JSE Top 40 Holds Above 91,400 as Bulls Target 92,968 Amid Trade Tensions

SA markets are under pressure but the JSE Top 40 is showing some technical strength. The JSE FTSE All Share closed at 99,057.27...

Quick overview

- The JSE Top 40 is showing technical strength despite broader market pressures, holding above 91,400 after a breakout.

- Investor caution is driven by fragile economic signals, looming tariffs, and political uncertainty, with the JSE FTSE All Share down 0.60%.

- The South African Reserve Bank faces a tough decision on interest rates as inflation remains below target amid a cloudy macro backdrop.

- Key resistance levels for the JSE Top 40 are at 91,587, 92,312, and 92,968, while support is found at 90,766.8 and 89,957.8.

SA markets are under pressure but the JSE Top 40 is showing some technical strength. The JSE FTSE All Share closed at 99,057.27 on Tuesday, down 596 points or 0.60%. This is due to investor caution as the economic signals are fragile, tariffs are looming and politics is uncertain. But even as the broader market struggles the JSE Top 40 is holding above 91,400 after a sharp technical breakout – so sentiment and price are diverging.

Much of the market unease is due to the 1.3% decline in the South African Reserve Bank’s leading business cycle indicator for May, following a 0.6% decline in April. Back to back declines is what we feared for growth. And political tensions – partly eased by the removal of a controversial minister – is still casting a cloud over near term stability. The rand was around 17.64 to the dollar, slightly weaker on the day, and the dollar index up 0.1%.

Rate Cut Bets Weigh on Confidence

The South African Reserve Bank (SARB) has a tough balancing act. Inflation is below its 3-6% target range so they could cut rates. But the macro backdrop is cloudy. Since September 2024 SARB has cut rates by 100 basis points. Now with the July meeting approaching the markets are split between another cut or a pause.

The problem is broader than just inflation. US trade tensions, weak global demand and internal fiscal pressures is giving the central bank limited room to move. According to Aluma Capital’s Frederick Mitchell, tightening would strangle long term growth – but cutting too much would spook the markets further.

Factors influencing SARB policy direction:

- Core inflation is below target so pressure is easing.

- Political turnover is creating policy uncertainty.

- Aggressive US tariffs and weak global trade is weighing on exports.

JSE Top 40 Bulls Eye 92,968 as Chart Support Holds

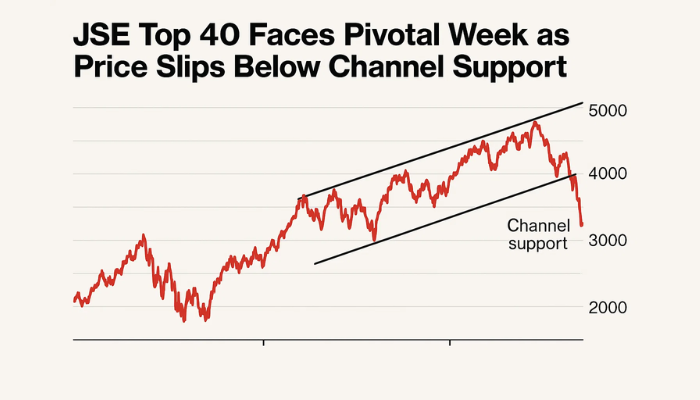

Despite the macro headwinds the JSE Top 40 is showing technical strength. After breaking above 91,400 it’s consolidating just below 91,587. Price is well above the 50-SMA at 89,957.8 and the lower channel boundary and 90,766.8 is the key support zones. The RSI has come down from overbought territory and is currently at 60.78 so it’s a pause not a reversal.

If the bulls get back above 91,587 the next targets are 92,312 and 92,968.4. For now the trend is intact and supported by a broader improvement in emerging market risk appetite. But any new macro shock – like another tariff or inflation surprise – could change the picture quickly.

Levels to watch:

- Resistance: 91,587, 92,312, 92,968

- Support: 90,766.8, 89,957.8, 89,891.6

The index holding this structure may be a gauge for broader investor confidence in the weeks to come. Keep an eye on momentum and volume to see if this bullish channel can hold through quarter end.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account