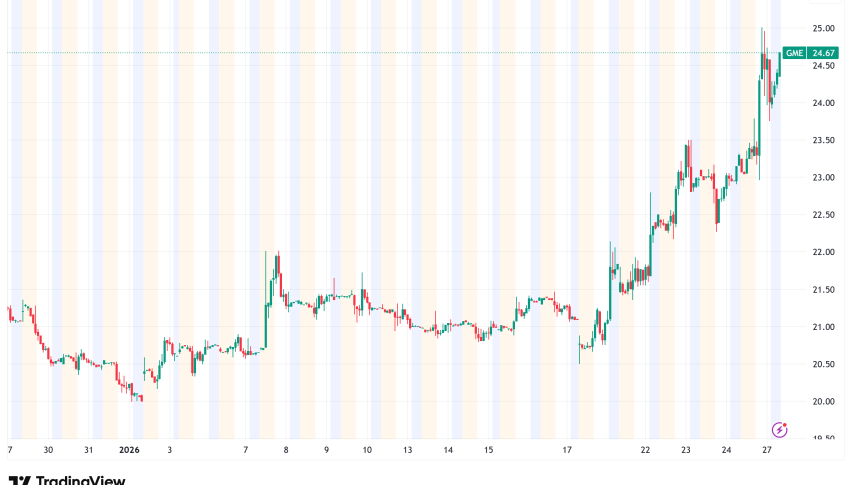

GME Stock Jumps on Pokémon Event, Eyes $35 As It Extends GameStop Earnings Rally

GameStop’s stock climbed nearly 5% on Friday to $26.61 as a new Pokémon distribution event boosted in-store traffic and added to...

Quick overview

- GameStop's stock rose nearly 5% to $26.61, driven by a Pokémon distribution event and strong Q2 earnings.

- The Pokémon event is attracting various players and boosting in-store traffic, enhancing GameStop's relevance in the gaming community.

- GameStop's Q2 revenue surged 21.8% year over year, exceeding Wall Street expectations and indicating successful strategic changes.

- Investor sentiment is further bolstered by excitement surrounding the upcoming indie game Hollow Knight: Silksong.

GameStop’s stock climbed nearly 5% on Friday to $26.61 as a new Pokémon distribution event boosted in-store traffic and added to the momentum from its robust Q2 earnings.

Pokémon Event Draws Crowds and Lifts Sentiment

GameStop’s rally reflects the combined impact of strong Q2 earnings, renewed retail investor interest, and a Pokémon promotion that’s driving foot traffic and buzz across the gaming community. GameStop (NYSE: GME) gained renewed attention from both gamers and investors after launching a limited-time Pokémon distribution event. Starting September 26, U.S. GameStop stores will hand out exclusive serial codes for Shiny Miraidon and Shiny Koraidon—two legendary Pokémon from the Scarlet and Violet series that aren’t found in the wild.

The event is attracting competitive players, collectors, and casual fans, helping to drive foot traffic into GameStop’s physical locations. The timing coincides with the release of the Mega Evolution Pokémon Trading Card Game (TCG) set, giving the retailer a valuable boost in relevance and customer engagement.

Stock Rebounds After Midweek Dip

GameStop’s rally on Friday capped a volatile week for the stock. Earlier, GME had climbed to $26.65 on Monday as retail investors showed renewed interest amid discussions about the company’s Bitcoin-related initiatives and upbeat Q2 earnings. The midweek pullback, however, was short-lived as buyers stepped back in, sending shares up nearly 5% to close at $26.61 on Friday.

Traders are now watching to see if the stock can retest its 2025 peak near $36 as enthusiasm picks up again.

GME Stock Chart Daily – Pushing Above the 50 SMA Again

Q2 Earnings Beat Expectations

GameStop’s second-quarter results were a bright spot for investors. Revenue surged 21.8% year over year to $972.2 million, surpassing Wall Street’s forecast of $823.2 million. Adjusted earnings per share came in at $0.25—well above the $0.16 analysts expected and a significant jump from $0.01 in the same quarter last year.

The strong financial performance suggests that GameStop’s ongoing strategic changes and fan-driven promotions are starting to pay off.

Hollow Knight Buzz Adds to Optimism

Investor sentiment also benefited from early-September excitement around Hollow Knight: Silksong. GameStop announced that the highly anticipated indie game will retail for $19.99, sparking a wave of fan enthusiasm. Even without a confirmed launch date from developer Team Cherry, the announcement fueled optimism about GameStop’s ability to capture sales from popular titles.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM