Forex Signals Brief June 20: Gold and Nasdaq Futures Drop Ahead of Weekend

Markets navigated a blend of central bank moves, simmering Middle East conflict, and mixed economic data, with US equities on pause for...

Quick overview

- US markets paused for Juneteenth amid mixed economic data and geopolitical tensions in the Middle East.

- The Swiss National Bank cut rates to 0.00%, while the Bank of England and Federal Reserve held their rates steady, reflecting differing economic conditions.

- Canadian retail sales are expected to show modest declines, but underlying consumption remains resilient despite consumer pessimism.

- Bitcoin has retreated to around $100,000 as risk appetite softens, while Ethereum has gained over 20% due to institutional interest.

Live NAS100 Chart

Markets navigated a blend of central bank moves, simmering Middle East conflict, and mixed economic data, with US equities on pause for Juneteenth and global risk sentiment showing signs of strain.

Central Bank Divergence: SNB Eases, BOE and Fed Hold Steady

In a mixed week for global monetary policy, the Swiss National Bank (SNB) delivered a 25 basis point rate cut, bringing its benchmark rate to 0.00%, providing modest relief to households and businesses. By contrast, the Bank of England (BOE) maintained its key rate at 4.25%, following the Federal Reserve’s decision less than 24 hours earlier to keep US interest rates at 4.50%.

The diverging paths reflect differing economic priorities: while Switzerland grapples with mild deflation and slowing growth, the UK and US are maintaining a tight stance amid still-elevated inflation and persistent core price pressures.

Geopolitical Uncertainty Casts a Shadow

While US equity and bond markets remained closed for Juneteenth, global investors stayed focused on Israel-Iran tensions, which intensified midweek. Military exchanges, fatalities, and infrastructure damage fueled caution across markets.

Although President Trump indicated the US would avoid direct intervention for at least two weeks, uncertainty looms. As a result, oil prices briefly surged toward $76 before easing back to settle near $74, reflecting tempered concerns about near-term escalation.

Futures on major equity indices dropped roughly 1%, signaling a bearish open for Thursday’s session across European bourses.

Today’s Forex Market Events:

Canadian Retail Outlook Shows Resilience

In economic data, attention turned to Canada’s April retail sales, which are expected to show modest softness in headline figures but stronger core momentum:

- Headline sales are forecast to decline -0.5%, down from March’s +0.8%.

- Core retail sales (excluding autos and gas) are seen at -0.2%, improving from -0.7% previously.

Despite deteriorating confidence metrics, underlying consumption remains surprisingly resilient. RBC cardholder data supports a continued upward trend into May. Although auto sales fell in April and May, the drop followed a tariff-driven surge in March.

Analysts caution, however, that persistent consumer pessimism and affordability challenges may drag on spending in the second half of the year—especially in high-ticket categories like housing and automobiles.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD jumping above 1.16 but returned back below 1.15, while stock markets retreated on Friday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

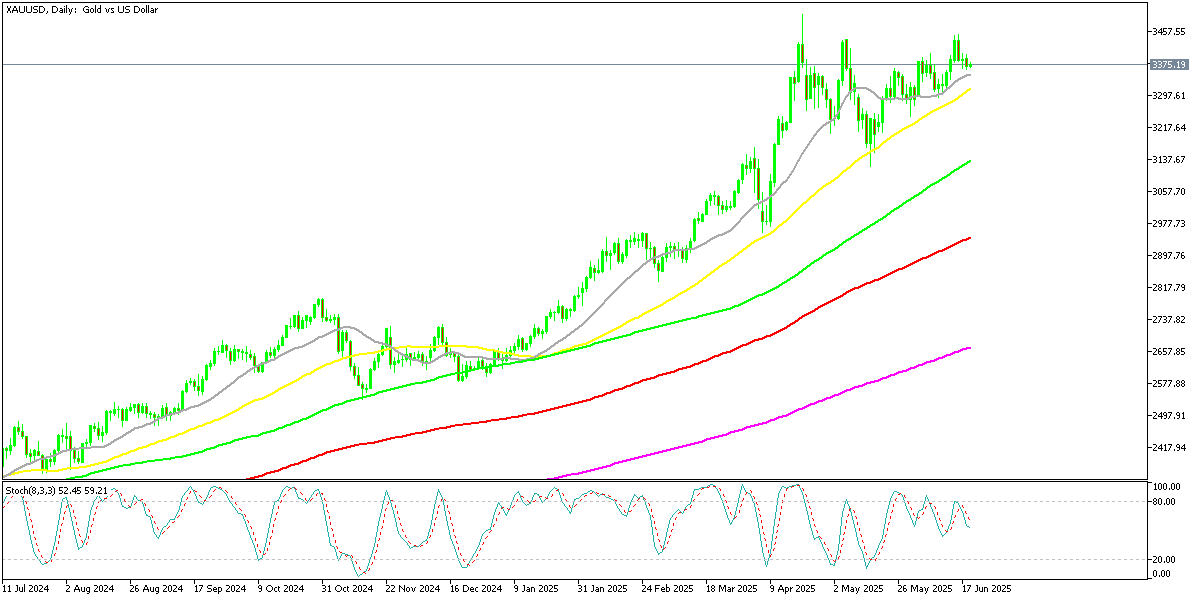

Gold Steady Despite War Fears; Traders Watch $3,200–$3,500 Range

Gold prices remain anchored around $3,250, holding onto recent gains even as war fears rise. Despite its reputation as a geopolitical hedge, gold’s rally has been muted by US dollar strength and elevated real yields.

Still, longer-term support is holding, driven by declining real interest rates and global growth doubts. A break above $3,400 would set up a retest of April’s record high above $3,500, but a move below $3,200 could signal a deeper pullback.

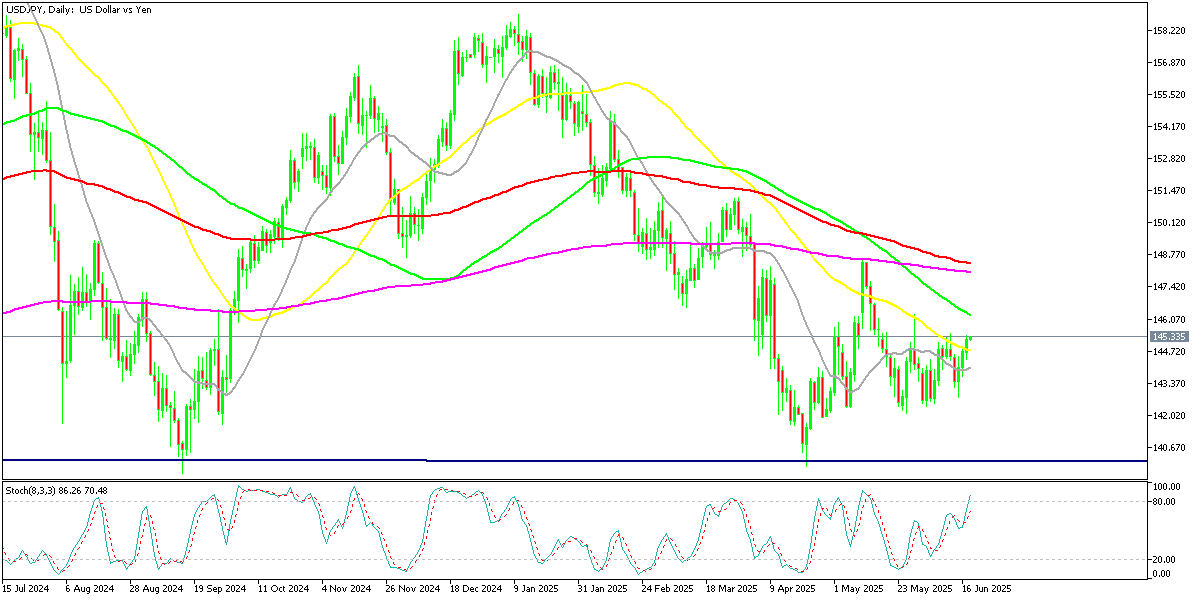

USD/JPY Moves Higher Amid Japanese Outflows

In the currency market, the USD/JPY pair is acting independently of traditional rate spread logic. Instead, capital outflows from Japan—triggered by rising global uncertainty and search for yield—are driving flows.

The pair has climbed from 143.40 to 144.31, with analysts highlighting that this move is more flow-driven than fundamentals-based. While resistance sits near 145.00, broader gains may stall unless risk sentiment stabilizes. Immediate support lies around 142.70.

USD/JPY – Daily Chart

Cryptocurrency Update

Bitcoin Retreats as Risk Appetite Softens

Bitcoin, which surged past $110,000 in late May, has since pulled back and now hovers near $100,000. The 20-day moving average has capped upside momentum, while the 50-day SMA is now acting as short-term support.

With risk appetite fading and geopolitical fears lingering, the crypto market is increasingly vulnerable. In the absence of ETF inflows or fresh catalysts, a dip toward $95,000 cannot be ruled out.

BTC/USD – Daily chart

Ethereum (ETH): Strength in Structure and Sentiment

Ethereum (ETH), on the other hand, has outpaced Bitcoin in recent weeks. Bolstered by institutional interest and the successful Pectra update—which enhanced wallet usability and staking performance—ETH has climbed over 20% since April. Although it faces resistance at the 200-day moving average, a sustained move above that level could set the stage for a breakout toward $4,000.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM