Bonk Breaks Out: 20% Surge Sets Sights on $0.00002728 Resistance Level

BONK jumps 20% and clears key trendline resistance. With volume rising and moving averages aligning, can BONK reach $0.00002728? Key levels

Quick overview

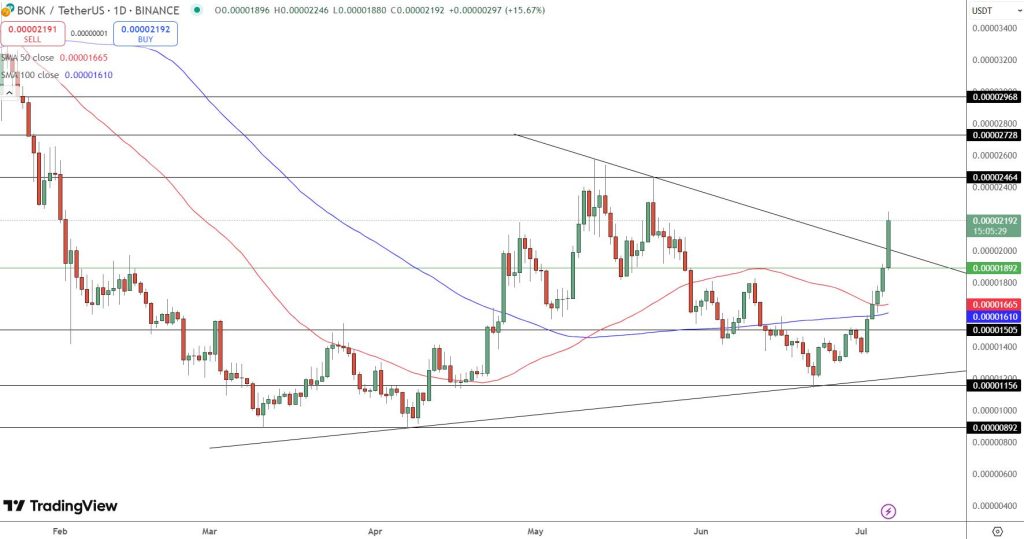

- BONK (BONK/USDT) surged 20% to $0.00002218, marking a significant breakout from a descending triangle pattern.

- The breakout was confirmed with high volume and strong daily close, indicating potential for continued upward momentum.

- Key support is now at $0.00001892, with resistance at $0.00002464 and breakout targets set between $0.00002728 and $0.00002968.

- Traders are advised to consider a retest of support for entry, with a bullish bias as long as the price remains above the 50 and 100-day SMAs.

BONK (BONK/USDT) just had one of its biggest moves in months, up 20% to $0.00002218. This isn’t just a meme pump; this is a clean breakout from the descending triangle that’s been capping price since April.

The breakout above $0.00001892, a long-held horizontal resistance, was confirmed with high volume and a strong daily close. What makes this move significant is the technicals: the breakout was backed by strength across all the moving averages, so this may not be a one and done.

BONK Technicals Align for Breakout Continuation

On the daily chart, BONK is above both the 50-day SMA ($0.00001664) and 100-day SMA ($0.00001610). This is a golden cross, a rare occurrence for meme coins, and could signal a long-term trend change.

Support and resistance levels are now clear:

- Immediate Support: $0.00001892 (previous resistance)

- Key Resistance: $0.00002464

- Breakout Target: $0.00002728 → $0.00002968 (swing targets)

Volume is up with the breakout and higher lows since mid-June suggest accumulation was already underway before this move. The bullish momentum now has structure behind it, not just sentiment.

BONK Trade Setup: Breakout and Retest in Focus

Traders watching BONK may have a textbook breakout and retest setup. Late entries are riskier, but a pullback to support could be a clean entry.

Breakout Trade Plan:

- Entry: Wait for a retest of $0.00001892, ideally with a bullish reversal candle (e.g. engulfing or hammer)

- Targets: $0.00002464 → $0.00002728

- Stop-Loss: Below $0.00001600 (below the 100-day SMA for extra protection)

- Bias: Bullish while price is above the 50/100-day SMAs and broken trendline

This gives a defined risk reward setup for those who want to trade BONK’s volatility without chasing the top.

Final Thoughts

Biggest technical move in the meme coin space this quarter. Volume up, moving averages aligned, resistance zones ahead. If risk appetite improves, bulls have a good case. Watch $0.00002464. Close above that and we could see $0.00002728.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM