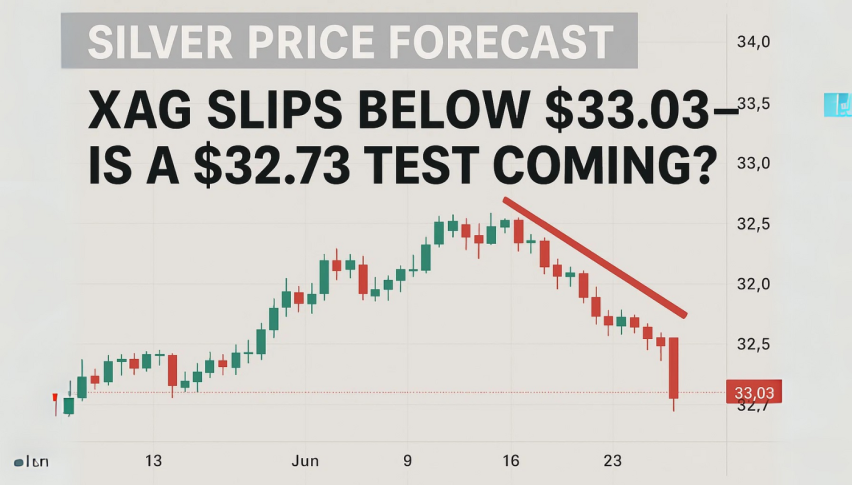

Silver Price Forecast: XAG Slips Below $33.03—Is a $32.73 Test Coming?

Silver prices (XAG/USD) are feeling the pressure. After a steady climb, the metal has broken below its crucial $33.22 support...

Quick overview

- Silver prices have broken below the crucial $33.22 support level, indicating a potential shift in market momentum.

- Technical indicators show rising selling pressure, with the MACD displaying a bearish crossover.

- Investors are concerned about the U.S. fiscal deficit, which adds to the uncertainty surrounding silver's attractiveness.

- Traders should remain cautious, watching for decisive moves below $33.03 or a recovery above $33.22 to gauge market direction.

Silver prices (XAG/USD) are feeling the pressure. After a steady climb, the metal has broken below its crucial $33.22 support, hinting at a possible shift in momentum. As of now, silver is trading near $33.14, with technical indicators pointing to rising selling pressure. The MACD shows a bearish crossover with deepening red histogram bars, while recent candlestick patterns feature small-bodied candles and long lower wicks—classic signs of market indecision leaning bearish.

Macro Factors Drive Uncertainty

A weaker U.S. dollar has been a supporting factor for silver, but that’s not the whole story. Investors are wrestling with worries about a widening U.S. fiscal deficit, especially with the proposed tax cut plan potentially adding $3.8 trillion to the national debt. This backdrop of economic uncertainty and potential dollar weakness has made silver attractive, but recent price action shows the bulls might be losing steam.

Key Technical Levels to Watch

-

Resistance levels: $33.22 (50 EMA), $33.70

-

Support levels: $33.03, $32.73, $32.45

-

MACD signals rising bearish momentum

If XAG/USD fails to reclaim $33.22 and continues to trade below this level, a drop toward $32.73 or even $32.45 could follow. However, a strong bounce above $33.22, especially with volume confirmation and bullish patterns like engulfing candles, could shift momentum back to the bulls.

Silver Outlook: Caution as Bears Take the Lead

While silver has enjoyed support from macroeconomic factors, the recent technical breakdown is a cautionary signal for traders. The market’s indecision, reflected in candlestick formations, suggests it’s waiting for a clear catalyst. Fed policymakers’ comments this week and upcoming U.S. economic data, including the core PCE index, could provide that spark.

For now, the bearish signals on the chart mean traders should stay cautious. Watch for a decisive move below $33.03, which could open the door to deeper declines. On the flip side, a quick recovery above $33.22 might signal that buyers are regaining control. Either way, patience is key. Let the price action lead the way.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM