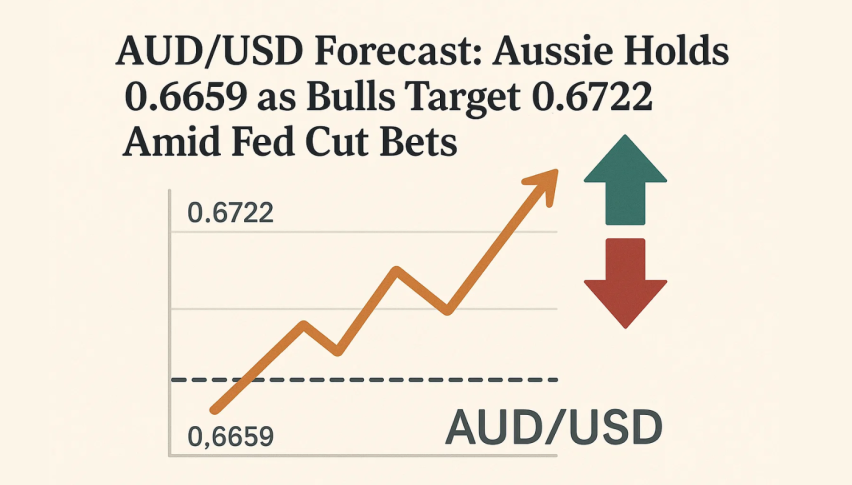

AUD/USD Forecast: Aussie Holds 0.6659 as Bulls Target 0.6722 Amid Fed Cut Bets

The Aussie is holding strong, AUD/USD is at 0.6659 in early European trade. Despite weaker Chinese data, the pair...

Quick overview

- AUD/USD is holding strong at 0.6659, supported by positive domestic fundamentals despite weaker Chinese data.

- Australia's July inflation and Q2 GDP growth exceeded expectations, reinforcing the Aussie’s strength.

- External risks from China’s disappointing economic data and ongoing US-China trade talks could impact the AUD.

- Technically, AUD/USD shows bullish momentum with immediate resistance at 0.6669 and support near 0.6630.

The Aussie is holding strong, AUD/USD is at 0.6659 in early European trade. Despite weaker Chinese data, the pair is being supported by domestic fundamentals. Australia’s July trade surplus and Q2 GDP both came in good, and July inflation surprised higher.

Consumer Inflation Expectations for September rose, adding to the pressure on the RBA to keep rates steady. Swaps now price an 86% chance of no rate cut in September. RBA Governor Michele Bullock said the private sector is seeing “a little bit more growth”.

Key drivers of the Aussie’s strength:

- July inflation higher than expected.

- Q2 GDP growth better than forecast.

- Trade surplus reinforces external resilience.

Weak Chinese Data and Global Trade a Drag

External risks remain a problem. China’s August retail sales rose 3.4% YoY, missing the 3.8% forecast, while industrial production expanded 5.2% YoY, short of expectations. The National Bureau of Statistics said the global trade environment is still a challenge.

Meanwhile, US-China trade talks in Madrid are being watched closely. Any breakthrough in the talks could lift risk sentiment, while further strain could weigh on the Aussie given Australia’s reliance on Chinese demand.

AUD/USD Technical: Channel Supports Bullish Bias

Technically, AUD/USD is in an ascending channel, printing higher lows and higher highs since early September. The 50-EMA at 0.6627 and the 200-EMA at 0.6540 are both sloping up, confirming the bullish momentum.

Recent candles are spinning tops, not a trend reversal but short-term indecision. The RSI is at 60, plenty of room for more upside.

- Immediate resistance: 0.6669

- Next targets: 0.6696 and 0.6722

- Support zone: 0.6630 near the 50-EMA

- Risk trigger: A close below 0.6620 could open up 0.6589

Trade Setup: For new traders, buying dips near 0.6630-0.6640 with a stop below 0.6620 looks good. First targets are 0.6696 and 0.6722. If the channel breaks, step aside and wait for a new setup.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account