USDJPY Comeback After Jump in US Consumer Confidence

The US CB Consumer Confidence survey revealed a notable improvement in consumer sentiment, which sent USD/JPY 50 pips higher.

The US CB Consumer Confidence survey revealed a notable improvement in consumer sentiment, which sent USD/JPY 50 pips higher. It showed increased optimism about the labor market, personal income and overall expectations, despite growing concerns about inflation.

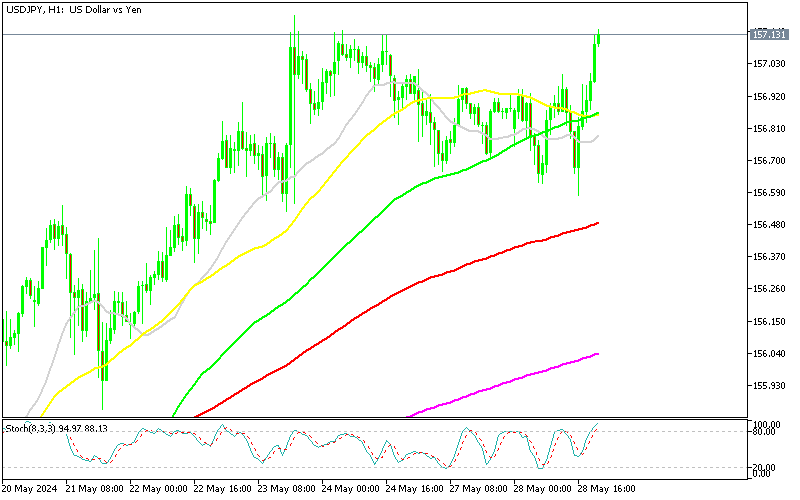

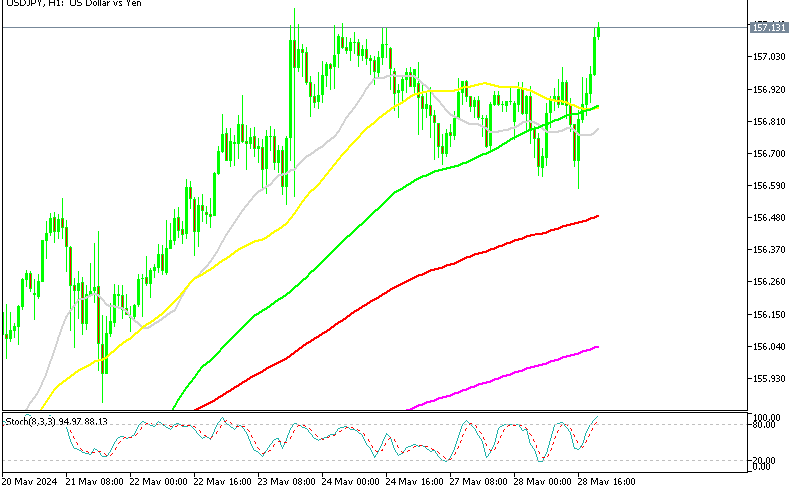

USD/JPY Chart H1 – Returning Above 157

This positive outlook has prompted a swift turnaround in the US dollar’s performance, signaling a rebound from months of decline. Interestingly, a considerable portion of the dollar’s strength was observed prior to the release of the favorable consumer confidence data, suggesting that market participants may have anticipated the positive outcome.

US Consumer Confidence data from The Conference Board for May 2024

- The US May consumer confidence index exceeded expectations, reaching 102.0 points compared to the forecast of 95.9 points.

- The consumer confidence index for April was 97.0 points (revised to 97.5 points)

- Present situation index: 143.1 points, slightly higher than the previous reading of 142.9 points.

- Expectations index: Rose to 74.6 points from the previous 66.4 points.

- Jobs hard-to-get: Decreased to 13.5 points from 15.5 points in the prior reading.

- 16.9% of consumers expect their incomes to increase, up from 16.8% in the previous month.

- 12-month inflation expectations: Increased to 5.4% from the previous 5.3%.

The Conference Board, noted a rebound in consumer confidence for May after three consecutive months of decline. Despite a slightly less positive assessment of the current business environment compared to the previous month, consumers’ overall view was bolstered by the robust labor market. The improvement was particularly evident in perceptions of the labor market, with fewer respondents indicating that jobs were “hard to get.” Additionally, the Expectation Index rose as consumers expressed decreased expectations for future declines in income, job opportunities, and business conditions.

Peterson highlighted that while confidence has improved, it remains within a relatively narrow range observed over the past two years. Supporting this perspective, Tony Pasquariello, Global Head of Hedge Fund Coverage at Goldman Sachs, emphasized the unexpectedly strong expansion of the US economy and the faster-than-average rise in wages compared to overall inflation. This has led to an increase in real disposable income. Pasquariello also pointed to a significant “wealth effect” resulting from the performance of the housing and stock markets, combined with robust household balance sheets. He argued that despite some pessimistic views, US consumption appears to be more resilient.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM