Avalanche (AVAX) Defends Major Support at $17.17 — Bullish Reversal Looms Ahead

Quick overview

- Avalanche (AVAX) has reached a critical support level at $17.17, potentially marking a bottom after a prolonged bearish cycle.

- The price action shows early signs of a bullish reversal, with a breakout above $18.82 targeting $21.49 and $25.35 in the medium term.

- Avalanche is expanding its blockchain ecosystem with new integrations and partnerships, enhancing its real-world application potential.

- The long-term bullish outlook for AVAX remains intact as long as it sustains above the key support level of $17.17.

After an extended bearish cycle that drove Avalanche (AVAX) down toward multi-month lows, the market appears to be shifting sentiment as price action decisively tests a key structural support.

Our previous bearish forecast on June 18, 2025, accurately anticipated a move toward the $17.17 major key-support, which has since been reached and defended — potentially marking a critical bottom and long-term turning point for the asset.

Now, with global risk appetite improving and crypto market participants returning to speculative assets, AVAX is showing early signs of a bullish reversal. The technical picture, combined with fundamental network developments, paints an encouraging outlook for the coming weeks.

Technical Overview

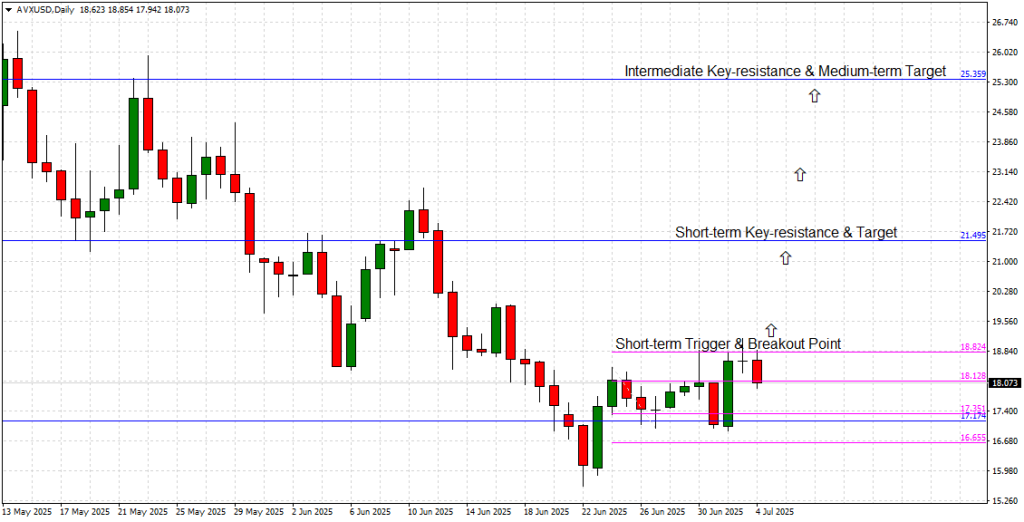

The Daily chart reflects the precision of this technical setup. Following sustained downside pressure, AVAX bottomed out at $17.17, precisely at our identified support zone. Since then, price action has stabilized, printing a series of higher lows while repeatedly testing overhead resistance levels around $18.12–$18.82.

This range now represents the short-term breakout zone. A daily close above $18.82 would constitute a confirmed breakout and trigger a fresh bullish impulse, targeting the next key resistance level at $21.49 in the short term.

Further upside momentum would likely propel price action toward the intermediate key-resistance and medium-term target at $25.35, a historically significant inflection point on higher timeframes.

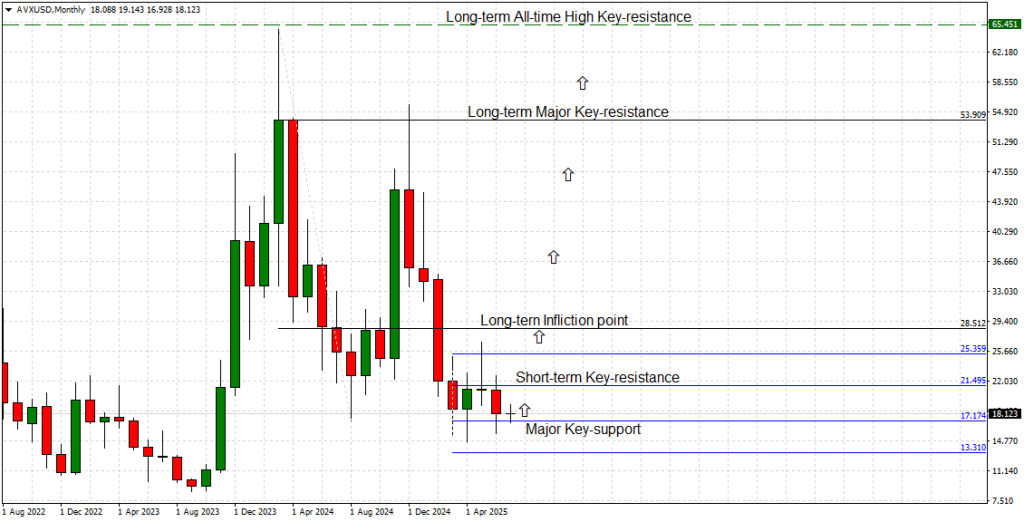

Zooming out to the Monthly chart, AVAX has also successfully defended its major key-support while maintaining structural integrity above $17.17. The long-term outlook remains bullish as long as price sustains above this base.

A sustained bullish wave could eventually retest the long-term inflection point around $28.51, with further breakout triggering a long-term bull cycle toward $53.90 and $65.45, the latter marking AVAX’s all-time high resistance.

Market Outlook

Technically, the formation of a bullish base above $17.17 suggests the selling pressure has exhausted itself for now, with early signs of accumulation visible in both price structure and volume patterns. The daily higher low sequence and tight consolidation beneath breakout resistance typically precede explosive moves.

From a risk management perspective, invalidation of this bullish thesis occurs with a confirmed break and close below $17.17, opening the door for a move to the $13.31 major support zone and last line of defense. However, current momentum indicators lean in favor of bulls as long as AVAX remains inside the $18.12–$18.82 breakout pocket.

Avalanche (AVAX) Technology Update

On the fundamental side, Avalanche continues to expand its Layer-1 blockchain ecosystem, focusing on speed, scalability, and low-cost transactions. In recent months, AVAX developers have successfully integrated Avalanche Warp Messaging (AWM) across multiple subnets, enabling seamless cross-chain communication and interoperability — a significant leap toward true blockchain modularity.

Avalanche is also accelerating its enterprise blockchain adoption strategy, with recent partnerships in supply chain logistics and real estate tokenization initiatives. These integrations highlight AVAX’s real-world application potential beyond retail speculation.

Conclusion

In summary, Avalanche’s bearish correction appears to have concluded with a clean technical reaction off the $17.17 major key-support. The market now shifts focus toward a bullish breakout above $18.82, which would unlock upside potential toward $21.49 and $25.35 in the medium term.

Coupled with network growth, DeFi expansion, and increased interoperability via Avalanche Warp Messaging, the long-term bullish thesis for AVAX remains intact.

Key Levels to Watch:

-

Resistance: $18.82, $21.49, $25.35

-

Support: $17.17, $13.31

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM