Forex Signals Brief Sept 8: Brace for US CPI Inflation and ECB Rate Decision Amid Political Tensions

Last week the soft NFP shocked markets while this week we have the ECB rate meeting and the US CPI and PPI inflation, which will have...

Quick overview

- North America's job markets faced challenges last week, with weaker-than-expected employment data leading to increased rate cut expectations.

- Gold prices surged to a record high as investors sought safe-haven assets amid a dovish shift in monetary policy.

- This week, key economic events include the ECB rate meeting and U.S. CPI and PPI inflation data, which are expected to drive market volatility.

- Political developments and inflation readings will dominate the narrative, influencing market direction in the coming weeks.

Live BTC/USD Chart

Last week the soft NFP shocked markets while this week we have the ECB rate meeting and the US CPI and PPI inflation, which will have market’s attention.

North American Jobs Data Sparked Rate Cut Expectations Last Week

Weak Labor Market Performance

Last week proved challenging for North America’s job markets, with both the U.S. and—more notably—Canada reporting weaker-than-expected employment data. The disappointing figures reinforced the case for rate cuts later this month, weighing on both currencies. The Canadian dollar underperformed slightly against the U.S. dollar, though neither suffered a sharp selloff.

Market Pricing Turns More Dovish

Investors swiftly adjusted their rate outlooks. Markets are now pricing in 47 basis points of Canadian easing over the next year, alongside 131 basis points in the U.S.. Fed futures show a 90% probability of a cut at each of the three remaining meetings this year, with a slim chance of a deeper 50-basis-point cut in September.

Gold Surges on Policy Shift

Gold was the clear beneficiary of the dovish shift. The precious metal surged to a fresh record high as investors sought a hedge against easing monetary policy and rising economic uncertainty.

Equities Show Mixed Reactions

The response in equities was less straightforward. U.S. indices initially rallied on hopes of cheaper borrowing costs, with all three major benchmarks reaching new record highs. However, concerns about a potential recession later pulled stocks lower. Even so, late-session bids once again provided support, and the main U.S. indexes ultimately closed the week in positive territory.

Key Market Events to Watch This Week

This week brings a heavy mix of economic data, central bank policy, and political risk events that will shape global market direction. Inflation remains the central theme, with U.S. CPI and PPI alongside the ECB decision likely to drive volatility. Political developments—from France’s no-confidence vote to discussions at the UN—could add another layer of uncertainty. Traders should prepare for a week where policy signals and inflation readings dominate the narrative, setting the tone for the weeks ahead.

Monday: Mixed Data and Political Tensions

- Japan GDP (Q2): Investors will assess whether the Japanese economy continues to recover amid yen weakness and inflation pressures.

- German Industrial Output (July): A crucial signal for Eurozone manufacturing health after months of sluggish activity.

- Eurozone Sentix Index (September): Sentiment reading could confirm whether confidence is stabilizing or slipping further.

- U.S. Employment Trends (August): Provides a broader labor market view following the weak Non-Farm Payrolls report.

- French No-Confidence Vote: Political risk enters the spotlight, potentially affecting French assets and broader EU stability.

Tuesday: Diplomatic and Tech Spotlights

- UN General Assembly: Focus will likely be on Iran and global geopolitical tensions, keeping energy markets on alert.

- Apple Event: Key product launches and updates may impact tech stocks and supply-chain sentiment globally.

Wednesday: Inflation in Focus

- U.S. Producer Price Index (August): An early read on inflation trends, with wholesale prices offering clues about future consumer inflation.

Thursday: Central Bank and U.S. Inflation

- ECB Policy Announcement: Markets will watch closely for any signal of rate path adjustments as growth slows but inflation lingers.

- U.S. Consumer Price Index (August): The most critical data point of the week, with shelter and services inflation likely to dominate discussions.

Friday: UK Growth and U.S. Confidence

- UK GDP (July): Provides insight into how resilient the British economy is amid persistent inflation and Bank of England policy tightening.

- U.S. University of Michigan Consumer Sentiment (September, prelim): Offers a forward-looking gauge of inflation expectations and household confidence.

Last week, markets were quite volatile again, with gold soaring to $3,600. EUR/USD continued the upward move toward 1.17, while main indices closed higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Kisses $3,600 on the Way to $4,000

Meanwhile, gold continues to attract strong safe-haven flows. Prices surged above $3,570 early last week, hitting a new record high, before briefly slipping back toward $3,511. But buyers quickly returned, helping to stabilize the market. Technical charts now highlight the $3,600 level as the next major resistance, which will be broken soon as the upside accelerates.

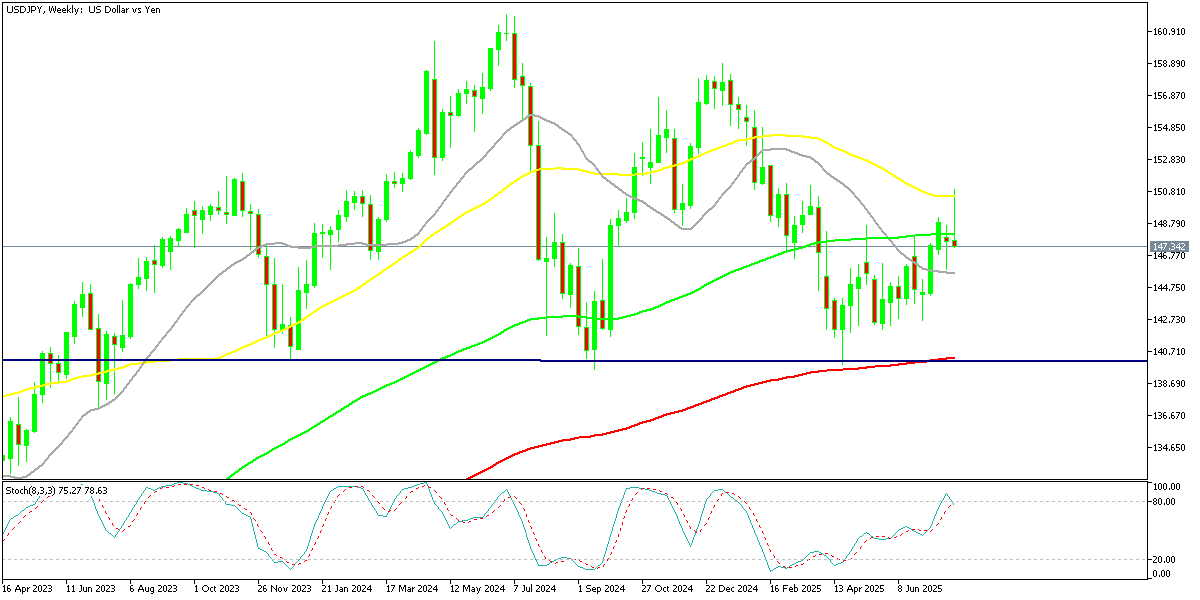

USD/JPY Jumps 1 Cent on US

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. The move underscored persistent volatility as traders weighed Japan’s intervention risks against evolving Fed expectations.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Climbs Above the $110K Level Again

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $113,000 before recovering above $116,000 last week, however sellers returned and sent BTC below $110,000, however we saw a rebound off the 20 weekly SMA (gray) yesterday.

BTC/USD – Weekly chart

Ethereum Heads to $4,500

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. However buying resumed and on Sunday ETH/USD printed another record at $4,941. However we saw a retreat to $,000 lows over the weekend, but yesterday buyers returned.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM