QS Stock Rally on QuantumScape’s Innovation Holds Intact Despite Small Pullback

Investor enthusiasm for QuantumScape's (NYSE: QS) solid-state battery technology frequently clashes with doubts about its commercialization

Quick overview

- QuantumScape's stock remains volatile as excitement over its solid-state battery technology clashes with doubts about commercialization and profitability.

- After a significant share price surge following a demo at the IAA Mobility conference, the stock quickly fell due to skepticism about immediate impacts.

- Quarterly earnings showed slight improvement but highlighted ongoing losses, with analysts predicting a long path to profitability.

- Despite its innovations, QuantumScape faces intense competition and must prove its ability to scale production to attract more stable investor confidence.

Investor enthusiasm for QuantumScape’s (NYSE: QS) solid-state battery technology frequently clashes with doubts about its commercialization and profitability, making it one of the most volatile companies on Wall Street.

Demo Hype Fizzles into Market Reality

The latest drama began when QuantumScape showcased its QSE-5 lithium-metal solid-state cells during Volkswagen Group’s IAA Mobility conference in Munich. A Ducati motorcycle powered by the breakthrough battery sent QS shares soaring over 30% in a single day, climbing from $7.90 to $10.70.

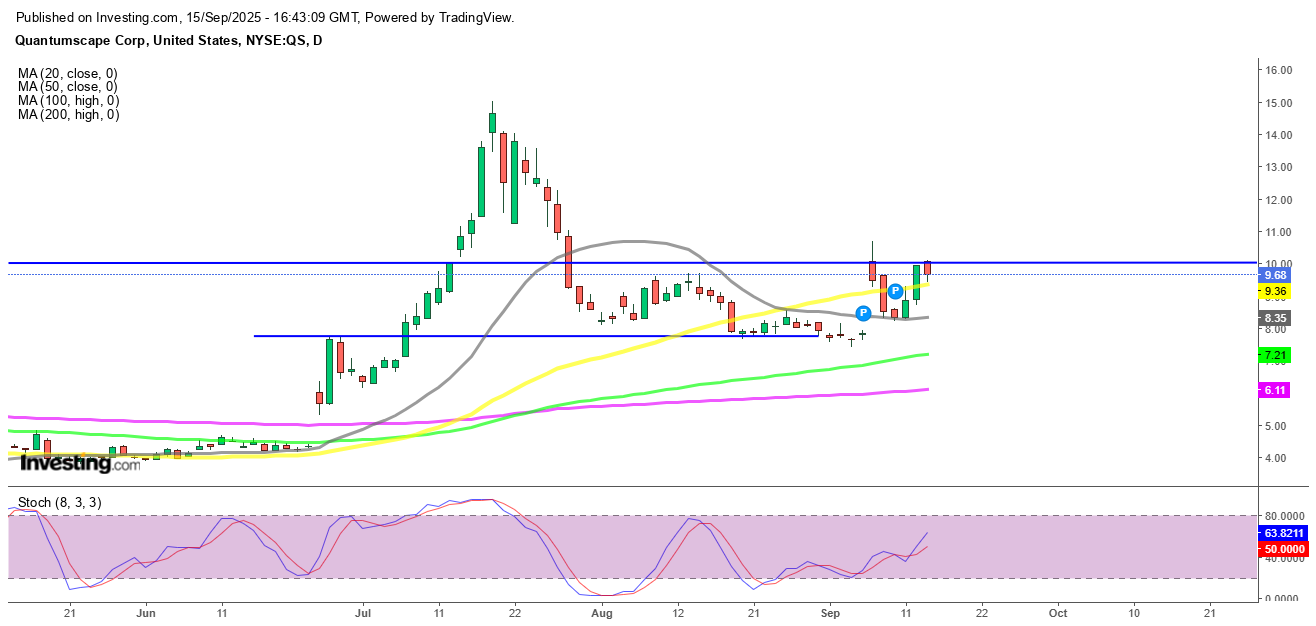

But enthusiasm was short-lived. Traders quickly questioned whether the demo had real near-term impact, sparking a 20% drop to $8.20 within just two days. Although the stock later rebounded to above $10, it has since slipped below that level again. On the charts, $7.80 stands out as firm support, while $10 marks a strong resistance zone. A late-week rally lifted QS above its 50-day simple moving average (yellow), offering renewed technical strength and confirming the upside moentum.

Financial Results Fail to Inspire

Quarterly earnings released in late July did little to stabilize sentiment. Revenue came in at $36.7 million, paired with a net loss of $0.20 per share—slightly better than last year’s -$0.25, but far from profitability. Analysts still expect a full-year EPS of -$0.82, underscoring the company’s long runway before reaching breakeven.

Liquidity remains solid at over $800 million, giving QuantumScape breathing room to continue its R&D efforts. Still, meaningful revenue growth is unlikely before 2026, when commercial field trials are slated to begin. Insider share sales further rattled investors, raising concerns that leadership is cautious about sustaining high valuations until its technology matures.

QS Chart Daily – The 50 SMA Held As Support Today

Innovation as the Long-Term Anchor

Despite the volatility, QuantumScape’s progress on the technical front is undeniable. Its “Cobra” ceramic separator, which accelerates heat treatment 25-fold, represents a significant manufacturing breakthrough and was a catalyst behind the stock’s massive 350% surge earlier this summer. Such advancements underline the company’s role as a leader in the solid-state battery race.

The Road Ahead: Competition and Uncertainty

The bigger challenge lies in execution. With major automakers and well-funded start-ups pushing into the same space, QuantumScape must prove it can scale its prototypes into reliable, mass-produced solutions. Until then, investors face a classic high-risk, high-reward scenario.

Conclusion: QuantumScape continues to straddle the line between breakthrough innovation and relentless volatility. Its technology could transform the EV industry if scaled successfully, but until commercial timelines become clearer, QS will remain a stock for bold investors who can stomach sharp swings.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM