JSE Top 40 Climbs Toward 98K as South Africa Faces Growth and Job Strains

The JSE Top 40 is still rising in a rising channel, despite SA’s economy still struggling with structural issues...

Quick overview

- The JSE Top 40 is rising within a channel, supported by a stronger rand and previous record highs, despite South Africa's economic struggles.

- GDP growth of 0.8% in Q2 2025 indicates a fragile recovery, with the government aiming for 3% growth through reforms in key sectors.

- Unemployment remains high at 33.2%, and major companies are cutting jobs, with nearly 100,000 positions at risk this year.

- Technical analysis shows the JSE Top 40 in an uptrend, with key support levels and potential for further gains if certain thresholds are maintained.

The JSE Top 40 is still rising in a rising channel, despite SA’s economy still struggling with structural issues. Higher lows since early September show resilience, helped by a stronger rand and earlier record highs this year.

But these market moves are at odds with the fundamentals. GDP grew 0.8% in Q2 2025 – its fastest in two years – but the recovery is fragile. The coalition government, formed after last year’s election, has promised reforms in freight, rail and power generation to get growth to 3% in three years. The South African Reserve Bank expects only 2% growth by 2027.

Unemployment is still a major issue, at 33.2% in Q2 2025 – one of the highest globally. Business confidence is still low, with private investment indices showing hesitation.

Jobs at Risk as Companies Cut Back

Job losses are mounting across the board. Employment Minister Makhosazana Meth recently warned that nearly 100,000 jobs could disappear this year as major companies including ArcelorMittal, Goodyear and Ford South Africa announce retrenchments.

The government plans to create 240,000 new jobs in 2025, but execution risks remain. Stabilisation efforts at Eskom and operational improvements at Transnet have eased some pressure, but tariff headwinds loom. New US tariffs of up to 30% on SA exports add to competitiveness risks for manufacturers.

Key challenges are:

- Years of mismanagement at Eskom slowing down power supply.

- Transnet inefficiencies weighing on logistics and trade.

- Global tariffs putting pressure on exporters.

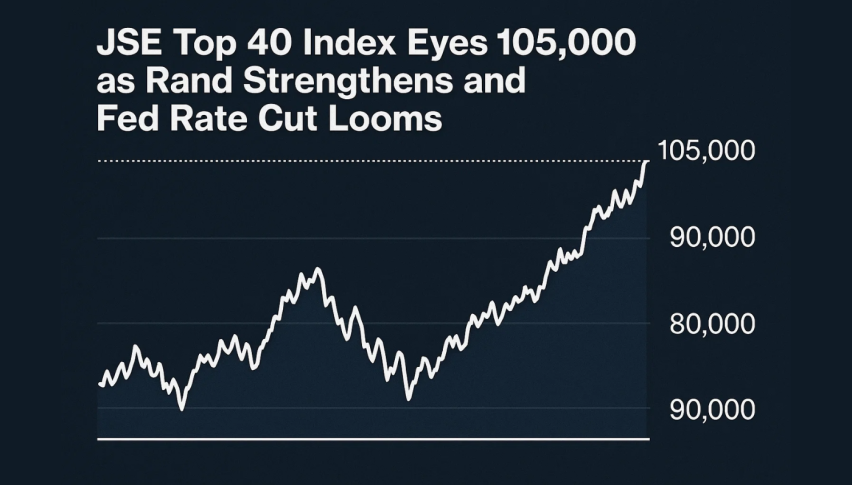

JSE Top 40 Index Technical Outlook

Technically the JSE Top 40 is still in an uptrend, in an ascending channel. The 50-EMA at 96,387 is acting as support, while the 200-EMA at 93,179 reinforces the bullish view.

Momentum is positive with the RSI at 63, so there’s upside potential without going overbought. A break above 97,520 would clear the way to 97,979 and 98,453, in line with the channel’s upper trendline.

For traders, buying at 96,580-96,700 is a good entry, with stops at 96,100 to get out on breaks. Think of the index as a staircase: as long as each higher step holds, the trend is intact. A break below 96,000 would break the pattern and could lead to a bigger pullback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account