GME Stock Breaks Resistance Pre-Earnings, Targets $25 with Retail Buzz in Play

GameStop (NYSE: GME) shares have staged a comeback, lifted by renewed retail investor enthusiasm, upcoming game releases, and speculation...

Quick overview

- GameStop shares have surged above $23.50, driven by renewed retail investor enthusiasm and anticipation of upcoming game releases.

- The company's recent announcement of carrying the highly anticipated game Hollow Knight: Silksong has further boosted investor sentiment.

- Despite mixed Q1 results, including a revenue drop but a surprising net profit, investors are hopeful for a turnaround in Q2 earnings.

- GameStop's bold move into digital assets, including a significant Bitcoin investment, has sparked speculation and increased retail interest.

GameStop (NYSE: GME) shares have staged a comeback, lifted by renewed retail investor enthusiasm, upcoming game releases, and speculation surrounding its bold digital asset strategy.

Retail Momentum Returns

GameStop Corp. has once again captured market attention, with shares surging above $23.50 today and continuing to gain in after-hours trading. A mix of factors—including anticipation of the company’s Q2 earnings next week, revived interest in its Bitcoin investment strategy, and excitement around new game releases—has fueled the rally.

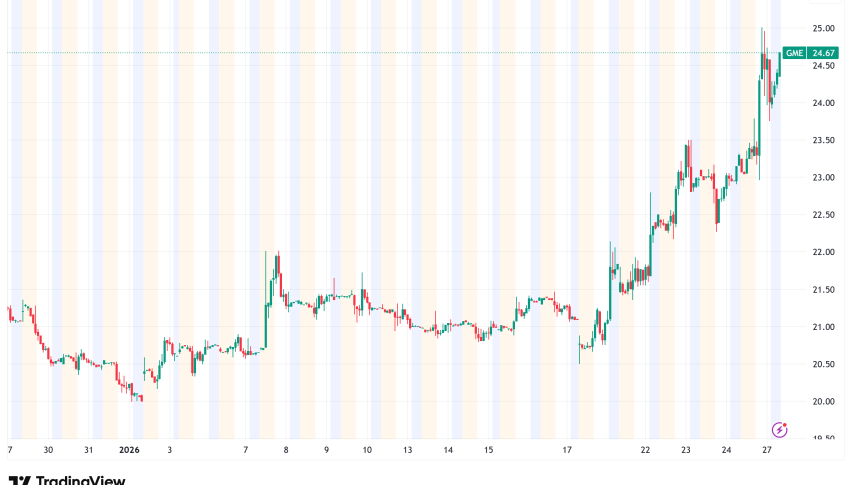

GME Stock Chart Weekly – Rejected at Resistance

The stock had previously struggled, dropping in late May after weak Q2 guidance and declining again in June. However, a support base around $22 held firm during months of consolidation. Today’s 5% intraday jump to $23.60 suggests momentum may be building again, with the July peak near $25 now back in focus.

Hollow Knight Release Adds Fuel

Adding to the buzz, GameStop announced over the weekend that it will carry Hollow Knight: Silksong for $19.99. The dark, 2D adventure game has been one of the most anticipated releases in years, and news of its availability at GameStop helped boost sentiment around the stock. Fans are still awaiting official confirmation from developer Team Cherry, but excitement is already spilling into retail investor chatter.

Mixed Q1 Results, Hopes for Q2

GameStop’s volatile stock action has closely mirrored its uneven financial results. In Q1, the company reported a 17% drop in revenue year-over-year, disappointing on the sales front. However, it surprised analysts by delivering a net profit of $44.8 million, compared with a loss of $32.3 million in the same quarter last year.

Operating losses narrowed significantly to $10.8 million, highlighting improved cost controls and operational efficiency. These steps provided some optimism, but the lack of top-line growth continues to underscore challenges in a gaming industry increasingly dominated by digital distribution platforms.

With Q2 results set for release on September 9, investors will be closely tracking metrics such as cash flow, profitability, and sales growth. Demonstrating a sustainable turnaround could restore investor confidence and extend the rally.

Crypto Strategy Rekindles Speculation

Another major driver of GME’s stock swings has been its surprising move into digital assets. Last month, the company announced a $515 million Bitcoin investment, acquiring roughly 4,710 BTC. The decision electrified retail traders, pushing GME shares up 25% in just three trading days.

This bold pivot into crypto was seen as both a diversification play and a signal that GameStop is still willing to embrace risk. Combined with buybacks and heightened retail participation on social media, the move briefly lifted shares as high as $35.81 in late May before retracing.

Conclusion: GameStop continues to thrive on a unique mix of speculation, retail momentum, and strategic pivots, with its stock price reflecting both risk and opportunity. The company’s upcoming Q2 earnings report could prove pivotal: strong results might validate the recent rally, while weak numbers may expose the stock to another selloff.

For now, with renewed gaming excitement, crypto speculation, and a loyal base of retail investors, GameStop remains one of the most volatile and closely watched meme-stocks in the market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM