GME Stock Eyes $45 Then $65 after GameStop Blasts Past $33 on DBK AG, Bitcoin Hype

GameStop stock has risen substantially once more, backed by growing crypto mania, significant institutional investment, and speculative...

Quick overview

- GameStop stock surged over 10% amid renewed crypto enthusiasm and significant institutional investment.

- Deutsche Bank increased its stake in GameStop by over 1,000%, adding credibility to the stock's momentum.

- GameStop confirmed plans to hold Bitcoin on its balance sheet, aligning itself with digital finance trends.

- Investor interest has been reignited by Roaring Kitty's substantial position in GameStop, targeting the $65 level.

Live BTC/USD Chart

GameStop stock has risen substantially once more, backed by growing crypto mania, significant institutional investment, and speculative interest in Bitcoin exposure.

GameStop Climbs as Crypto Sentiment Lifts Markets

GameStop (NYSE:GME) shares leapt over 10% during Tuesday’s U.S. session, closing at $30.91 and continuing to tick higher in after-hours trading to $31. This surge aligns with broader gains in stocks tied to digital assets, as Bitcoin reached a fresh record above $112,000, stoking optimism across speculative corners of the market.

Deutsche Bank’s Bet on GME: A 1,000%+ Increase

Fueling bullish sentiment was news that Deutsche Bank AG dramatically increased its stake in GameStop during Q4, according to the bank’s latest SEC filing. The firm boosted its holdings by over 1,000%, acquiring an additional 194,612 shares to reach a total of 213,873—worth approximately $6.7 million. This institutional move added credibility to GameStop’s momentum, suggesting larger players may be positioning for more than just a meme-driven pop.

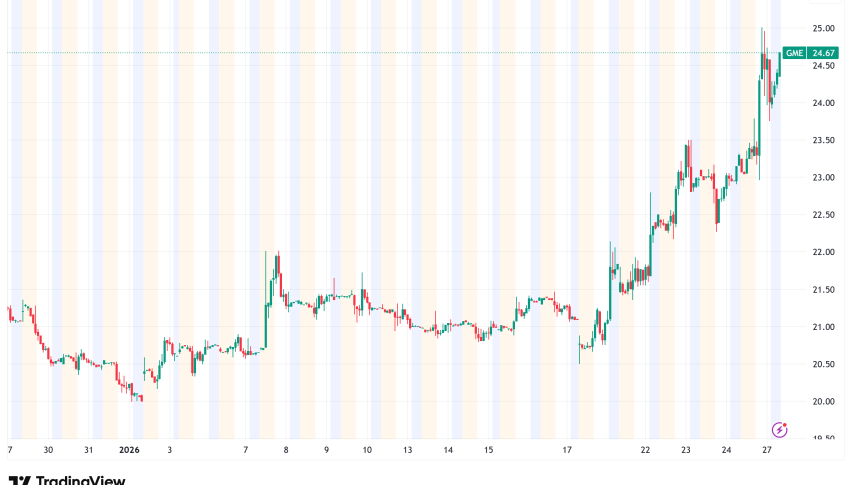

MGE Stock Chart Daily – Breakout Validates Bullish Momentum

GameStop’s breakout above its 200-week simple moving average signals a potential shift in market structure, as the stock gains technical validation following months of consolidation. With the price now comfortably above this key resistance, buyers appear to be targeting the January peak of $34.50 next, and possibly the 2024 high near $65.

Bitcoin Holdings Confirmed Amid Crypto Hype

Despite a 28.5% decline in Q4 year-over-year revenue and earnings that fell short of expectations, GameStop’s updated investment policy stole the spotlight. The company confirmed plans to hold BITCOIN on its balance sheet—an announcement that had been circulating in rumors for weeks. This development reinforces the narrative of GameStop aligning itself with digital finance trends, much like Tesla and MicroStrategy before it.

Roaring Kitty’s Target in Focus

Investor attention has also returned to Keith Gill, a.k.a. Roaring Kitty, who recently disclosed a massive $115.7 million position in GameStop. His personal target is believed to be around the $65 level, coinciding with prior 2024 highs. His reappearance has reinvigorated retail enthusiasm, driving volume and volatility reminiscent of the 2021 meme stock era.

Conclusion: GameStop’s recent rally is being powered by a confluence of institutional buying, crypto-fueled momentum, and the resurgence of retail legend Roaring Kitty. While fundamentals remain weak, the technical breakout above the 200-week SMA and confirmation of Bitcoin holdings may be enough to keep bullish momentum alive in the short term. If current sentiment holds, GME could realistically retest the $34.50 resistance and potentially aim for the psychologically charged $65 level—where the next chapter of the GameStop saga may unfold.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM