Sharps Tech Loads Up on BONK: Will 2M SOL Ignite the Next Meme Coin Boom?

Sharps Technology is going to put 2 million Solana (SOL) into BonkSOL, BONK’s liquid staking token (LST). The move is funded...

Quick overview

- Sharps Technology is investing 2 million Solana (SOL) into BonkSOL, funded by a private deal led by Cantor Fitzgerald & Co.

- The partnership aims to enhance returns for shareholders and strengthen Sharps' involvement in Web3.

- BONK has evolved from a meme coin to a utility-driven project with over 400 integrations and significant trading volume.

- Analysts are optimistic about BONK's potential for growth, citing institutional backing and improving market conditions.

Sharps Technology is going to put 2 million Solana (SOL) into BonkSOL, BONK’s liquid staking token (LST). The move is funded by a private investment deal led by Cantor Fitzgerald & Co. to generate staking yields and liquidity in the Solana and meme coin space.

James Zhang, strategic advisor at Sharps, said “We are committed to Solana projects. Partnering with BONK gives us ways to deliver more returns to our shareholders and deepen our role in Web3”

BONK team echoed this vision saying the partnership cements BONK’s institutional presence. With one of the most active Solana treasuries, the project has been expanding its infrastructure role across the blockchain.

BONK Expands Ecosystem

BONK has grown from a meme coin to a utility driven project with wide adoption on Solana. It now has over 400 integrations. Key products:

- BONKBot: $14 billion in lifetime trading volume

- Bonk.fun: $28 million in quarterly revenue

- BonkSOL: 200,000 SOL staked

Sharps is doing the same thing as Lion Group Holding did with Solana holdings into Hyperliquid (HYPE). This growing institutional involvement is showing how meme coins are becoming broader infrastructure assets in crypto.

Analysts See Upside for BONK

After BONK’s recent dip, analysts are getting more bullish. A well known market strategist on X said “this is the last dip before parabolic” and the risk reward is very good.

Additional momentum came from Tuttle Capital’s filings for multiple income based ETFs on BONK, Sui and Litecoin. BONK went up over 3% in 24 hours after the news.

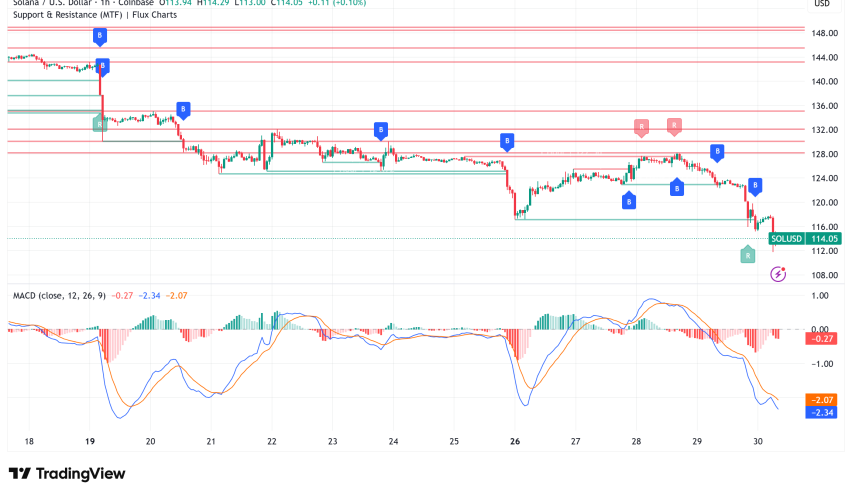

Crypto expert Kadense said BONK is retesting critical liquidity zones. With macro tailwinds like rate cuts, traders are saying BONK could retest and potentially go above previous highs.

Institutional backing, expanding utility and improving technicals is setting up BONK to break out.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM