Bitcoin Bulls Eye $130K Target as $20 Billion Options Expiry Approaches Critical Support Level

Bitcoin is still holding strong above the critical $107,000 level, and it has gone up 1.25% in the last 24 hours as traders get ready for a

Quick overview

- Bitcoin is currently trading above $107,000, showing a 1.25% increase in the last 24 hours ahead of a significant $20 billion options expiry.

- The options market is bullish, with $11.2 billion in call options compared to $8.8 billion in puts, suggesting a higher likelihood of price increases.

- Elliott Wave analysis indicates Bitcoin may be entering a powerful Wave 3 phase, with potential targets exceeding $130,000.

- Recent institutional adoption and favorable Federal Reserve comments could further support Bitcoin's price growth in the near future.

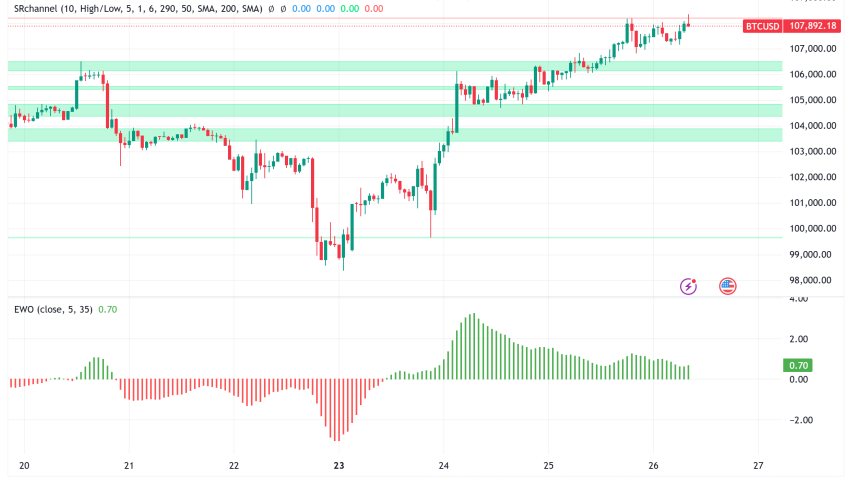

Bitcoin BTC/USD is still holding strong above the critical $107,000 level, and it has gone up 1.25% in the last 24 hours as traders get ready for a huge $20 billion monthly options expiry on Friday. Technical analysts say that the cryptocurrency’s current position is good for bulls who want to break out and reach new all-time highs, with objectives as high as $130,000.

Options Market Dynamics Favor Bullish Sentiment

With call options far outnumbering puts in terms of open interest, the impending options expiration looks quite optimistic. There are currently $11.2 billion in call options and $8.8 billion in put options. This is a big difference that makes prices more likely to go higher.

The distribution of put options is especially interesting because $7.1 billion worth of them have strike prices of $101,000 or less. This concentration means that bears would have to push Bitcoin below $101,500 by Friday’s expiration date, which would be a 5% drop from where it is now, in order to limit their losses and keep control.

The options data reveals several key price scenarios for the expiry:

- Between $106,000-$108,000: Bulls hold a $2.1 billion advantage

- Between $104,500-$106,000: Bulls maintain a $1.4 billion edge

- Between $102,500-$104,500: Bulls lead by $750 million

If bulls can keep prices over $106,000 until Friday’s expiration, it might lay the groundwork for a big rise in July, especially if spot Bitcoin ETF inflows keep coming in at their current rate.

Elliott Wave Analysis Points to Major Breakout

Using Elliott Wave theory for technical analysis, it looks like Bitcoin is ready for its biggest move ever. XForceGlobal, a crypto expert, says that Bitcoin’s recent drop seems to have finished a WXY pattern, with Wave 2 going back to the best Fibonacci levels between 23.6% and 38.2%.

The correction started after Bitcoin hit an all-time high of $111,814 on May 22. It found support near $98,200, which was the minimum target in the $90,000 range. This pullback was important because it kept the overall positive structure instead of going deeper into bear market territory.

If this analysis is right, Bitcoin is now in Wave 3 of its Elliott Wave sequence. This is usually the most powerful and explosive part of any bull market cycle. The projection shows a target above $130,000, which would mean a possible 20% gain from where we are now.

Institutional Adoption Drives Macro Asset Behavior

Recent study by Glassnode and Avenir Group shows that most of the money coming into spot Bitcoin ETFs is not hedged, which means that institutions really believe in the asset rather than just using short-term arbitrage methods. This information points to Bitcoin moving from being a speculative asset to a real macro-driven financial tool.

Bitcoin is now strongly positively linked to classic risk-on assets like the S&P 500, Nasdaq, and gold, but it is negatively linked to the US Dollar Index and credit stress indicators. This change shows that Bitcoin is becoming a more mature institutional asset class.

André Dragosch of Bitwise Europe backs this up by saying that for every $1 trillion increase in the global money supply, Bitcoin’s price might go up by $13,861. This shows how sensitive the cryptocurrency is to changes in global liquidity.

Federal Reserve Policy Could Provide Additional Catalyst

Jerome Powell, the head of the Federal Reserve, has said things that are good for risk assets in all markets. The S&P 500 has reached four-month highs thanks to Powell’s comment that “many paths are possible” for interest rates, including probable cuts if inflation stays low.

Several members of the Federal Reserve, notably Governors Michelle Bowman and Chris Waller, have said they expect rate reduction to happen as soon as July since inflationary pressures are under control. This prognosis for monetary policy could help Bitcoin even more as investors move from government bonds with lower yields to riskier assets.

Bitcoin Price Prediction and Key Levels to Watch

Bitcoin looks like it’s ready for a big rally since technical analysis, options positioning, and improved macro conditions all point in the same direction. The first level of resistance is roughly $110,000. If that level is broken, it may lead to $130,000.

The important support levels are still around $105,000 and $101,500. The latter is the level that bears must break through to regain control before options expire on Friday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM