AvaTrade Minimum Deposit Review

AvaTrade makes trading accessible with a low $100 minimum deposit on core accounts. Offering beginner-friendly tools, competitive spreads, and multiple platforms, it provides a simple, cost-effective way for traders of all levels to start investing confidently and efficiently in global markets.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Minimum Deposit and Account Types

AvaTrade supports traders of all experience levels through four distinct account types: Retail, Islamic, Professional, and Demo. With a modest 100 USD starting deposit, flexible leverage options, and tailored features, AvaTrade ensures a trading environment that adapts to diverse needs, from beginners to advanced professionals.

Frequently Asked Questions

What is the minimum deposit for a Retail Account?

The Retail Account at AvaTrade starts with a minimum deposit of $100, making it accessible for both new and seasoned traders to begin trading across multiple markets and platforms.

Can I trade cryptocurrencies with an Islamic Account?

No. AvaTrade’s Islamic Account excludes cryptocurrency trading to maintain Sharia compliance. It allows trading in forex, commodities, and CFDs, using a transparent markup fee instead of interest.

Our Insights

AvaTrade’s account structure offers flexible, inclusive trading solutions. Whether you’re entering with a modest deposit, need Islamic-compliant features, or qualify for professional-level tools, AvaTrade aligns its accounts with trader goals and regulatory standards.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

How To Open an AvaTrade Account

To register an account, click the “Open a Real Account” button on the AvaTrade Homepage. Next, follow these steps to complete the process:

1. Step 1: Complete the Online Registration Form. Enter your email address and create a new password.

2. Step 2: Complete the remainder of the registration form. Select your country of residence and account type. You may choose between a Retail Demo Account, a Retail Account, and a Professional Account.

3. Step 3: Fill out the remainder of the registration form. This will contain your personal information, including your name, birthdate, and address. Verify your account and submit a copy of your ID and proof of residence.

Finally, fund your account. You can fund your account using a credit card, debit card, or bank transfer. Once your account is funded, you may begin trading on the AvaTrade platform.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Deposit and Withdrawal

AvaTrade provides multiple deposit and withdrawal options, including credit/debit cards, bank wire transfers, e-wallets, and cryptocurrencies. The process is secure and user-friendly, with most transactions completed promptly and free from broker-imposed fees.

| Feature | Details |

| Deposit Methods | Credit/debit cards bank wire transfers e-wallets cryptocurrencies |

| Withdrawal Methods | Same as deposit methods |

| Processing Time | Usually 24–48 hours (depending on the method) |

| Broker Fees | Third-party fees may apply |

| User Experience | Fast, secure, and intuitive platform interface |

Frequently Asked Questions

What methods can I use to deposit funds into my AvaTrade account?

AvaTrade accepts various deposit methods, including bank wire transfers, credit/debit cards, e-wallets, and cryptocurrency wallets. Simply access the deposit section from your account dashboard and follow the on-screen instructions.

How do I make a deposit using Bank Wire Transfer?

Log in to your AvaTrade account, navigate to “Deposit,” choose “Bank Wire Transfer,” and enter the deposit amount and currency. Provide your bank details, confirm the request, and complete any remaining steps prompted by the platform.

Our Insights

AvaTrade’s deposit and withdrawal process stands out for its flexibility, speed, and security. With no added broker fees and broad payment method support, it offers an efficient funding experience that caters well to both novice and experienced traders.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Perks of Signing Up with AvaTrade

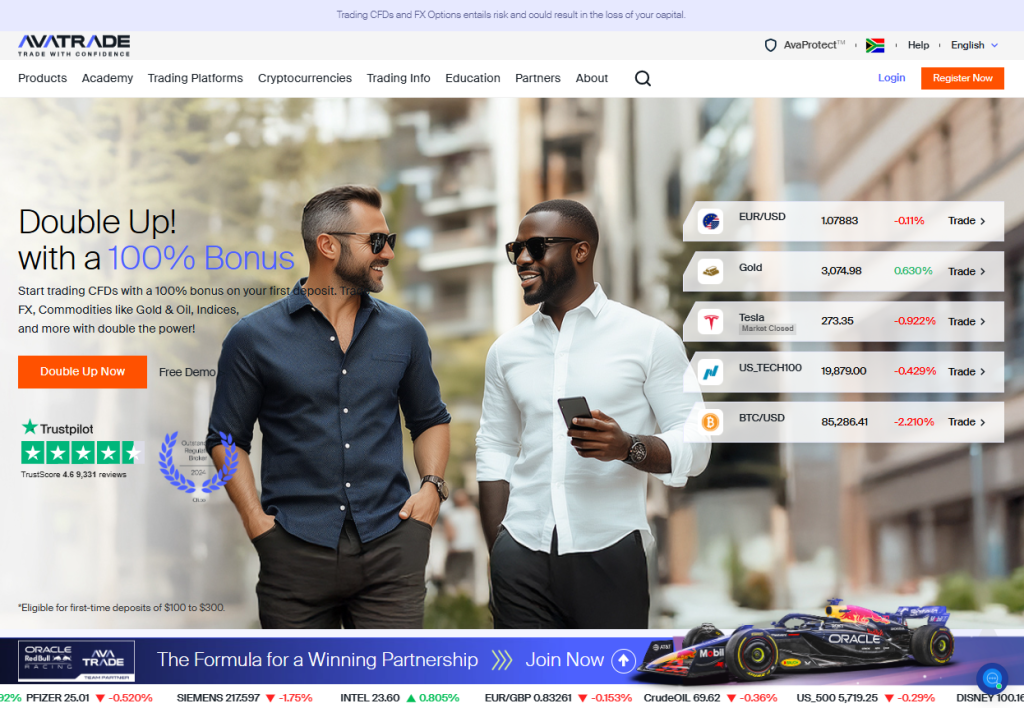

AvaTrade’s “Double Up!” promotion rewards new users by matching their first deposit, between 100 USD and 300 USD, with a 100% bonus. This boost effectively doubles their trading capital, offering a strong start in forex, indices, and commodities.

Frequently Asked Questions

Who is eligible for the 100% bonus?

This promotion is available to new AvaTrade users who are making their first deposit. To qualify, the deposit must be between $100 and $300 and will be matched with a 100% trading bonus.

How does the bonus work?

After depositing an eligible amount between 100 USD and 300 USD, AvaTrade will add a matching bonus to your account. For instance, a 250 USD deposit results in 500 USD total trading capital, expanding your initial market exposure.

Our Insights

AvaTrade’s “Double Up!” promotion is ideal for new traders eager to increase their initial trading power. It provides a helpful boost in capital and leverage, but be sure to understand the bonus conditions and volume requirements before committing.

★★★★★ | Minimum Deposit: $100 Regulated by: CBI, BVI, FSC, ASIC, FSCA, JFSA, FFAJ Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about AvaTrade’s minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open an AvaTrade account? – Carlos, Brazil

A: AvaTrade requires a minimum deposit of 100 USD (or equivalent in EUR, GBP, AUD), ensuring a low-cost entry point for new traders looking to access the platform’s full range of instruments.

Q: How quickly can I withdraw funds from AvaTrade? – Aisha, UAE

A: AvaTrade processes withdrawal requests within 24–48 hours. The total time until funds arrive depends on the method: e-wallets/card transfers (1–5 business days), and wire transfers can take up to 10 business days.

Q: Does AvaTrade charge fees for deposits or withdrawals? – Mark, Canada

A: AvaTrade does not impose broker fees on deposits or withdrawals. However, your bank or payment provider might charge transaction or conversion fees.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: Due to anti-money laundering rules, the same method used for deposits must be used to receive up to 100% of that amount. Profits beyond the deposit can be withdrawn via another method in your name.

Q: What perks come with signing up at AvaTrade? – John, UK

A: New AvaTrade users enjoy key benefits like no-commission accounts, a free demo account, welcoming bonuses (where available), and advanced tools like AvaProtect, delivering excellent value with a low $100 entry

In Conclusion

AvaTrade’s 100 USD minimum deposit offers a low entry barrier without compromising quality. It enables beginners and cost-conscious traders to access global markets confidently, supported by reliable platforms, account variety, and a secure, regulated trading environment.

You might also like:

References:

Faq

When you deposit in a currency that AvaTrade does not directly support, your bank or payment provider will normally manage the conversion.

While AvaTrade’s minimum deposit is 100 USD, the minimum trade size can vary depending on your trading instrument. Opening positions smaller than your initial deposit is possible, allowing for better risk management.

No. AvaTrade typically requires the minimum deposit through a single payment method.

AvaTrade generally accepts wire transfers from personal bank accounts only. If you need to use a business account, you may need to provide additional documentation and get approval from their compliance team.