BNB Faces Technical Consolidation Near $800 as Corporate Treasury Adoption Accelerates

BNB is currently trading at about $800, down over 4% in the last 24 hours as the token enters a very important phase of consolidation.

Quick overview

- BNB is currently trading around $800, down over 4% in the last 24 hours, as it tests a critical psychological support level.

- The cryptocurrency experienced significant growth in July, surpassing Solana in market capitalization, but is now showing mixed technical signals and increased volatility risk.

- Corporate interest in BNB is rising, with Windtree Therapeutics and CEA Industries planning substantial investments, potentially making BNB a key asset in corporate treasury strategies.

- Analysts predict a long-term price increase for BNB, with potential growth of 300% by 2028, driven by its expanding ecosystem and institutional adoption.

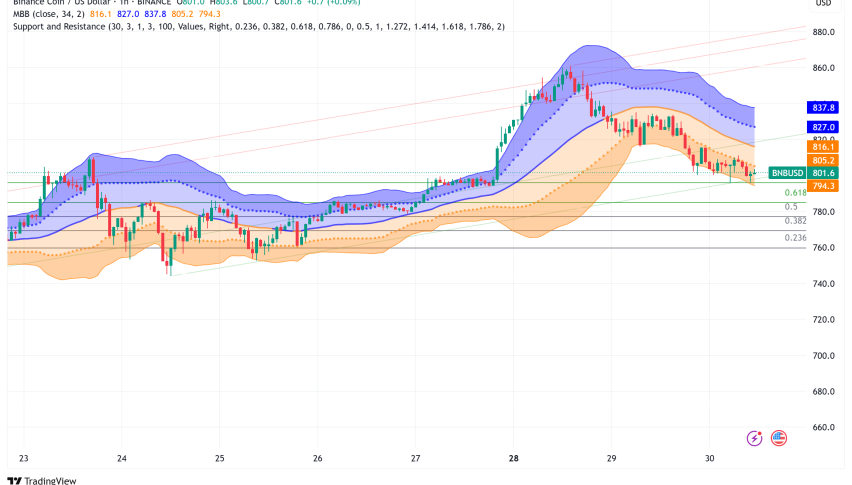

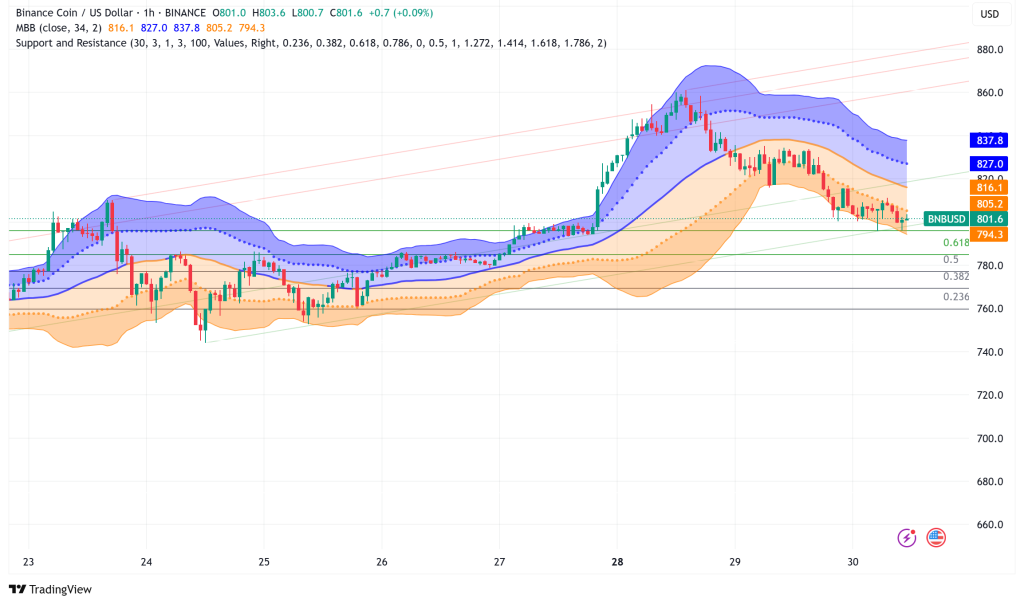

BNB BNB/USD is currently trading at about $800, down over 4% in the last 24 hours as the token enters a very important phase of consolidation. The cryptocurrency hit a high of $835 yesterday, but it has since dropped back to test the psychological support level of $800. Most of the trading is happening in the narrow band of $803 to $806.

The recent price movement shows that the market is naturally cooling off after BNB’s amazing July performance, when the token gained more than 30%. This jump in value enabled BNB exceed Solana SOL/USD in market capitalization, making it the fifth-largest cryptocurrency by market cap.

BNB/USD Technical Analysis: Mixed Signals, Increased Volatility Risk

Momentum Indicators Show Overheating

Technical signs make it hard to see what will happen to BNB in the near future. The MACD is still in its golden cross pattern, which means that the underlying bullish trend is still going strong. However, a number of warning signs have appeared. The RSI has dropped from yesterday’s overbought levels, but it is still high, which means that strength is still there but may be getting close to unsustainable levels.

Market data shows that there has been a lot of selling pressure for a long time, which could mean that the token’s price is too high. Momentum indicators have been in the overbought zone for a long time, which supports the idea that the risk of going down is rising.

Price Structure Analysis

BNB is now trading in a rising channel pattern and has hit the resistance zone near the top of the channel. This technical position, along with worrying signs from buying and selling pressure heatmaps, makes it more likely that a reversal will happen.

Key Technical Levels:

- Immediate Support: $800 (critical psychological level)

- Secondary Support: $780 (potential pullback target)

- Channel Support: $580+ (rising with channel structure)

- Resistance: $835 (yesterday’s high)

- Extended Targets: $850-$880 range upon breakout

The Bollinger Bands have shown convergence with prices running close to the middle band, indicating short-term consolidation is likely to dominate price action.

Corporate Treasury Revolution: $1+ Billion BNB Commitments

Windtree Therapeutics’ Bold $520 Million Strategy

Windtree Therapeutics (NasdaqCM: WINT) has announced up to $520 million in additional fundraising, with 99% of the money going to buy BNB. This is a big step forward for companies that want to use crypto. This biotech company has a $500 million equity line of credit and a $20 million stock purchase agreement with Build and Build Corp. CEO Jed Latkin said that this move is very important for the company’s strategy. He said, “We are excited to incorporate these new facilities to enable our future BNB acquisitions as part of our BNB treasury strategy.” Getting more money to buy more BNB coin is an important part of our plan.

Windtree expects the entire BNB investment to go as high as $700 million when combined with other initiatives it has already disclosed. This would make it one of the largest corporate treasury strategies centered on a single altcoin.

CEA Industries’ $500 Million BNB-Focused Treasury

CEA Industries has also said it wants to raise $500 million just for BNB purchases, and this amount could go up to $1.25 billion. David Namdar, the new CEO and co-founder of Galaxy Digital, thinks that BNB is an undervalued chance that Western investors have missed.

“Most of it has truly been a story outside of the U.S. Namdar said, “Most of the investors in the Western capital markets have been completely cut off.” “People haven’t really paid enough attention to or realized what BNB is.”

BNB Ecosystem Growth Driving Fundamental Value

The rise in corporate interest matches big changes in the BNB ecosystem. There are now several DePIN (Decentralized Physical Infrastructure Networks) and RWA (Real World Assets) projects on BNB Chain. These projects make the currency more useful and provide it more uses than just being an exchange.

Analysts at Standard Chartered have set high long-term goals for BNB, saying that prices may grow by 300% by 2028, reaching $2,775. This outlook shows that more and more people are realizing how important BNB Chain is becoming in decentralized finance and new technologies.

BNB Price Prediction and Outlook: Consolidation Before Next Move

Short-Term Outlook: The $800 level is the most important bull-bear boundary in this strong consolidation phase. The technical setting shows that BNB may become more volatile as it deals with the current hot conditions.

Scenario Analysis:

- Bullish Case: Holding above $800 support could enable a challenge of $835 resistance, with extended targets at $850-$880

- Bearish Case: Breaking below $800 may trigger a deeper correction toward the $580 channel support level

BNB is in a unique situation because of the combination of technical overheating signs and the fact that corporate treasuries are using it for the first time. It looks like there will be short-term consolidation, but the huge pledges from institutions create a strong fundamental backdrop that could support higher prices until technical conditions return to normal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account