GME Stock Builds Momentum Pre-Q2 Earnings As GameStop Pears Show Strength

GameStop shares climbed above $23, with investors eyeing the earnings release amid fresh excitement over new game launches and...

Quick overview

- GameStop shares rose above $23 as investors anticipate upcoming earnings and new game launches.

- The stock experienced volatility last week but regained momentum with a 2% increase on Monday.

- Analysts expect Q2 revenue to reach $823.2 million, indicating a potential recovery from previous declines.

- The announcement of the game Hollow Knight: Silksong has further boosted investor sentiment towards GameStop.

Amid renewed excitement about new game releases and the company’s aspirations for digital assets, investors were watching the earnings release, which caused GameStop shares to spike above $23 to start the week.

Stock Performance: Buyers Regain Momentum

GameStop (NYSE: GME) started last week strong, buoyed by renewed retail investor enthusiasm, chatter around its bold Bitcoin-linked strategy, and anticipation for its upcoming Q2 earnings. However, the stock lost steam midweek, dipping to fresh lows before buyers regained control on Monday.

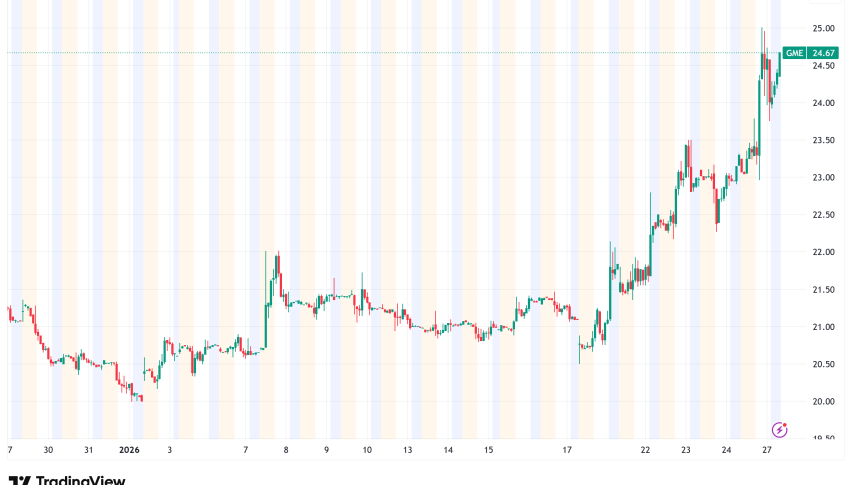

Today’s 2% intraday move above $23 has reignited momentum, with traders watching closely if the stock can retest its July peak near $25. A steady base around $22 has provided reliable support during months of consolidation, setting the stage for potential upside.

GME Stock Chart Daily – Pushing Above the 50 SMA Again

Looking Back: Q1 Misses and Sector Comparisons

In its most recent quarter, GameStop reported $732.4 million in revenue, a 16.9% year-over-year decline and 2.9% below analyst forecasts. Despite the revenue miss, the company surprised on the upside with earnings per share and gross.

GameStop’s upcoming Q2 earnings report is shaping up as a potential turning point. A positive revenue reversal and projected EPS gain could restore investor confidence, but sustaining growth in a competitive retail environment remains the real challenge.

GameStop Q2 Preview: Modest Recovery Expected

Revenue Outlook:

- Analysts expect Q2 revenue to reach $823.2 million, reflecting 3.1% year-on-year growth.

- Marks a sharp reversal from the 31.4% decline in revenue reported during the same quarter last year.

Earnings Forecast:

- Adjusted earnings per share (EPS) are projected at $0.16.

- This would indicate a return to modest profitability compared to recent quarters of uneven performance.

Context:

- Growth expectations highlight a potential stabilization of GameStop’s business, supported by ongoing restructuring efforts.

- Performance will be closely watched as investors gauge whether the company can sustain momentum beyond a one-quarter rebound.

Excitement Over Hollow Knight Release

Fueling optimism, GameStop revealed over the weekend that the highly anticipated title Hollow Knight: Silksong will be available at $19.99. This announcement quickly energized retail investors and fans alike, as the game is considered one of the most awaited indie releases of recent years.

Even without an official launch confirmation from developer Team Cherry, the buzz has been strong enough to lift sentiment toward GME stock, highlighting the ongoing influence of product announcements on investor mood.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM