Forex Signals Brief June 18: USD Gains, BTC Falls as Traders Eye FOMC and Global Risk

With U.S. geopolitical risks escalating and financial markets reacting sharply, attention turns squarely to the Federal Reserve’s upcoming..

Quick overview

- U.S. geopolitical tensions have led to a notable rise in the U.S. dollar and a surge in oil prices, while bond yields have retreated.

- Gold has remained steady despite geopolitical uncertainty, while Bitcoin has faced selling pressure, and Ethereum has shown resilience due to recent updates.

- The Federal Reserve is expected to hold interest rates steady amid mixed economic signals, with recent retail sales data indicating a softening in certain sectors.

- Upcoming U.K. inflation data is anticipated to show a modest cooling, although underlying pressures remain evident.

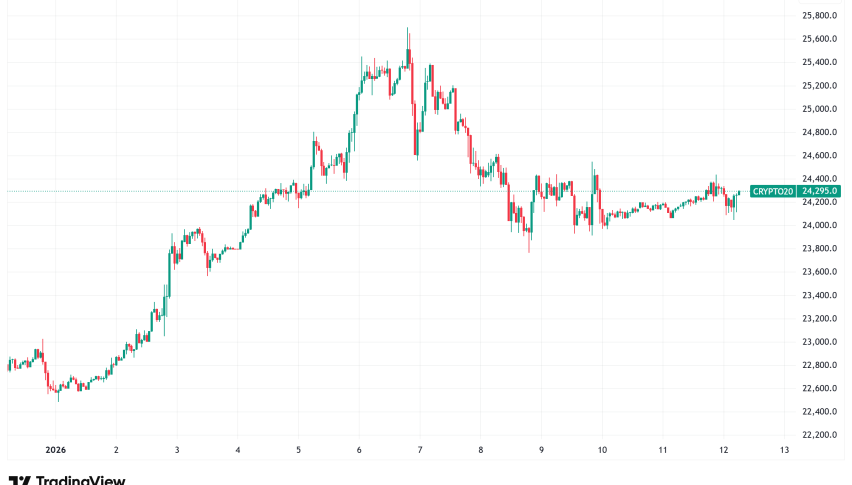

Live BTC/USD Chart

With U.S. geopolitical risks escalating and financial markets reacting sharply, attention turns squarely to the Federal Reserve’s upcoming policy stance.

U.S. Dollar Rises on Geopolitical Escalation

Tensions in the Middle East surged on Tuesday, triggering strong market reactions. The U.S. dollar appreciated notably following statements suggesting potential American military involvement in the Iran-Israel conflict. Israeli Prime Minister Netanyahu warned of imminent U.S. engagement in a strange comment, while President Trump held emergency talks with national security officials. These developments unsettled investors and fueled a move into traditional safe havens.

Oil and Bonds React to Middle East Risks

WTI crude oil surged $3 to settle at $73.27, marking its highest close since January. Heightened geopolitical risk helped drive the rally, as did concerns over supply disruption. Meanwhile, U.S. Treasury yields retreated across the curve, with the 10-year falling 7 basis points to 4.385% and the 30-year slipping to 4.88%, signaling increased bond buying as risk aversion deepened.

Mixed Reactions Across Asset Classes

Despite the rising tension, gold (XAU/USD) held steady around $3,380, showing an uncharacteristically muted response to geopolitical uncertainty. In contrast, Bitcoin (BTC) experienced renewed selling pressure, falling from last week’s peak of $109,356 to below $103,400. Ethereum (ETH), however, held firm, buoyed by growing interest following its recent Pectra update, which improved staking and wallet functionality.

Today’s Forex Market Events:

Wednesday features key inflation data from the U.K., along with U.S. unemployment claims which are expected to be little changed at 246K from 248K previously. UK April inflation data surprised to the upside, with headline CPI rising to 3.5% while core and services inflation also remained elevated. Although this may prove temporary as May CPI is expected to cool off to 3.3%.

U.K. inflation data, due Wednesday, is expected to show a modest cooling from 3.5% to 3.3%, though elevated services and core inflation suggest underlying pressures remain.

All Eyes on the Fed: Policy Hold Expected

As geopolitical events unfold, the Federal Open Market Committee (FOMC) is poised to release its latest interest rate decision. Markets widely expect the Fed to hold rates steady, maintaining the federal funds target range amid mixed economic signals.

Recent data suggests a softening in certain sectors:

- U.S. retail sales for May dropped -0.9%, weaker than the -0.7% forecast.

- Core retail sales (excluding autos) also disappointed, falling -0.3% versus a +0.1% estimate.

- However, the GDP control group surprised to the upside, rising +0.4%, exceeding forecasts.

Although labor markets have cooled slightly, the unemployment rate remains stable at 4.2%. Inflation has ticked lower, but the Fed remains cautious, unwilling to ease until it sees sustained progress.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD jumping above 1.16 but returned back below 1.15, while stock markets retreated on Friday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold (XAU/USD): Holding Ground as Safe Haven Bid Lingers

Gold remains a steady performer in a storm of geopolitical and economic crosscurrents. Spot prices are currently hovering around $3,250, holding most of the gains from last week’s rally. While traditionally a beneficiary of rising geopolitical tension, gold has reacted less dramatically than expected to the Israel-Iran conflict, partly due to high interest rates and strength in the USD.

Still, falling real yields and growing doubts over global economic momentum are supportive for gold in the medium term. Should prices reclaim the $3,400 level, traders are likely to eye a retest of the April all-time high above $3,500. A break below $3,200, however, could prompt a sharper correction.

USD/JPY: Capital Flows Trump Fundamentals

The USD/JPY currency pair posted an unusual rally, rising from 143.40 to 144.31, in a move that diverged from traditional rate differential logic. Analysts attribute the move primarily to capital outflows from Japan, as investors reposition in response to heightened geopolitical risks and shifting global risk appetite.

This pair has become increasingly flow-driven rather than macro-driven, with Japanese investors pulling funds into higher-yielding or “safer” foreign assets amid uncertainty. With U.S. yields retreating and Fed policy on hold, the upside in USD/JPY may be limited unless global equity sentiment improves. Technical resistance lies at 145.00, while support can be seen around 142.70.

USD/JPY – Daily Chart

Cryptocurrency Update

Bitcoin (BTC): Heavy Resistance, Light Support

Bitcoin’s recent price action has turned choppy after its late-May surge. After briefly pushing above $110,000, BTC has struggled to maintain momentum and now trades just below $100,000, with the 20-day moving average acting as a ceiling.

Support is currently seen around the 50-day SMA, but waning risk appetite and geopolitical overhangs have prompted increased profit-taking. Capital outflows and global portfolio rebalancing — not just fundamentals — are adding downward pressure. Without a near-term catalyst or renewed ETF inflows, Bitcoin may continue to consolidate or face downside testing toward $95K.

BTC/USD – Daily chart

Ethereum (ETH): Strength in Structure and Sentiment

Ethereum continues to outpace Bitcoin in relative strength, driven by renewed institutional interest and recent network upgrades. Since April, ETH has gained more than 20%, buoyed by the Pectra update, which significantly enhanced staking efficiency and wallet usability — key priorities for enterprise-level adoption.

Despite broad crypto market volatility, ETH has shown resilience. The technical picture remains constructive, with price holding above key support levels. However, the 200-day moving average still looms overhead as a major resistance zone. A sustained breakout above that level could pave the way for a move toward the $4,000 region, provided broader risk sentiment remains favorable.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account