Can the ETH Bet Save BitMine Immersion Tech After 17% BMNR Stock Drop?

BitMine Immersion Technologies has expanded its Ethereum treasury to record levels, but sharp volatility and renewed selling pressure...

Quick overview

- BitMine Immersion Technologies has significantly expanded its Ethereum treasury, now holding approximately 1.7 million ETH valued at around $7.9 billion.

- Despite a brief surge in BMNR stock following positive sentiment from the Federal Reserve, shares ultimately fell 17% by the end of the week, raising concerns about stability.

- The company's management aims to secure up to 5% of Ethereum's total circulating supply, reinforcing their commitment to the asset despite market volatility.

- Investors are closely monitoring BMNR's ability to maintain support levels, as further declines could lead to significant losses.

BitMine Immersion Technologies has expanded its Ethereum treasury to record levels, but sharp volatility and renewed selling pressure have left investors questioning whether BMNR can stabilize after last week’s steep losses.

Fed Sparks Risk Appetite, But Momentum Fades

At the Jackson Hole Symposium, Federal Reserve Chair Jerome Powell struck a dovish tone, signaling that interest rate cuts may arrive sooner than markets previously anticipated. Traders quickly priced in the likelihood of two cuts in 2025, fueling risk-on sentiment across both equities and crypto.

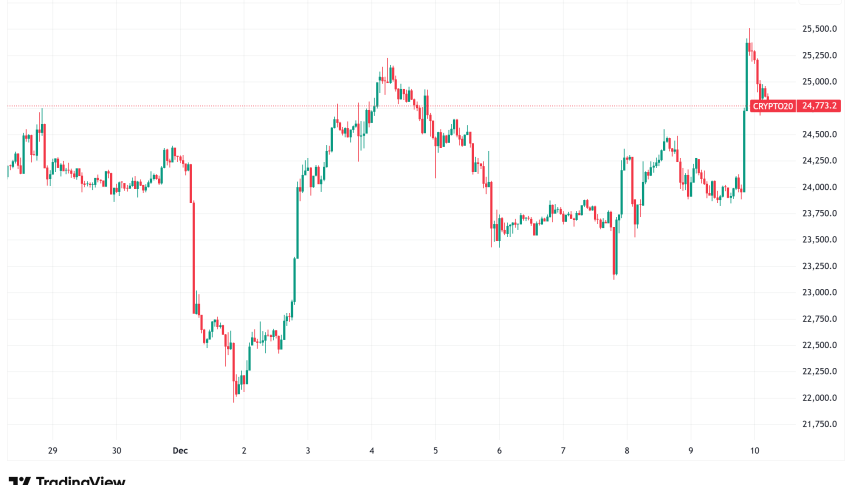

BMNR Chart Daily – The 50 SMA Has been Broken

Ethereum surged by $500 in a single session, while BMNR stock jumped more than 14%, briefly rebounding from its 20-day moving average support line. However, the rally proved short-lived. By week’s end, BMNR shares had lost 17%, reflecting fragile confidence in the company’s strategy and the ongoing struggle to sustain upward momentum.

Ethereum Treasury Expansion Strengthens Position

Amid the volatility, BitMine continued to grow its Ethereum reserves. The company purchased an additional 190,500 ETH, valued at roughly $900 million, bringing its total holdings to 1,713,899 ETH—worth about $7.9 billion.

Combined with cash reserves, the company’s total liquid assets stood at $8.8 billion as of Sunday, though the sharp correction in digital assets has eroded that valuation. Still, this move places BitMine as the second-largest publicly listed cryptocurrency treasury, behind only Michael Saylor’s MicroStrategy Bitcoin stash, and ahead of rivals such as ETHZilla, The Ether Machine.

Management reaffirmed its ambitious long-term goal of securing up to 5% of Ethereum’s total circulating supply, underscoring its conviction in Ethereum as a core balance sheet asset.

Technical Landscape: Support Levels Tested

BitMine’s stock has experienced dramatic swings this summer. From trading below $5 in July, shares skyrocketed to $161 before plunging back near $30. A brief recovery in early August lifted BMNR above $70, supported by the 50-day simple moving average, but momentum quickly reversed.

By late last week, BMNR had slipped back below $45, breaching both its 20-day and 50-day moving averages. The next key downside levels are $40, $30, and potentially as low as $20 if selling accelerates further.

Still, if the stock manages to stabilize above support, with the help of Ethereum price, there is room for another rebound attempt toward $70. A recovery at that level would indicate renewed buying interest and possibly mark the beginning of a stabilization phase after weeks of sharp volatility.

Outlook: BitMine’s growing Ethereum treasury underscores its bold positioning as a crypto-first public company. Yet, its stock price continues to swing wildly, reflecting the risks of tying corporate value so tightly to a single volatile asset. With the Fed’s dovish pivot providing a supportive backdrop, investors will be watching closely whether BMNR can defend its current support levels—or whether another leg lower awaits.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account