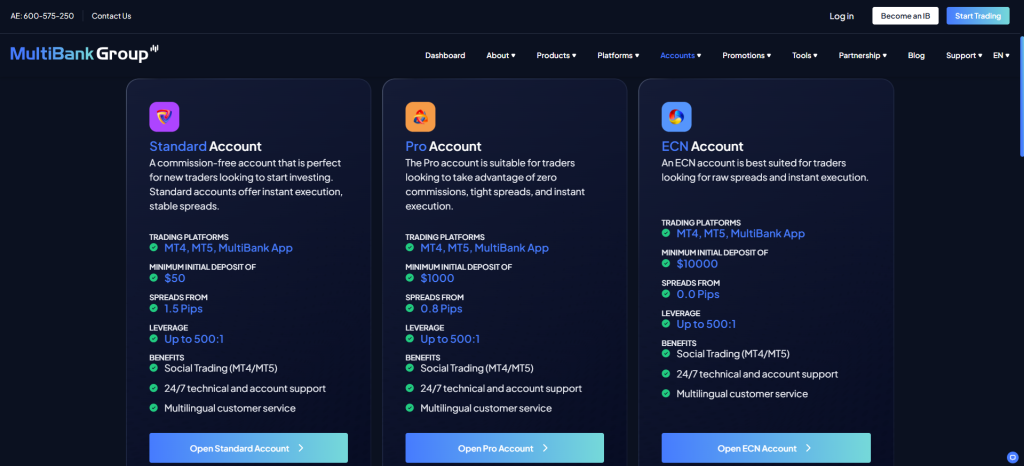

1. MultiBank Group

MultiBank Group is a globally regulated forex and CFD broker known for supporting big trading accounts. It offers high leverage, deep liquidity, low spreads, and institutional-grade execution, making it ideal for professional and high-volume traders seeking secure and efficient trading environments.

Frequently Asked Questions

Is MultiBank Group authorized to handle large forex accounts?

Yes, MultiBank Group is authorized to handle large accounts. It is regulated by 18 financial authorities globally, has over $322 million in paid-up capital, and offers an ECN account with a high minimum deposit ($10,000) suitable for professional and institutional traders.

What are the benefits of opening a big account with MultiBank Group?

Big accounts, particularly the ECN Account ($10,000 minimum), benefit from raw spreads starting at 0.0 pips, instant market execution, and access to an institutional-grade ECN model with deep liquidity.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Higher minimum deposit requirements |

| Deep liquidity and institutional-grade execution | Limited availability of certain account types by region |

| Tight spreads for large-volume trading | Advanced platforms may be complex for beginners |

| High leverage options for professional traders | Inactivity fees may apply |

| Dedicated account managers and priority support | Some withdrawal methods may take longer to process |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized, globally regulated forex broker ideal for traders managing big accounts. With deep liquidity, low spreads, and robust security, it offers professional traders a reliable and efficient high-capital trading environment.

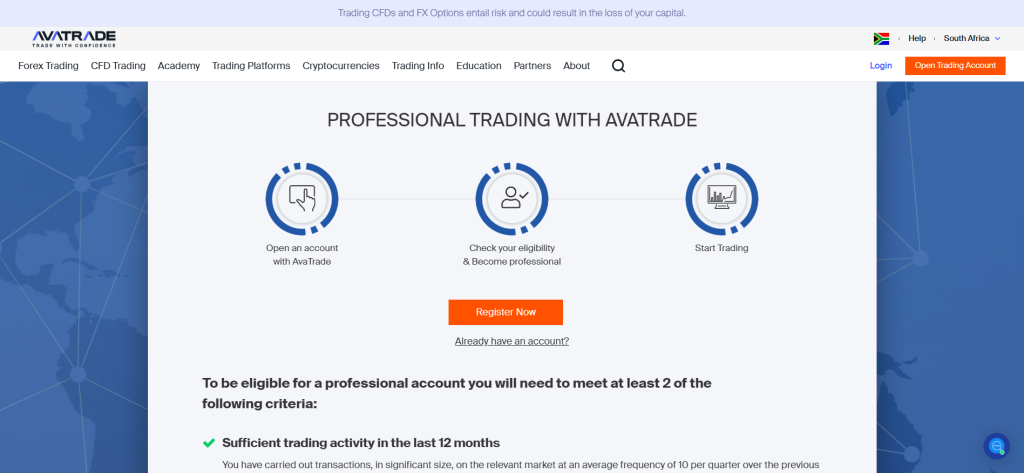

2. AvaTrade

AvaTrade is an authorized and globally regulated forex and CFD broker that supports big trading accounts. It offers tight spreads, advanced trading platforms, high leverage, and dedicated account managers, making it ideal for professional and high-volume traders seeking secure and efficient trading conditions.

Frequently Asked Questions

Is AvaTrade a legit broker for big trading accounts?

Yes, AvaTrade is a legitimate and highly-regulated broker globally. For big accounts, they offer a Professional Trader Account with higher leverage and have a VIP Membership tier structure with exclusive benefits for high-volume traders.

Does AvaTrade protect funds in big accounts?

AvaTrade generally protects client funds through segregated accounts across its regulated entities. While Negative Balance Protection and their unique AvaProtect exist, the statutory Investor Compensation limits apply to all clients, not just big accounts, and may not fully cover large balances in case of insolvency.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and well regulated globally | Limited product range in some regions |

| Tight spreads for high volume trading | No direct access to ECN accounts |

| Advanced trading platforms | Withdrawal fees may apply depending on the method |

| Dedicated support for VIP and big account holders | Inactivity fees after prolonged non-use |

| Negative balance protection | Customer service response times may vary |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a highly regulated, legitimate broker suitable for big account traders. It offers secure fund protection, low spreads, and premium support, making it a reliable choice for professional, high-volume investors.

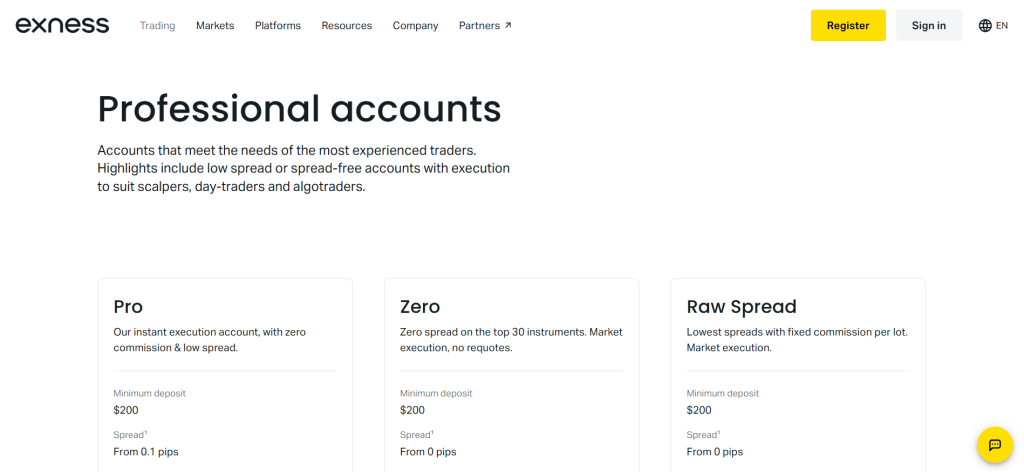

3. Exness

Exness supports big-account trading through its professional account types offering ultra-tight spreads, high (even unlimited) leverage, instant withdrawals, and global regulatory licences, designed for high-volume and experienced traders seeking powerful execution.

Frequently Asked Questions

Is Exness a legal broker for big trading accounts?

Yes, Exness is a legal and regulated broker with multiple licenses globally, including top-tier jurisdictions like the FCA and CySEC. Its structures, like the Premier Program, are specifically designed to accommodate high-volume and large trading accounts.

What advantages do big account holders get with Exness?

Big account holders at Exness benefit from the Premier Program, which offers preferential trading conditions, lower spreads/commissions, access to exclusive events, dedicated account management, and potential volume-based cash rebates.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and globally regulated broker | Limited product selection beyond forex and CFDs |

| Ultra-tight spreads and fast execution | Some advanced features may suit professionals only |

| High or unlimited leverage options | Limited customer support on weekends |

| Instant deposit and withdrawal processing | Regional restrictions may apply |

| Excellent transparency and trading analytics | High leverage increases trading risk |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legal, globally regulated broker ideal for traders managing big accounts. With tight spreads, high leverage, and instant withdrawals, it offers professionals a secure, transparent, and efficient trading experience.

Top 3 Forex Brokers with Big Accounts – MultiBank Group vs AvaTrade vs Exness

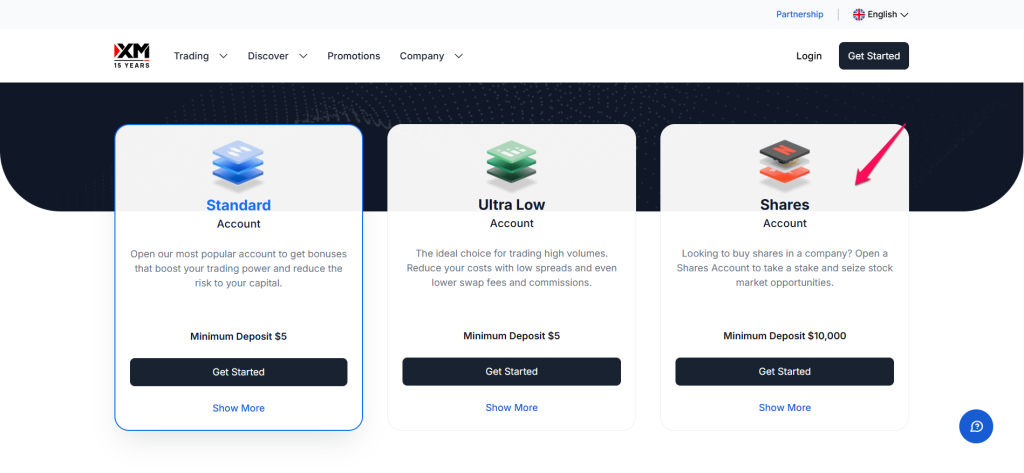

4. XM

XM is tailored for high-capital investors with a dedicated Shares trading account requiring a $10,000 minimum deposit. It provides serious traders managing large portfolios with access to over 1,150 CFD shares and ultra-tight spreads.

Frequently Asked Questions

Is XM a legal broker for big trading accounts?

Yes, XM is a legal broker operating through multiple regulated entities, including those under top-tier oversight like CySEC and licenses in other jurisdictions. This multi-regulation approach makes it suitable and secure for big trading accounts.

What are the benefits of having a big account with XM?

Bigger accounts, especially the Shares Account ($10,000 min.), grant access to 1,150+ CFD shares and ultra-tight spreads. High-volume trading may also lead to VIP-level support and loyalty program rewards.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and globally regulated broker | High-volume traders may face regional leverage limits |

| Tight spreads with fast order execution | Limited advanced trading tools compared to ECN brokers |

| Wide range of tradable instruments | Inactivity fees may apply |

| Dedicated support for large account holders | Some withdrawal methods may take time |

| Multiple trading platforms | Not all account types available in every region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legal, well-regulated forex broker ideal for big account traders. It offers tight spreads, fast execution, and strong fund protection, providing professionals with a secure and efficient environment for managing large investments.

5. FOREX.com

FOREX.com offers dedicated programs for high-volume traders managing large accounts, including premium pricing tiers, personalized support, and access to reduced spreads and rebates designed for institutional-level trading.

Frequently Asked Questions

What benefits do big account traders get with FOREX.com?

Big account traders on FOREX.com’s Active Trader program get monthly cash rebates based on volume, a dedicated Relationship Manager, VIP access to events/previews, and sometimes interest on available margin plus reimbursement of bank wire fees.

Does FOREX.com protect large account funds?

Yes, FOREX.com emphasizes client fund segregation from its own operational capital, holding it with top-tier banks, which provides a key layer of protection for all client funds, including large accounts. They are part of the NASDAQ-listed StoneX Group Inc.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Higher minimum deposits for premium tiers |

| Tight spreads and advanced trading conditions | Limited leverage in some regulated regions |

| Premium account management and support | Withdrawal processing can take up to 48 hours |

| Access to rebates and loyalty rewards | No crypto deposits available |

| Reliable trading platforms with institutional-grade execution | Complex platform for complete beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FOREX.com is an approved, globally regulated broker ideal for traders with big accounts. It provides premium pricing, advanced tools, and secure fund management, making it a trusted platform for professional and institutional-level investors.

6. Pepperstone

Pepperstone’s large-volume accounts receive dedicated trading conditions, featuring institutional-grade execution and tight spreads starting at 0.0 pips. This includes high leverage up to 1:500 (in certain jurisdictions) and tailored support designed for high-net-worth and professional traders.

Frequently Asked Questions

Is Pepperstone a registered broker for big trading accounts?

Yes, Pepperstone is a highly regulated broker globally. For big trading accounts, they offer a Professional Client status and an Active Trader Program, which provide tailored benefits, higher leverage (where regulation permits), and volume-based rebates for high-volume traders.

What benefits do big account traders get with Pepperstone?

Big account traders can join the Active Trader Program for volume-based cash rebates on commissions and spreads. They may also qualify as a Professional Client for benefits like higher leverage, a dedicated account manager, and complimentary VPS hosting.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated by leading financial authorities | Limited asset selection outside forex and CFDs |

| Ultra-tight spreads and deep liquidity | High leverage restricted in some regions |

| Advanced platforms | No fixed-spread accounts |

| Fast trade execution with low latency | Inactivity fees may apply |

| Professional customer support and educational tools | No proprietary platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a registered, globally regulated broker ideal for big account traders. It provides ultra-tight spreads, fast execution, and advanced platforms, making it a trusted choice for professionals managing large trading volumes.

7. FP Markets

For traders dealing with large volumes, FP Markets has tailored professional-level accounts. These accounts grant access to leverage as high as 1:500 and feature Direct Market Access (DMA) across more than 10,000 instruments, all tradable on the powerful IRESS and MetaTrader platforms.

Frequently Asked Questions

Is FP Markets an authorized broker for big trading accounts?

Yes, FP Markets is an authorized broker well-suited for big trading accounts. It offers institutional-grade ECN accounts with high leverage, deep liquidity, tight spreads, and advanced execution, making it ideal for professional and large-volume traders.

Does FP Markets offer fund protection for big accounts?

Yes, FP Markets offers fund protection for big accounts. Client funds are held in segregated accounts with top-tier banks, ensuring security and protection even in financial distress. Negative balance protection is also available for professional accounts, adding an extra layer of safety.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and well regulated broker | Higher deposits may be required for DMA accounts |

| Direct market access with institutional grade liquidity | Platform features may be complex for beginners |

| Tight spreads and fast execution | Limited educational tools for advanced traders |

| High leverage options for professionals | No crypto deposits available |

| Dedicated support and account management | Regional restrictions on some services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an authorized, globally regulated broker ideal for big account traders. It offers DMA access, tight spreads, and high leverage, providing professionals with secure, transparent, and efficient trading conditions.

8. HFM

HFM provides professional-grade trading conditions ideal for big accounts, including extremely high leverage up to 1:2000 in certain regions, very tight spreads, and access to more than 500 tradable instruments, all regulated by multiple global authorities.

Frequently Asked Questions

What are the benefits of big accounts with HFM?

Big accounts with HFM benefit from ultra-low spreads, high leverage up to 1:2000, and no commission charges. Traders enjoy fast execution, flexible trade sizes, swap-free options, and access to advanced trading platforms and tools tailored for professionals.

Does HFM protect funds for big account traders?

HFM protects funds for big account traders by keeping client money in segregated accounts with major global banks, ensuring it cannot be used for company expenses. They provide negative balance protection, resetting negative balances to zero, and maintain comprehensive insurance cover against risks like fraud, enhancing fund security.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | High leverage increases trading risk |

| High leverage options up to 1:2000 | Limited features in some account types |

| Tight spreads and fast execution | Regional restrictions on certain products |

| Wide range of over 500 trading instruments | Inactivity fees may apply |

| Premium support and account management | Withdrawal processing times vary |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a reputable, fully regulated broker tailored for traders with large accounts. It provides competitive tight spreads, high leverage options, and professional customer support, ensuring a secure and efficient trading environment ideal for experienced and high-volume investors.

9. IG

IG provides professional and institutional clients with access to diverse global markets, deep liquidity pools, and tailored account solutions, specifically designed for traders managing large trading volumes who require premium trading conditions and dedicated support.

Frequently Asked Questions

Is IG a legal broker for big trading accounts?

Yes, IG is a fully legal broker for big trading accounts. It is regulated by top-tier authorities including the UK’s FCA, Australia’s ASIC, the US CFTC and NFA, South Africa’s FSCA, and others, ensuring a secure and compliant environment for large-volume traders.

What are the benefits of big accounts with IG?

IG delivers professional and institutional clients access to extensive global markets, substantial liquidity, and customized account options, created specifically for traders handling large volumes who require superior trading conditions and dedicated client support.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Higher minimum deposits for premium accounts |

| Deep liquidity and competitive spreads | Limited leverage due to strict regulations |

| Access to over 17,000 financial instruments | Platform may feel advanced for beginners |

| Professional-grade tools and analytics | Inactivity fees after prolonged periods |

| Dedicated relationship managers for large accounts | No cryptocurrency deposits available |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legal, top-tier regulated broker ideal for big account traders. It offers deep liquidity, tight spreads, and premium service, ensuring secure, professional, and transparent trading for experienced and institutional investors.

10. Interactive Brokers

Interactive Brokers delivers sophisticated account solutions tailored for high-volume and institutional traders managing extensive portfolios. Their offerings include access to over 160 global markets, competitive financing rates, master-sub-account structures, and prime brokerage services, making them ideal for serious big-account clients.

Frequently Asked Questions

Is Interactive Brokers a legal broker for big trading accounts?

Interactive Brokers is a fully legal broker for big trading accounts, regulated by multiple top authorities such as FINRA, SEC, CFTC in the US, ASIC in Australia, FCA in the UK, and others, ensuring strict compliance and client protection worldwide

Does Interactive Brokers provide legal protection for large accounts?

Interactive Brokers provides strong legal protection for large accounts by segregating client funds in exclusive bank accounts and conducting daily reconciliations to ensure accuracy. Accounts are protected by SIPC insurance, covering up to $500,000 plus additional Lloyd’s of London coverage, safeguarding against broker failure but not market losses.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated in multiple major jurisdictions | Complex platform for beginners |

| Access to 160+ global markets and asset classes | High minimum deposits for certain account types |

| Low commissions and financing costs | Inactivity or data fees may apply |

| Institutional-grade trading tools and analytics | Limited leverage compared to other brokers |

| Strong account protection and transparency | Customer support response times can vary |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is a legal, globally regulated broker ideal for large account traders. It provides deep market access, low costs, and robust legal protection, making it perfect for institutional and professional investors seeking reliability and precision.

What are Big Accounts in Forex Trading?

Big Accounts in Forex Trading refer to trading accounts that hold large capital balances, typically ranging from $50,000 to several million dollars, managed by professional, institutional, or high-net-worth traders. These accounts enable access to premium trading conditions, such as tighter spreads, faster execution, higher leverage options, and personalized support.

Big accounts often receive priority liquidity, dedicated account managers, and customized trading solutions, making them suitable for traders who aim to execute large orders efficiently while maintaining full control and security over substantial investments.

Criteria for Choosing a Forex Broker with Big Accounts

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is fully authorized and regulated by reputable financial authorities to protect large investments. | ⭐⭐⭐⭐⭐ |

| Fund Security | Brokers must keep client funds in segregated accounts and comply with strict legal standards. | ⭐⭐⭐⭐⭐ |

| Spreads & Commissions | Low spreads and transparent commission structures help maximize profitability for high volume traders. | ⭐⭐⭐⭐☆ |

| Execution Speed & Liquidity | Fast execution and deep liquidity are essential for handling large orders without slippage. | ⭐⭐⭐⭐⭐ |

| Leverage Options | Flexible or high leverage allows traders to manage large positions efficiently, depending on regulation. | ⭐⭐⭐⭐☆ |

| Account Types | Availability of professional, VIP, or institutional accounts with premium trading conditions. | ⭐⭐⭐⭐☆ |

| Customer Support | 24/5 or 24/7 dedicated account managers and support for big account holders. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Efficiency | Fast, secure, and fee free transactions are crucial for large capital transfers. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Access to advanced, stable, and customizable platforms like MT4, MT5, or proprietary systems. | ⭐⭐⭐⭐☆ |

| Reputation & Transparency | The broker’s track record, legal standing, and client reviews indicate reliability and trustworthiness. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers with Big Accounts – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From fund protection to commission, we provide straightforward answers to help you understand big accounts and choose the right broker confidently.

Q: How do brokers handle fund protection for large accounts? – Thalia P.

A: Brokers protect large accounts by using segregated client funds, holding them separately from company assets. They operate under strict regulatory supervision, often providing insurance coverage and transparent auditing to ensure safety and compliance with financial standards.

Q: What platforms are best for high-volume trading? – Robin M.

A: The platforms that work best for high-volume trading offer institutional-grade execution, low latency, deep liquidity access, and advanced order types. Examples include MetaTrader 4, MetaTrader 5 and cTrader.

Q: Are there commissions or fees to worry about on big accounts? – Jay C.

A: Yes. Even with big accounts you still need to factor in costs. Brokers may charge commissions per trade, spread mark-ups, overnight financing (swap) fees, and inactivity or withdrawal fees depending on account type.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tighter spreads | High minimum deposit |

| Priority customer support | Higher risk exposure |

| Personal account manager | Possible overtrading |

| Higher leverage options | Limited availability |

| Exclusive tools and features | Stricter withdrawal verification |

| Faster withdrawals | Psychological pressure |

| Access to custom trading conditions | Less flexibility for beginners |

You Might also Like:

- MultiBank Group Review

- AvaTrade Review

- Exness Review

- XM Review

- FOREX.com Review

- Pepperstone Review

- FP Markets Review

- HFM Review

- IG Review

- Interactive Brokers Review

In Conclusion

Forex brokers with big accounts offer superior trading conditions, tighter spreads, and exclusive perks ideal for experienced traders. However, they require significant capital, carry higher risk exposure, and are generally not suited for beginners.

Faq

A big forex account typically refers to a trading account with a minimum balance starting from $2,500 to $5,000 or more, allowing traders to place larger orders, access higher leverage, enjoy tighter spreads, and trade more currency pairs with better conditions.

Big forex accounts are best suited for experienced traders who can afford larger deposits and higher trading volumes. They seek access to more currency pairs, higher leverage, lower spreads, and better pricing per trade to maximize potential profits with manageable risk.

The main benefits of big forex accounts include increased trading options, the ability to absorb small losses while targeting consistent gains, higher leverage access, tighter spreads, better pricing on large volumes, and the potential for sustainable percentage gains.

To open a big forex account, traders typically need a minimum deposit ranging from $1,000 to $2,500 or more. This allows for larger trade volumes, access to better pricing, higher leverage, and more assets on offer.

Whether big forex accounts are safer depends on the broker category. Retail accounts (small/regular) get mandatory protection like Negative Balance Protection and leverage limits. Professional/Large accounts may waive these protections for higher leverage, increasing risk.

Yes, generally. Clients who qualify as “Professional Traders” (often needing a large portfolio or experience) can access significantly higher leverage than the regulatory limits imposed on smaller, retail accounts.

Yes, brokers frequently offer better customer support for large accounts, often through VIP or Professional programs. These can include dedicated relationship managers, priority service, and exclusive resources.

Yes, many brokers offer Active Trader or VIP programs for large accounts. Benefits often include cash rebates based on trading volume, spread discounts, wire transfer fee reimbursements, and access to exclusive events.

While possible, it is highly discouraged. Beginners should start with micro or mini accounts with a small deposit ($100-$500). A large account significantly magnifies risk and potential losses due to using larger trade sizes, which is detrimental without experience.

Yes, sometimes they are. Many brokers offer VIP or Active Trader programs to large account holders, which can include benefits like priority withdrawal processing and reimbursement of wire transfer fees, leading to faster access to funds.