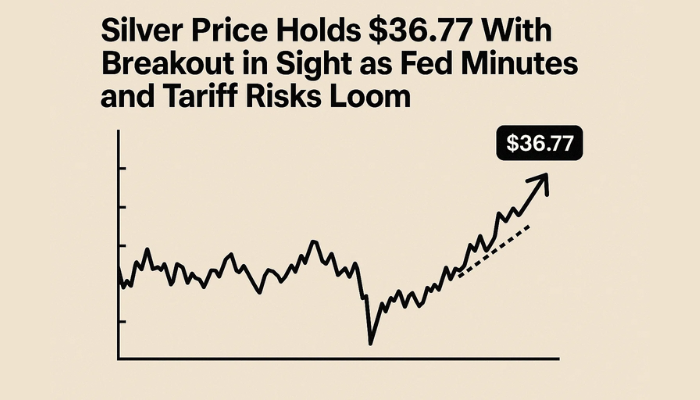

Silver Price Holds $36.77 With Breakout in Sight as Fed Minutes and Tariff Risks Loom

Silver (XAG/USD) is trading steady near $36.77, caught between mixed macro signals and a technical setup that leans slightly bullish.

Quick overview

- Silver (XAG/USD) is trading around $36.77, influenced by mixed macro signals and a slightly bullish technical setup.

- The market is balancing safe-haven interest from tariff threats against downside pressure from rising US Treasury yields.

- A breakout above $37.25 could signal a bullish shift, while a drop below $36.17 would invalidate the current bullish structure.

- Traders are awaiting the Federal Reserve's June meeting minutes, which could impact silver's momentum.

Silver (XAG/USD) is trading steady near $36.77, caught between mixed macro signals and a technical setup that leans slightly bullish. While price action has cooled since tapping a high of $37.25 last week, the broader structure remains constructive. This comes as traders brace for the release of the Federal Reserve’s June meeting minutes and new developments around Donald Trump’s tariff push.

Markets have been balancing two key narratives:

- Modest safe-haven interest from tariff threats

- Downside pressure from increasing US Treasury yields.

Trump’s proposal to reimpose 25% tariffs on key Asian trading partners has sparked concern, but without a clear escalation, the reaction in precious metals has been measured. That said, the threat of retaliatory action, especially from China, continues to hang over sentiment.

The real test will come midweek, when the Fed releases its latest policy commentary. With yields holding near recent highs, a hawkish tone could dampen silver’s momentum. But if there’s any hint of softening, metals may catch a bid.

Bullish Channel Structure Remains Intact

Technically, silver continues to respect a rising channel that’s been in place since late June. The metal bounced cleanly off the 50-period SMA at $36.63 earlier this week, with buyers defending the trendline support. This setup keeps the door open for a breakout above $37.25—a resistance level that’s been tested twice in recent days but not yet cleared.

The RSI sits at 53.39, signaling neutral-to-mildly bullish momentum. It’s recovering from a recent dip, suggesting sellers may be losing strength but buyers haven’t yet seized full control.

Key Levels to Watch:

- Resistance: $37.25 (breakout trigger), $37.59 (channel top), $37.90 (June swing high)

- Support: $36.63 (50-SMA), $36.17 (channel base), $35.80 → $35.42 (deeper retracement zones)

Trade Setup: Breakout or Breakdown?

This week’s trade setup is relatively straightforward: the bullish bias holds as long as price stays within the rising channel and above $36.63. A strong daily close above $37.25 with volume would likely confirm a breakout and open the path toward $37.90.

On the flip side, a failure to hold $36.17 would invalidate the bullish structure and potentially drag silver toward $35.80 and lower.

Trade Setup to Watch:

- Bullish Entry: Above $37.25 with volume confirmation

- Targets: $37.59 → $37.90

- Stop: Below $36.63

- Bearish Scenario: Break below $36.17

- Targets: $35.80 → $35.42

- Stop: Above $36.63

Conclusion:

Silver may not be exploding higher, but it’s showing resilience amid rate jitters and trade tension. A confirmed move above $37.25 could change the tone fast. Until then, price action suggests patience—especially with key macro triggers just ahead.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM