Silver Hits $37.36 as Trump Tariffs & RSI 75 Signal Push Toward $37.92

Silver (XAG/USD) surged on Thursday to $37.36 after breaking above the key $37.21 level. The move came as market sentiment shifted...

Quick overview

- Silver (XAG/USD) surged to $37.36 after breaking the key $37.21 level, driven by safe-haven demand following new U.S. tariffs.

- The bullish trend in silver is supported by a sustained uptrend and a breakout above previous consolidation levels.

- Despite the RSI indicating overbought conditions, the overall market sentiment remains positive for silver as it follows gold's lead.

- Traders should watch for potential reentry opportunities if silver dips to trendline support or the 50 SMA.

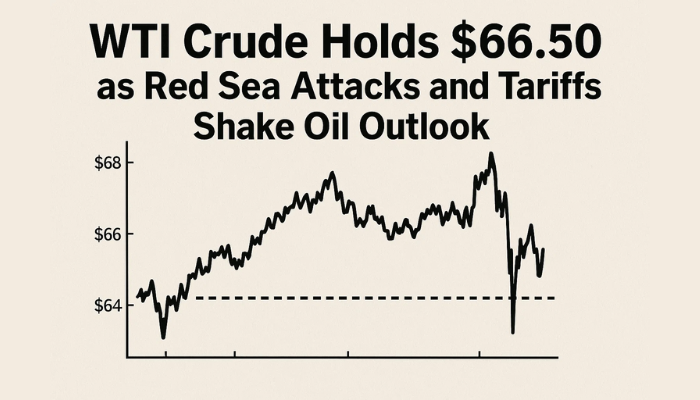

Silver (XAG/USD) surged on Thursday to $37.36 after breaking above the key $37.21 level. The move came as market sentiment shifted after U.S. President Donald Trump’s new tariff announcements. A 35% duty on Canadian imports, plus 15-20% on other countries including Japan and South Korea sparked safe-haven demand in precious metals.

Silver often follows gold’s lead in times of geopolitical or trade uncertainty. And with gold getting a bid on rising trade tensions, silver is benefiting from the same macro winds.

At the same time the dollar is capping gains to some extent. The US Dollar Index is on track for its best week since February which tends to weigh on non-yielding assets like silver. But so far buying interest in metals is outpacing the dollar drag thanks to institutional rotation back into commodities as uncertainty mounts.

RSI Flashes Overbought, But Structure Remains Bullish

From a technical perspective silver’s setup is still bullish. The 2 hour chart shows a sustained uptrend with higher lows since June 28 and support from the 50 SMA at $36.67. After multiple failed attempts the breakout above $37.21 was clean with a strong close and follow through to $37.36.

But the RSI is at 75.11 which is overbought. That’s not a sell signal but does suggest we may see some short term consolidation or a minor pullback before more upside.

Bullish highlights:

- Trendline support is intact

- RSI 75.11 confirms momentum but flags caution

- Breakout above $37.21 cleared previous consolidation

- SMA 50 is trending up at $36.67

Silver Trade Setup: Breakout or Retest Opportunity

If silver holds above $37.21 bulls could push to the next resistance levels at $37.61 and $37.92. Those levels are previous highs from late June. Any dip to the trendline or 50 SMA could be a cleaner reentry especially if accompanied by a bullish engulfing or hammer.

Trade Plan (Breakout Play):

- Entry: On a confirmed close above $37.2

- Stop-loss: $36.93 or $36.67 (SMA/trendline)

- Targets: $37.61 and $37.92

In my experience when silver rides strong RSI into horizontal breakouts especially with supportive macro winds like tariffs and global risk-off moves it tends to overshoot short term resistance. But don’t be surprised by a quick dip to retest the broken zones before bulls make their next move.

If gold keeps going silver won’t be far behind. Watch policy rhetoric and DXY strength this breakout still has room to run.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account