Altcoins melt like ice cream under sun

This week's more than 4.5% decline in Bitcoin indicates that bears are still active at around $70K resistance

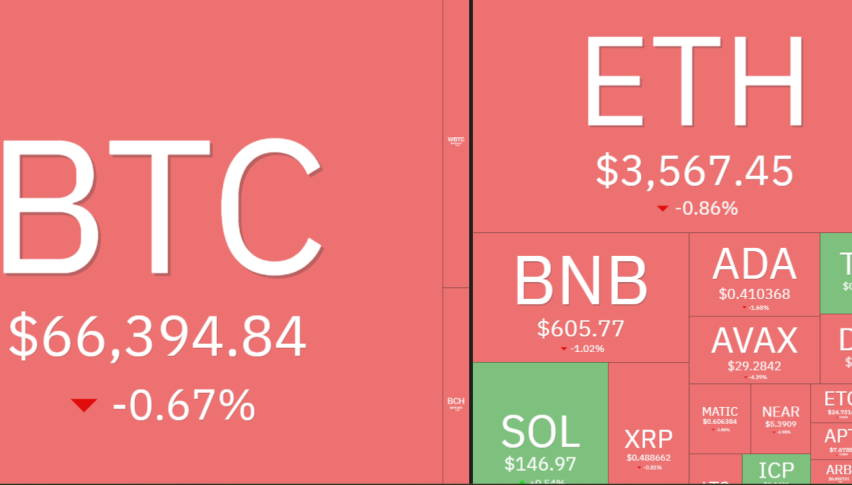

The altcoins are collapsing and wiping out most of the gains achieved during the March cryptocurrency market rise Bitcoin is still consolidating and about 10% below its all-time high. There are several causes for the current downturn in altcoin prices, which has seen many of them hit bear market lows.

This week’s more than 4.5% decline in Bitcoin indicates that bears are still active at around $70K resistance. Due to the recent decline in Bitcoin, there has been further selling pressure on several altcoins, causing them to fall to levels close to or below their immediate support.

An altcoin, or alternative coin, is any crypto asset that isn’t the bitcoin. Some of these digital tokens are built on different blockchain networks, even though they perform functions comparable to Bitcoin.

The crypto market valuation dropped to $2.41 trillion due to altcoin withdrawals, and the weekly position is now negative. The altcoin market most often correlates positively with bitcoin. The altcoin market usually increases in value when bitcoin does, when Bitcoin declines, other cryptocurrencies will often follow suit, declining more quickly and deeply. Price action affirms until Bitcoin has a respectable bounce, altcoins will not climb on their own, even though it is currently hovering around its solid support at $66K.

Bitcoin’s relative strength index (RSI) is in negative territory and the 20-day exponential moving average ($67,863) has begun to decline, indicating that the bears are in control. The BTC/USDT pair will signal the beginning of a more significant correction toward $60,000 if it declines from its current level or the 20-day EMA and breaks below the 50-day SMA.

There are fewer calls for an alt-season and social sentiment and the crypto market are down. A few things cause this bearishness toward altcoins.

The market leader in altcoins, Ethereum, has dropped 10% since the end of May. Because the Ethereum exchange-traded funds have been approved but are not yet listed for trading, there is much confusion around them. Ethereum will now be viewed as a commodity rather than a security, spot ETH ETFs might significantly increase altcoins if introduced soon.

Bitcoin dominance has been rising since December and is currently at 54%. Since the Ethereum ETF is scheduled to list in the coming weeks, it appears highly probable that the rotation will take place and that the current degree of Bitcoin dominance will not last.

The US economy’s data and the country’s ongoing high inflation are other factors impacting cryptocurrency markets and keeping the Federal Reserve from cutting rates. This has been observed in past cycles since altcoins do well when borrowing costs and interest rates are low. The market research firm Santiment stated that during Bitcoin’s decline to $66K, buying interest spiked while selling activity remained sluggish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account