Palantir PLTR and Nvidia Stocks Retreat as AI Overvaluation Concerns Take Over

After months of euphoria over artificial intelligence, markets are starting to show signs of skepticism for Palantir.

Quick overview

- Markets are showing hesitation around artificial intelligence stocks like Palantir and Nvidia due to concerns over overheated valuations and geopolitical risks.

- Palantir's stock dropped significantly, reflecting investor skepticism and insider selling, while Nvidia faced pressure from China's advancements in domestic semiconductor capacity.

- Despite recent volatility, Palantir's government contracts provide a stable revenue base, helping to anchor the company amid market turbulence.

- The AI sector is experiencing a pullback, with investors becoming cautious as the gap between high expectations and current realities raises concerns about potential corrections.

After months of euphoria over artificial intelligence, markets are starting to show signs of skepticism. Concerns about exaggerated valuations and escalating geopolitical threats also put pressure on Palantir Technologies and Nvidia on Wednesday; after an amazing run earlier in the year, selling took over.

Heavy Selling Weighs on Palantir

Palantir’s stock dropped $3 to close at $179.56, failing to break above its August high of $189.46. The decline reflected mounting skepticism among investors and analysts who have begun calling the stock “overvalued.” After gaining nearly 140% year-to-date, Palantir now trades at multiples that appear stretched by almost any traditional measure.

Large institutional investors have started paring positions, adding to the sense that confidence is cooling after months of relentless buying. The pullback of 3.5% in a single session underscored how quickly sentiment can shift when valuation risks collide with market volatility.

Nvidia Joins the Decline as China Moves Forward

The selling pressure was not confined to Palantir. Nvidia also saw its shares decline as Chinese technology stocks outperformed on the day. Beijing’s push to advance domestic semiconductor capacity, coupled with antitrust actions targeting Nvidia, boosted optimism in local AI players at the expense of U.S. chipmakers.

The Cyberspace Administration of China recently restricted Bytedance and Baidu from testing Nvidia’s RTX Pro 6000D, cutting into demand for its advanced AI processors. These moves highlight how geopolitical tensions continue to create headwinds for U.S. firms, with Palantir also indirectly exposed to the uncertainty.

Insider Selling Adds to Market Jitters

Investor unease was compounded by insider activity. On September 11, Palantir Director Lauren Elaina Friedman sold Class A shares worth nearly $3.5 million at prices between $164.26 and $167.25. Such significant insider sales, especially during a volatile market period, fed further doubts about near-term upside potential.

From Euphoria to Uncertainty

Just weeks ago, Palantir shares reached record highs above $189 after posting strong second-quarter results and upbeat guidance. Yet the rally proved fleeting. Valuation questions resurfaced as investors noted Palantir was trading at more than 700 times trailing earnings and a price-to-sales ratio above 100. Within days, shares plunged over 25% to near $142 before a short-lived rebound.

While Palantir briefly found technical support at the 50-day simple moving average, sellers quickly regained control, sending the stock lower again this week. The swings reflect a market caught between long-term optimism for AI adoption and near-term concerns over frothy valuations.

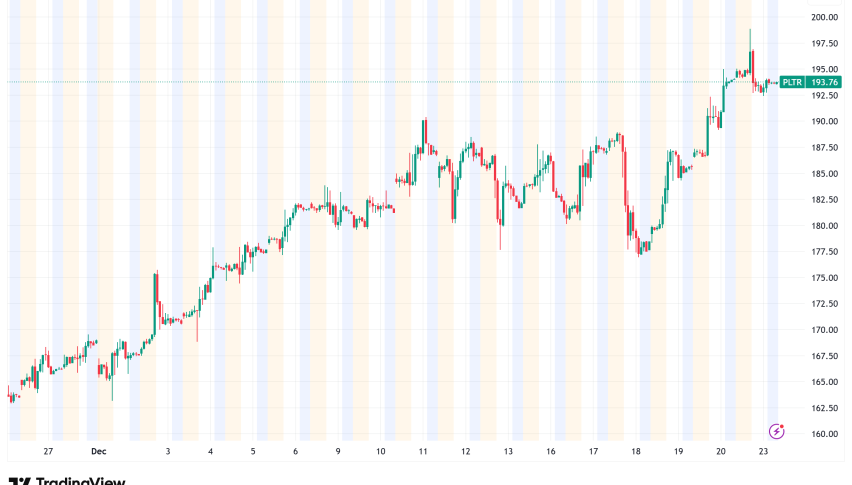

PLTR Chart Daily – Buyers Need to Break Above August’s High for the Upside to Continue

Government Contracts Still Provide Stability

Despite volatility in the stock, Palantir’s government business remains a reliable growth pillar. More than half of its revenues come from public-sector contracts, helping to anchor the company even in turbulent market conditions.

Speculation has also grown around potential U.S. government equity stakes in key defense and AI firms, following the recent purchase of a 10% stake in Intel. Commerce Secretary Howard Lutnick hinted that Palantir could be a candidate, reinforcing hopes that government support may help offset market turbulence.

Q2 2025 highlights illustrate Palantir’s strong operational momentum:

- Revenue: $1.004 billion (+48% YoY, +14% QoQ), beating expectations of $939 million.

- EPS: $0.16 versus $0.14 expected.

- U.S. revenue: $733 million (+68% YoY, +17% QoQ).

Bubble Fears in the AI Sector

The broader AI industry now faces questions reminiscent of past speculative booms, from the dot-com era to cryptocurrency manias. While adoption is undeniably accelerating, large-scale deployment is still limited. This gap between lofty expectations and current realities leaves stocks like Palantir especially vulnerable to sharp corrections.

At the same time, global policy headwinds remain a major risk factor. U.S. restrictions have already halted sales of advanced chip design software from Siemens EDA and Synopsys to China, reshaping the competitive landscape and fueling further uncertainty for American technology firms.

Conclusion: A Market at a Crossroads

The recent pullback in Palantir and Nvidia marks a turning point for AI-related equities. While the long-term growth narrative remains intact, near-term challenges around valuation, insider activity, and geopolitical risks are prompting investors to take a more cautious stance. Until confidence in fundamentals catches up with expectations, volatility is likely to remain the defining feature of this sector.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account