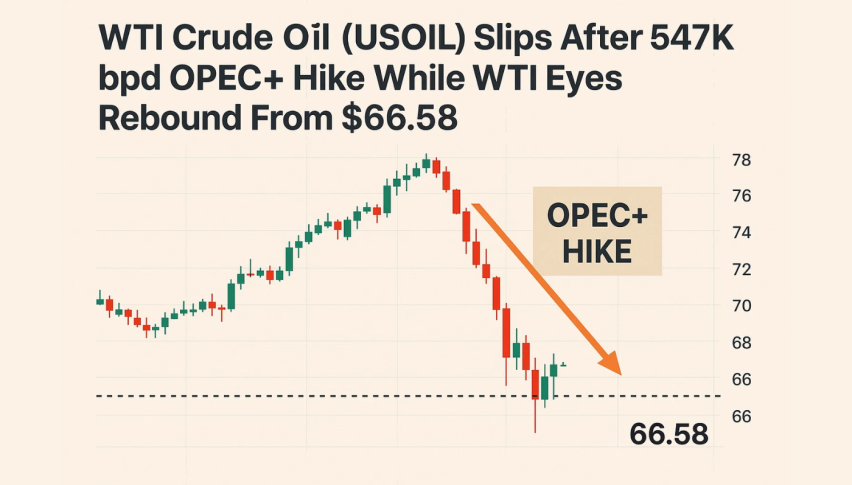

WTI Crude Oil (USOIL) Slips After 547K bpd OPEC+ Hike While WTI Eyes Rebound From $66.58

Oil markets opened the week under pressure after OPEC+ announced a 547,000 bpd increase for September...

Quick overview

- Oil markets are under pressure following OPEC+'s announcement of a 547,000 bpd increase for September, reversing previous cuts.

- Goldman Sachs estimates that actual additions will be around 1.7 million bpd due to underproduction by some OPEC+ members.

- Geopolitical tensions, including potential US tariffs on Russian crude, are impacting market dynamics and tempering the bearish effects of the supply increase.

- Technical indicators for WTI Crude Oil suggest a potential short-term bounce, with key resistance levels to watch around $67.81.

Oil markets opened the week under pressure after OPEC+ announced a 547,000 bpd increase for September. This is a full reversal of the group’s earlier cuts and adds up to 2.5 million bpd or 2.4% of global demand. The move was expected and driven by stable growth and low inventories.

Not all barrels will hit the market. Goldman Sachs estimates actual additions will be 1.7 million bpd as some OPEC+ members are underproducing due to capacity or compliance constraints. Analysts also note September could be the last increase given slowing demand and non-OPEC output growth.

But traders are watching how the market absorbs the extra supply. RBC Capital’s Helima Croft said “The bet that the market could absorb the additional barrels has paid off” and prices are holding near pre-tariff levels.

Geopolitical Risks Keep Markets on Edge

Tensions are high on the geopolitical front. US President Donald Trump has threatened 100% tariffs on Russian crude buyers and the market is already responding. At least two tankers carrying Russian oil have rerouted from India to other destinations, according to LSEG data.

Despite US pressure, Indian officials said they will continue to import Russian oil, citing energy security priorities. US Trade Representative Jamieson Greer also said tariffs on dozens of countries will remain in place, dashing hopes of a quick trade deal.

These risks have tempered the bearish impact of the OPEC+ increase as traders weigh supply increases against potential sanctions and retaliation that could upend the balance.

WTI Technical Setup: Eyes on $67.81 Breakout

While macro headlines dominate, technicals on WTI Crude Oil (USOIL) are pointing to a short-term bounce. After falling from over $70 to a low of $66.58, price action is stabilizing along a trendline from July’s low. RSI touched oversold at 30.83 and is now rising – an early sign of selling pressure easing.

Key levels to watch:

- Support: $66.58, $65.74, $64.77

- Resistance: $67.81, $68.75 (50-SMA), $69.57

- RSI (2H): 37 and rising

A close above $67.81 could trigger a move to the 50-SMA at $68.75. If momentum holds $69.57 is next.

Trade Setup:

- Entry: $67.85 (on close above $67.81)

- Stop-Loss: $66.30

- Targets: $68.75 and $69.57

- Risk-Reward: 2:1

Wait for confirmation above the 50-SMA before entering. A break below $66.58 could flip the trade bearish and open up $65.74.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM