USD-GBP Rate Holds in 1-Cent Range After UK BRC Retail Sales

The USD-GBP rate has been trading in a 1 cent range, with GBP/USD bouncing between 1.27 and 1.28, as volatility increased recently.

The USD-GBP rate has been trading in a 1 cent range, with GBP/USD bouncing between 1.27 and 1.28, as market volatility increased in the last several days. Following the Bank of England’s decision to cut the bank rate by 25 basis points, from 5.25% to 5.00%, the GBP/USD pair dropped by over 1 cent.

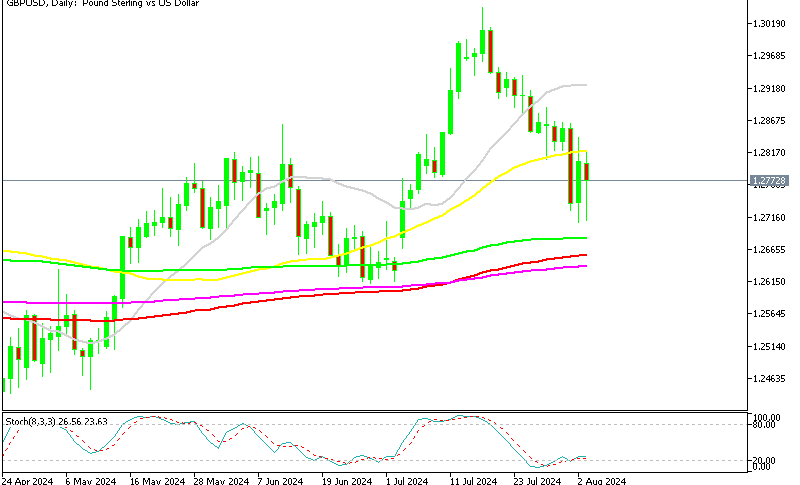

GBP/USD Chart Daily – The 50 SMA Has Turned into Resistance

To avoid signaling a series of rate cuts, BOE Governor Andrew Bailey did not suggest any additional actions for September. After Friday’s weak US non-farm payroll (NFP) employment data, the GBP/USD exchange rate climbed to 1.2840 but couldn’t sustain its gains above the 50-day Simple Moving Average (SMA), which now seems to be acting as resistance. Yesterday, after rebounding from a 100 pip drop during the European session, the pair faced rejection again at this moving average.

All major economies are experiencing a trend of lackluster economic performance, with the period of high inflation coming to an end. Central banks are now feeling the impact of persistently high interest rates. The GBP/USD exchange rate will hinge on which central bank—the Fed or the BOE—decides to cut rates first. This has led to increased economic uncertainty, resulting in reduced risk appetite among investors.

The British Retail Consortium for July 2024

- Total Retail Sales: Increased by 0.5% year-on-year (y/y)

- Compared to a -0.2% change in June

- The average rise over the past 12 months was 1.4%

- Like-for-Like Sales: Decreased by 0.3% y/y

- June saw a decrease of -0.6%

- Note: Like-for-like sales data strips out the impact of changes in store size

Barclays Spending Data

Data from Barclays on credit and debit card spending showed a -0.3% y/y decrease:

- Previous month saw a -0.6% decrease

Barclays highlighted several factors influencing spending:

- The Euro 2024 tournament boosted spending in pubs

- Sunny days in July led to increased spending on barbecues

- This was offset by reduced spending due to rainy weather during the month

- Overall, there was a recovery in spending power and consumer confidence

- Barclays noted: “This, coupled with the fact that the Bank of England has begun to reduce interest rates, should translate into stronger underlying spending growth, as we move through the second half of this year and into 2025.”

Both surveys indicated a fall in non-essential spending.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM