Uniswap (UNI) Bullish Breakout in Process as Major Inflection Point Comes Under Fire

After a well-anticipated pullback in late June, Uniswap (UNI) is now staging a technically significant bullish breakout attempt, confirming

Quick overview

- Uniswap (UNI) is attempting a bullish breakout above the critical resistance level of $7.56, which has been a barrier since March.

- A confirmed breakout could lead to a significant rally towards the next resistance at $14.02, representing a potential 100% upside.

- Fundamentally, Uniswap is progressing with its v4 development and expanding liquidity incentives, contributing to a positive growth narrative.

- Technical indicators suggest that a sustained breakout above $8.00 would validate a bullish continuation pattern, attracting more buying interest.

After a well-anticipated pullback in late June, Uniswap (UNI) is now staging a technically significant bullish breakout attempt, confirming the long-term bullish narrative we outlined in our June 20 forecast.

Back then, we projected near-term downside pressure but warned that the correction was likely a tactical move designed to build structural momentum for a larger bullish reversal. The market has validated that thesis.

As of this writing, UNI is aggressively testing the critical inflection point at $7.56, a zone that has acted as a stubborn multi-month resistance since March. A clean, confirmed breakout above this level would be an unmistakable bullish trigger — one that opens the path for an ambitious rally toward the next major resistance level at $14.02. Based on the unfolding structure and market sentiment, this could represent a 100% upside opportunity from the current levels.

Technical Analysis Breakdown

Let’s dissect what’s happening on the charts:

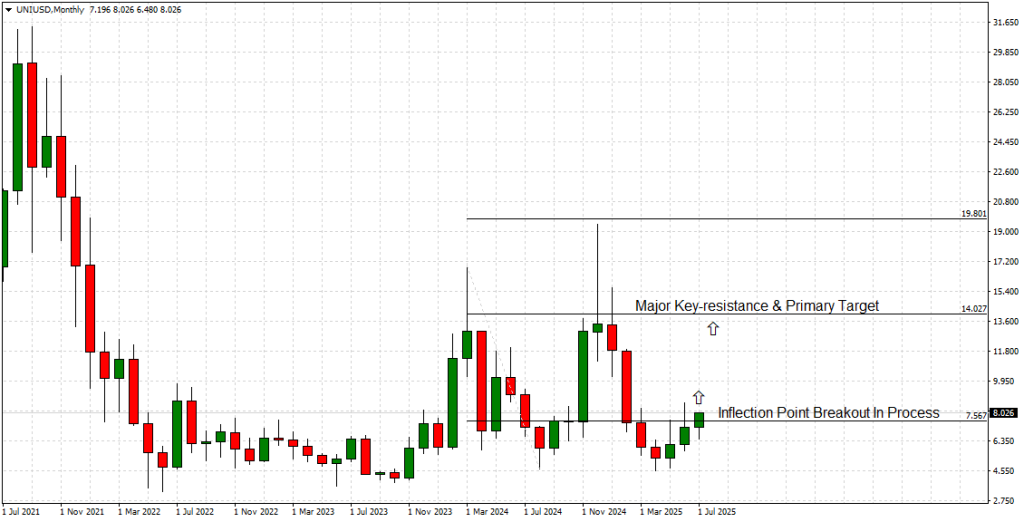

Monthly Chart (Attached)

-

Price action is attempting to break out above the $7.56 inflection point after multiple failed attempts earlier in 2025.

-

A sustained breakout would effectively mark the first monthly close above this zone since November 2024, signaling a long-term reversal pattern.

-

The Major Key-Resistance at $14.02 would become the primary target following a clean breakout.

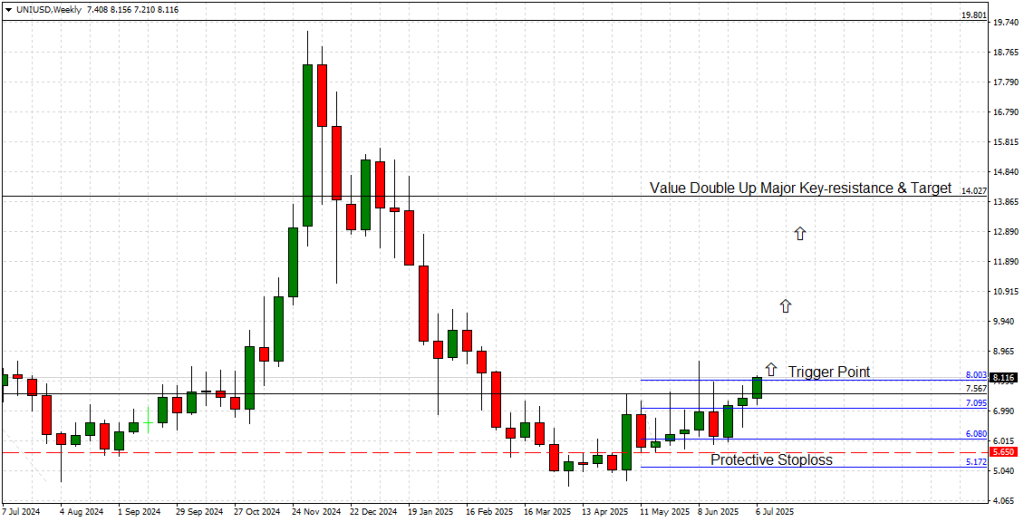

Weekly Chart (Attached)

-

The Trigger Point at $8.00 is under assault right now, following a sharp multi-week advance.

-

Weekly candles have established higher lows since early June, building a compact bullish base below the breakout level.

-

A break and hold above $8.00 would validate a bullish continuation pattern.

-

Notably, the chart highlights a Value Double Up Potential — a breakout above $8.00 projects a measured move toward $14.02, supported by historical price pivots from late 2024.

Protective Stoploss: Given the technical landscape, a tactical stop below $6.08 (Key-support area) would be appropriate for bullish setups.

Uniswap Ecosystem & Technology Update

From a fundamentals perspective, Uniswap’s growth narrative continues to gain traction. Over the past 30 days:

-

Uniswap v4 development has reached final audit stages, with several novel features poised to roll out in Q3 2025, including:

-

Hooks: Allowing custom contract logic between swaps.

-

Singleton architecture: Aims to reduce gas costs by 15–20%.

-

Enhanced on-chain governance modules designed to make proposal and voting mechanics more community-inclusive.

-

-

Layer 2 Expansion: Uniswap has also expanded liquidity incentives on Optimism and Arbitrum, with daily trading volumes on L2s increasing by over 18% in July so far.

-

Partnerships: The DEX recently integrated with SafePal and Coin98 wallets, broadening its access to retail and mobile-first DeFi users.

-

Liquidity Growth: TVL (Total Value Locked) across all Uniswap pools has climbed back above $5.4B for the first time since February 2025 — a key metric reinforcing growing on-chain activity and deepening liquidity.

Forecast Summary

| Inflection Point | Status |

|---|---|

| $7.56 | Breakout test in progress |

| $8.00 (Trigger) | Immediate short-term trigger level |

| Primary Target | $14.02 (100% upside potential) |

Conclusion

Uniswap is on the cusp of a major breakout that could usher in a new bullish cycle. Technical charts from both Weekly and Monthly timeframes are aligned for upward momentum, while fundamental and ecosystem growth metrics remain firmly positive. A confirmed breakout above $7.56–$8.00 would likely attract significant buying interest, positioning UNI for a swift advance toward $14.02.

For traders and investors, this presents a compelling value proposition, with clear technical triggers, defined stop levels, and a risk-reward profile favoring bulls.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM