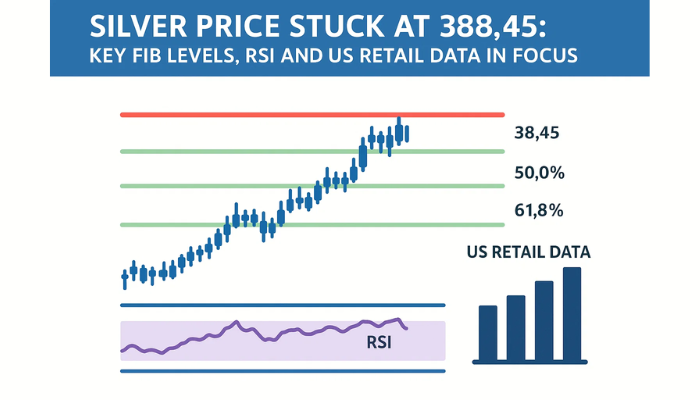

Silver Price Stuck at $38.45: Key Fib Levels, RSI and US Retail Data in Focus

Silver (XAG/USD) is stuck below $38.45 after a big move earlier in July ran into resistance. Price has cooled off after being rejected...

Quick overview

- Silver (XAG/USD) is currently consolidating below $38.45 after facing resistance at the 23.6% Fibonacci level.

- The 50-period simple moving average at $38.130 is acting as dynamic resistance, while the 61.8% Fibonacci level at $37.354 is holding as support.

- The RSI has weakened to 45.88, indicating a lack of momentum and potential for a breakout, though the direction remains uncertain.

- Today's US economic data releases could significantly impact silver prices, with stronger retail sales potentially pressuring the metal.

Silver (XAG/USD) is stuck below $38.45 after a big move earlier in July ran into resistance. Price has cooled off after being rejected at the 23.6% Fib at $38.449. Since then it’s been consolidating between key Fib zones with buyers and sellers struggling to take control.

The 50 period simple moving average (SMA) at $38.130 is acting as dynamic resistance on the 2 hour chart. Price has failed to close above this zone so the rally has lost steam. Below that the 61.8% Fib at $37.354 has been tested multiple times and is holding for now. This area is often referred to as the “golden ratio” by traders and could be the key to preventing further downside.

With these technical standoffs in place today’s US data could be the wild card that tips the scale. Retail sales and jobless claims are due out soon and could inject some volatility into the market.

RSI is Weakening

The RSI has dropped to 45.88 below the 50 level and is reinforcing the lack of momentum on both sides. Historically RSI in this zone during consolidation periods often precedes a breakout but the direction is unknown until follow through appears.

The RSI has also failed to close above 50 in recent attempts and is hinting that the recent buying pressure is fading. Traders often interpret this RSI stagnation as a warning sign that a pullback could be imminent unless sentiment shifts quickly.

If RSI starts to rise with volume and closes above 50 that could be a sign of bullish momentum returning. But if it falls below 40 that could be a bearish sign especially if supported by macro data shocks.

US Economic Releases Today

Thursday’s economic calendar is packed with high impact US data that could impact precious metal sentiment:

- Core Retail Sales (MoM): 0.3%, prior -0.3%

- Retail Sales (MoM): 0.1%, prior -0.9%

- Unemployment Claims: 233K, prior 227K* Philly Fed Manufacturing Index: -1.2, prior -4.0

Any surprise in retail sales could strengthen the dollar and put pressure on silver as a stronger greenback usually hurts precious metals. Weak jobless claims or soft retail sales could give silver the room to test the upper Fib zones.

Key Levels:

- Resistance: $38.031 (38.2% Fib), $38.449 (23.6% Fib), $39.126 (Swing High)

- Support: $37.693 (50% Fib), $37.354 (61.8% Fib), $36.867–$36.259 (Fib Cluster)

Conclusion

Silver is stuck between 23.6% Fib resistance and 61.8% support. With RSI cooling off and the US macro calendar heating up a big move could be coming. Whether that move is up or down will depend on today’s data and dollar strength and overall risk appetite.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM