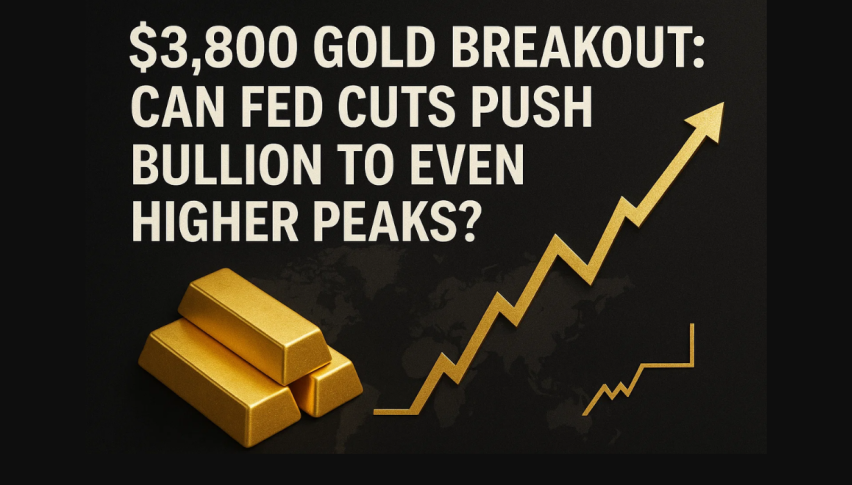

$3,800 Gold Breakout: Can Fed Cuts Push Bullion to Even Higher Peaks?

Gold prices broke above the $3,800 per ounce milestone on Monday, marking a historic first. The move was fueled by a weaker...

Quick overview

- Gold prices surpassed $3,800 per ounce for the first time, driven by a weaker U.S. dollar and expectations of Federal Reserve interest rate cuts.

- Analysts view the recent benign inflation data as a catalyst for market confidence in upcoming rate cuts, with a 90% chance for October and 65% for December.

- Geopolitical tensions and potential U.S. government shutdowns are contributing to safe-haven demand for gold, while traders monitor key U.S. economic data this week.

- Technically, gold remains bullish with strong buying pressure and potential for further upside if it breaks above $3,815.

Gold prices broke above the $3,800 per ounce milestone on Monday, marking a historic first. The move was fueled by a weaker U.S. dollar and rising bets that the Federal Reserve will cut interest rates again before the end of the year. As of Tuesday morning, spot gold traded around $3,805, holding firm just under fresh resistance at $3,815–$3,830.

The rally follows Friday’s U.S. inflation release, which showed the Personal Consumption Expenditures (PCE) index rose 0.3% in August, in line with forecasts but only a touch higher than July’s 0.2%. Analysts say the print was “benign enough” to keep the Fed leaning dovish.

“That benign inflation print has given markets confidence that cuts are coming in October and December,” said Capital.com analyst Kyle Rodda.

According to the CME FedWatch Tool, traders are pricing in a 90% chance of an October rate cut and about 65% odds of another in December.

Geopolitical Risks Add to Safe-Haven Demand

Beyond Fed policy, safe-haven flows are keeping bullion well-supported. U.S. equities opened cautiously in Asia trading as investors braced for a potential U.S. government shutdown. Meanwhile, geopolitical tensions remain high, with NATO vowing a robust response to Russian incursions and ongoing strikes on energy facilities in Eastern Europe.

Investors are also watching a string of U.S. data this week, including job openings, ADP private payrolls, the ISM manufacturing PMI, and Friday’s non-farm payrolls report. These releases could set the tone for the Fed’s next policy steps—and by extension, gold’s near-term trajectory.

Key market signals traders are monitoring:

- Fed policy odds: 90% chance of October cut, 65% for December.

- Upcoming U.S. data: Jobs and manufacturing reports.

- Geopolitics: Tensions in Russia-Ukraine and U.S. fiscal gridlock.

Gold (XAU/USD) Technical Outlook for Gold Prices

Technically, gold’s structure remains bullish. The 2-hour chart shows a rising trendline with consistent higher lows, while the 50-SMA at $3,759 continues to act as dynamic support. The 200-SMA at $3,668 adds another cushion, keeping the broader trend intact.

Recent candlestick formations, including large-bodied candles with shallow lower wicks, reflect strong buying pressure. The break above $3,780 and $3,791 has even produced a mini three white soldiers pattern—often a reliable continuation signal.

The RSI sits at 66, approaching overbought territory but not yet diverging from price, signaling momentum remains intact. A breakout above $3,815 could trigger upside toward $3,830–$3,845, with an extended target of $3,870 if momentum builds.

For traders, the strategy favors patience and confirmation:

- Long setup: Entry on a sustained close above $3,815, targeting $3,830–$3,845 with stops near $3,780.

- Pullback play: If resistance holds, dip-buying zones emerge at $3,773 and $3,759.

Gold’s rally, supported by both macro tailwinds and technical strength, suggests the path of least resistance remains higher—though volatility around U.S. data could spark short-term swings.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account