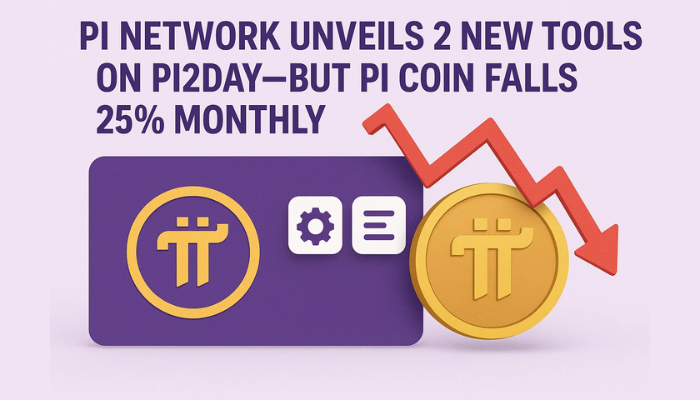

XRP Price Prediction: ETF Odds Drop to 75% While Solana Jumps to 92% Approval Momentum

XRP ETF odds slipping. On Polymarket, odds dropped from 98.2% to 75% in two weeks before recovering to 78%.

Quick overview

- XRP ETF approval odds have dropped from 98.2% to 75% due to ongoing legal uncertainties surrounding Ripple's case with the SEC.

- Despite the decline in XRP, analysts believe it may be a temporary reaction rather than a fundamental shift, with a potential for recovery.

- In contrast, Solana's ETF approval odds have risen to 92%, bolstered by legal clarity and strong institutional support.

- XRP's technical setup shows bullish potential if it breaks the $2.20 resistance level, targeting $2.27 in the short term.

XRP ETF odds slipping. On Polymarket, odds dropped from 98.2% to 75% in two weeks before recovering to 78%. This is the first time since April that XRP ETF odds have been below 80% and is raising new questions about the regulatory situation.

The root cause is ongoing legal uncertainty. Ripple dropped their appeal in the high profile SEC case but the case isn’t closed. Former SEC attorney Marc Fagel said unless the SEC formally withdraws their appeal through a vote the case is still open. This uncertainty is weighing on institutional confidence in the short term.

- XRP ETF odds dropped 23 points in two weeks

- Ripple’s legal battle with SEC is still open

- Bloomberg analysts still estimate 95% chance of approval

Despite the drop some analysts see this as a temporary reaction to procedural delays rather than a change in fundamentals. A favorable outcome could quickly restore market optimism.

Solana up to 92% on ETF Approval Bets

While XRP is down, Solana is up. Solana ETF approval odds are now at 92% on Polymarket, the highest of all crypto assets. Legal clarity, strong network metrics and institutional backing is helping SOL pull ahead of the competition in the ETF race.

Nine asset managers have filed ETF proposals, Invesco’s proposed ticker “QSOL” is the focal point for institutional traders watching Solana’s ecosystem mature.

What’s driving Solana’s move:

- No active lawsuits or regulatory threats

- Faster, cheaper transactions on a high throughput blockchain

- Staking enabled ETFs offer 8% annualized yield

Plus an upcoming Solana hard fork focused on efficiency improvements is another tailwind for the ETF.

XRP Technical Setup eyes $2.23 Breakout

XRP’s chart is looking bullish despite regulatory headwinds. Currently at $2.19 the token is pressing against the $2.20 resistance line, forming an ascending triangle on the hourly chart. This pattern usually precedes breakouts.Golden cross at $2.14 where 50-EMA crosses above 200-EMA. Bullish engulfing candle supported by trendline from $2.03 low means buyers are in control.

Trade setup:

- Buy on breakout: $2.205

- Target 1: $2.232

- Target 2: $2.277

- Stop-loss: Below $2.166

The market will be watching for a volume backed move above $2.20 to confirm the breakout. Otherwise a retest of $2.13 if momentum stalls.

In Summary:

- XRP ETF sentiment is weak at 75% odds due to ongoing legal issues.

- Solana is ahead at 92% approval and strong institutional backing.

- XRP technicals looking bullish if $2.20 breaks, targeting $2.27 short term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account