Euro Gains 13% in 2025 as Tariffs, Fed Politics, and Chart Signals Drive EUR/USD

The euro traded 1.1612 on Tuesday, steady despite headwinds from tariffs and corporate woes. So far this year the euro...

Quick overview

- The euro remains steady at 1.1612 despite challenges from tariffs and corporate issues, with a 13% increase this year.

- European companies are feeling the effects of currency strength, with several firms cutting guidance or considering production relocations due to tariff risks.

- The dollar is struggling amid Fed uncertainty, with expectations of a rate cut that could support the euro's strength.

- EUR/USD is consolidating around 1.1612, indicating a potential breakout as it remains range-bound between key levels.

The euro traded 1.1612 on Tuesday, steady despite headwinds from tariffs and corporate woes. So far this year the euro is up 13%, the Swiss franc and British pound also up as investors flee the dollar on US debt and trade concerns.

European companies are already feeling the impact of currency strength and tariffs. Deutsche Telekom took a €400m hit to earnings due to dollar weakness. AkzoNobel, Kuehne + Nagel, Julius Baer and EFG International cut guidance or flagged currency losses. Some are even considering moving production to the US or within the EU to offset tariff risks.

Despite all this the euro is holding strong. EUR/USD is defending the support levels and investors still see strength in the currency.

Fed Uncertainty Boosts Euro

Across the pond the dollar is struggling. Fed Chair Jerome Powell recently flagged labour market risks and the market is now pricing in a September rate cut. Futures are 84% for a 25bps move according to Bloomberg. Barclays and Deutsche Bank analysts also expect a cut which would support the euro.

On Friday the dollar index reached 98.32 but the medium term outlook is weak. In Europe sentiment is improving. German company confidence is rising and Eurozone bond yields are higher. Economists including Samy Chaar of Lombard Odier see EUR/USD at 1.20-1.22 in a year and that’s a bullish case.

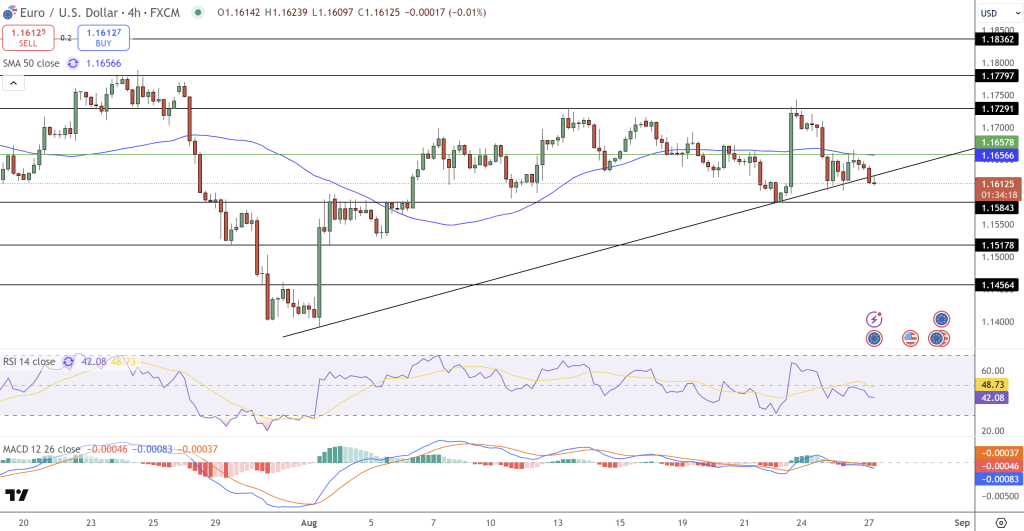

EUR/USD Technical Analysis

EUR/USD is consolidating at 1.1612 right on its trendline from July. The 4 hour chart shows repeated failures at the 50 period SMA at 1.1656 and price is coiling between 1.1657 and 1.1584. This narrowing structure means a breakout is imminent.

Candlestick signals are showing indecision. Rejection wicks above 1.1657 are selling pressure, no bullish engulfing or hammer candles and the RSI at 42 is falling and the MACD is flat, both indicators are showing weak momentum.

The levels are clear:

- Bullish: 1.1657 to 1.1729 to 1.1779

- Bearish: 1.1584 to 1.1517 to 1.1456

Until one side breaks, EUR/USD will be range bound. For traders this is a decision point: short under 1.1584, long above 1.1657.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account