Polkadot (DOT) Breakout Alert: Major Bull Cycle Brewing as $4.052 Falls

Quick overview

- Polkadot (DOT) has broken past critical resistance levels at $4.052 and $4.169, signaling a potential medium-term rally towards $4.958.

- The recent price action indicates a shift from consolidation to trend expansion, supported by rising volume and higher lows.

- Polkadot's ecosystem is strengthening with increased parachain adoption and improvements in cross-chain messaging, reinforcing its role in the blockchain economy.

- If DOT maintains its position above $4.17, it could mark the beginning of a larger bullish cycle, with a longer-term target of $5.40.

Polkadot (DOT) is flashing a powerful bullish signal as it pushes past a critical multi-timeframe resistance level at $4.052 — a line that acts as a pivotal inflection point. This breakout, reinforced by a short-term trigger breach at $4.169, is now opening the door to a medium-term rally that could propel DOT toward $4.958 — a move representing nearly 20% upside from current levels.

Backed by renewed interest in scalable layer-0 networks and cross-chain interoperability protocols, DOT’s technical and fundamental landscape is aligning for what could become the early phase of a much larger structural bull cycle.

Breakout Levels & Bullish Structure

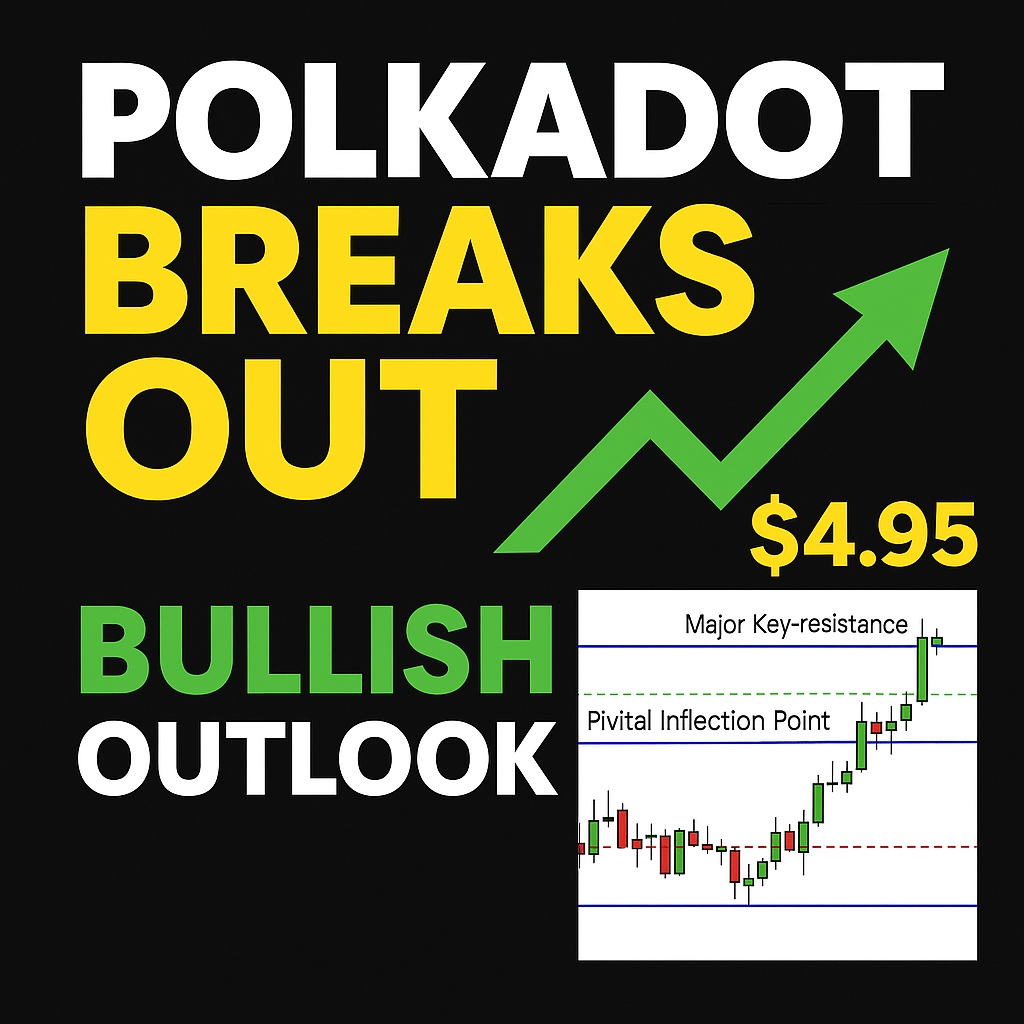

On the Daily chart, DOT has successfully broken above its short-term key resistance at $4.169, a level that capped price action throughout the early part of July. This breakout confirms short-term bullish momentum, especially as price is now sustaining above that threshold on successive daily candles.

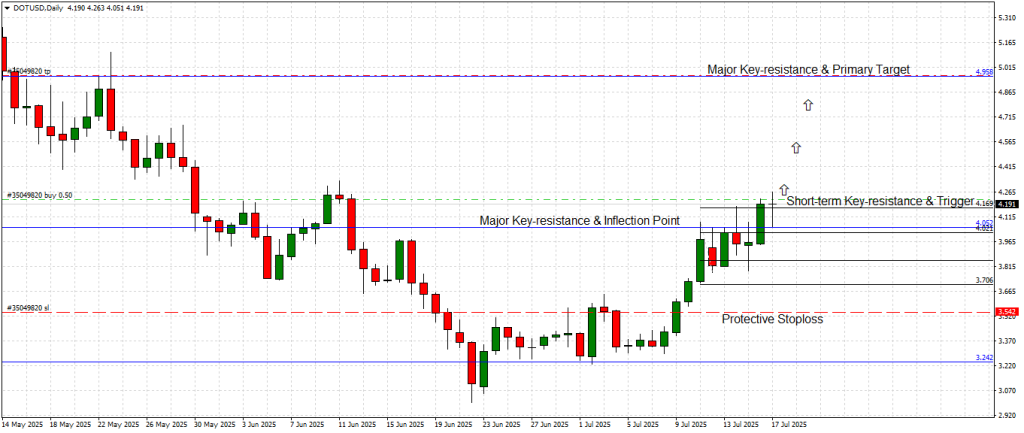

Zooming out to the Weekly chart, we’re seeing price breach the long-standing major resistance at $4.052, which has historically acted as both support and resistance across several market cycles. The convergence of these two breakout points — short-term trigger at $4.169 and macro inflection at $4.052 — adds significant credibility to the bullish thesis.

Key Levels

-

Bullish Trigger (Daily): $4.169

-

Macro Pivotal Key-level: $4.052

-

Next Major Key-resistance & Primary Target: $4.958

-

Extended Resistance / Previous High: $5.40

-

Invalidation / Stop Zone: Below $3.54

From a technical perspective, these breakouts mark a transition from consolidation into trend expansion. This structural shift implies that DOT could be entering a new impulsive wave — supported by higher lows and increasing volume on breakout candles.

Price Action Outlook: Bulls Take the Steering Wheel

Price action confirms that the bulls are taking initiative. The current breakout is not just a wick rejection or low-volume anomaly — it’s supported by multiple closes above the key levels, rising momentum, and a pattern of higher lows stretching back to late June.

Importantly, trading volume has seen a mild uptick over the past few sessions, suggesting that accumulation is active and follow-through buying is in play. If price can hold above the $4.17 region, traders should expect progressive stair-step movements toward $4.95 and beyond.

On the weekly timeframe, the structure looks even more compelling: DOT is breaking a macro downtrend structure that began in late Q1. This could be the early ignition point for a larger cycle, especially if Bitcoin and the broader market continue to stabilize or grind higher.

Polkadot Ecosystem Update: Fueling the Fundamentals

Polkadot continues to innovate as the most mature Layer-0 interoperability platform in the Web3 ecosystem. Its relay chain and parachain architecture allows multiple blockchains to operate independently while sharing security and communicating across chains — a unique advantage in a multi-chain future.

Recent developments include:

-

Continued growth in parachain adoption: New projects are winning auction slots and building vertical-specific chains (e.g. gaming, DeFi, identity).

-

XCM (Cross-Consensus Messaging) Expansion: Improving composability between parachains and the broader Web3 universe.

-

Governance 2.0 rollout: Giving token holders more responsive and efficient control over the protocol.

This robust ecosystem development reinforces the idea that DOT is not just another altcoin, but rather, a foundational infrastructure layer for the evolving blockchain economy.

Conclusion: DOT Eyes $4.958 as New Bull Cycle Ignites

With both the Daily and Weekly resistance levels caving in, Polkadot is showing strong potential to rally toward $4.958, its next major target. If bulls can maintain price above $4.17, the setup remains clean and directional, with the macro target at $5.40 a longer-term objective.

Traders and investors should watch for continued strength and consolidation above the breakout zones. This is a pivotal moment in DOT’s technical landscape — and one that could mark the beginning of a broader trend shift in its favor.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM