Chainlink (LINK) Bulls Face Major Inflection at $19.35 – Is a Breakout Imminent?

Quick overview

- Chainlink (LINK) has rebounded from key support levels and is now testing a critical resistance at $19.35.

- A successful breakout above this level could lead to targets of $22.20, $26.35, and potentially $31.00.

- Chainlink's technology developments, particularly the CCIP expansion and enterprise adoption, are strengthening its market position.

- Investor sentiment is positive, with rising participation in LINK futures and spot volume, supporting the bullish outlook.

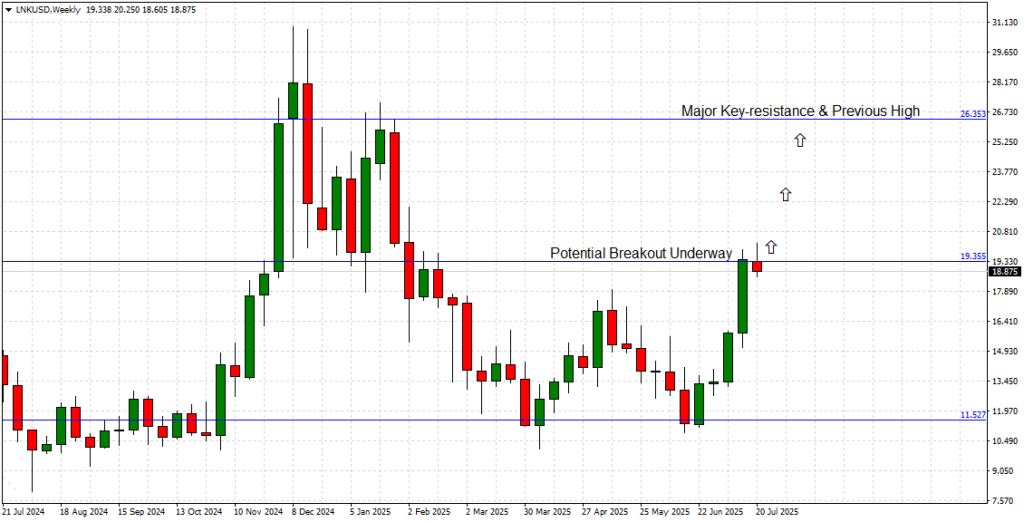

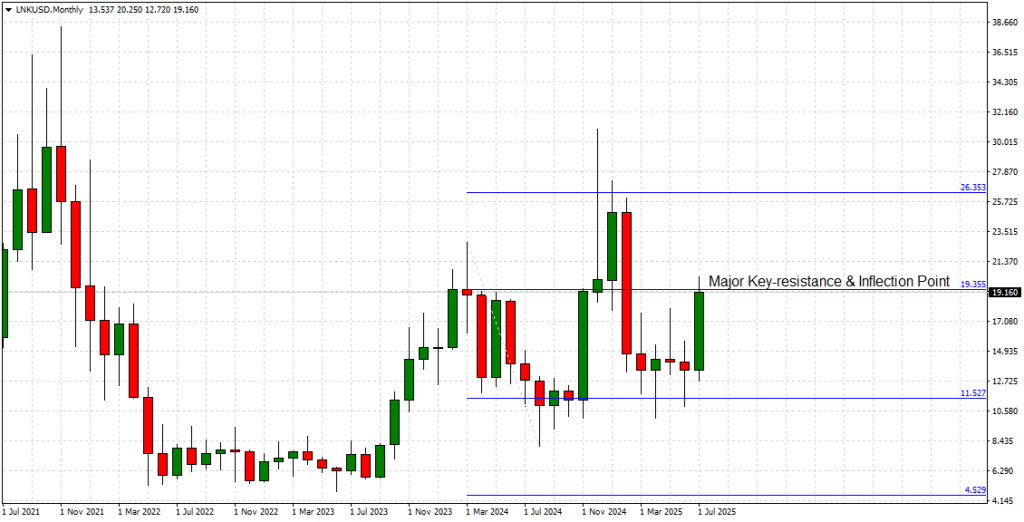

Chainlink (LINK), the decentralized oracle network, has followed our previous bullish roadmap with precision. As forecasted in our June 29 publication, LINK successfully rebounded from key support levels and has now surged to confront a critical major resistance and inflection point at $19.35.

This level is not just any price barrier—it represents a multi-timeframe convergence of past resistance and market memory, making it a make-or-break zone for Chainlink’s short- to medium-term trajectory.

Technical Picture: Weekly & Monthly Chart Synergy

The Weekly chart illustrates LINK attempting to punch through the $19.35 ceiling, which has proven resilient in multiple past attempts. The strong bullish candles in recent weeks reflect growing momentum and investor confidence. Should LINK successfully breach this resistance on a Weekly close, it opens the door to an extended move toward:

-

$22.20 – interim Fibonacci projection and micro-resistance.

-

$26.35 – next major key-resistance and structural pivot from Q1 2025.

-

$31.00+ – psychological level and multi-month high from earlier this year.

From a Monthly perspective, the breakout attempt is even more notable. LINK is reclaiming levels last seen during its Q1 2025 rally, reinforcing the narrative of a larger bullish continuation pattern. If the momentum continues and price closes above $19.35 on the Monthly timeframe, this could signal a full-scale bullish reversal pattern with potential longer-term implications.

However, bulls must remain cautious. A failure to clear $19.35 cleanly could result in consolidation or even a mild correction back toward $16.00, which now acts as a short-term support cluster.

Technology & Ecosystem: Gaining Strength Under the Hood

While price action steals the spotlight, Chainlink’s technology developments in 2025 have been equally instrumental in fueling this rally.

CCIP (Cross-Chain Interoperability Protocol) Expansion

Chainlink’s CCIP continues gaining traction across major L1 and L2 blockchains. In July 2025, integrations expanded to include Base, zkSync Era, and the TON network, enhancing Chainlink’s role as the go-to interoperability solution in DeFi and real-world asset tokenization.

The protocol’s ability to safely transmit messages and tokens across chains is a key value driver, especially as institutions seek robust cross-chain solutions. The growth of CCIP adoption provides strong fundamental backing to LINK’s valuation.

Enterprise Adoption & Tokenized Asset Infrastructure

Chainlink’s Proof of Reserve, Data Feeds, and Automation services are increasingly being used by traditional institutions. Partnerships with Swift, ANZ Bank, and DTCC for tokenized asset transfers are turning Chainlink from a DeFi darling into a full-fledged financial data infrastructure layer.

As RWA tokenization narratives continue to unfold in the second half of 2025, Chainlink is well-positioned to be the bridge between blockchain and traditional finance.

Investor Sentiment & Market Context

The broader altcoin market is showing renewed life following Ethereum’s stability and Bitcoin’s reclaiming of the $118K region. In this context, LINK’s sustained strength is encouraging—especially as it outperforms major L1s like Solana and Avalanche on a relative basis.

Open interest in LINK perpetual futures has surged over the past week, and the spot volume trend shows rising retail and institutional participation, adding credibility to the breakout attempt.

Conclusion: Bullish with a Watchful Eye

Chainlink is now facing its most crucial technical moment since early 2025. A clean breakout above $19.35 would confirm the resumption of its uptrend, likely targeting $26.35 and potentially $31.00 in the weeks to come. Strong fundamentals—driven by CCIP, real-world partnerships, and DeFi adoption—provide a compelling foundation for this bullish narrative.

However, the significance of this level demands respect. Should bulls falter, a healthy retest of lower supports could provide better re-entry opportunities.

Strategy Outlook:

-

Bias: Bullish to Natural

-

Breakout Confirmation: Weekly/Monthly close above $19.35

-

Next Targets: $22.20 → $26.35 → $31.00

-

Short-term Support: $18.70, $17.80

-

Invalidation: Weekly close back below $19.35

All eyes now turn to the next couple of candles. The breakout is in motion—will LINK seize the moment?

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM