Oil Price Prediction: WTI Holds $61.56 Support as Traders Eye $66 Recovery

Oil prices stabilised on Thursday after three days of losses, as sentiment was caught between supply concerns and geopolitical risks.

Quick overview

- Oil prices stabilized on Thursday after three days of losses, with WTI around $62.20 and Brent just above $66.

- Traders are optimistic due to potential tighter sanctions on Russian oil and increased Chinese stockpiling.

- Concerns over a US government shutdown and OPEC+ plans to increase output are putting pressure on prices.

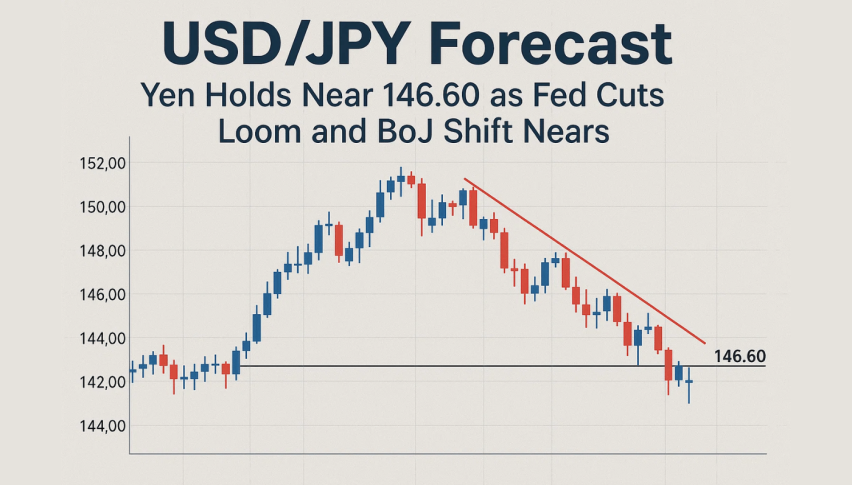

- Technical analysis suggests WTI is at a critical support level, with potential for a move back to the mid-$60s.

Oil prices stabilised on Thursday after three days of losses, as sentiment was caught between supply concerns and geopolitical risks. West Texas Intermediate (WTI) was hovering around $62.20, up slightly from its lowest close since May 30. Brent crude was trading just above $66 after falling to its lowest since early June.

Traders attributed the bounce to bargain hunting and speculation that tighter sanctions on Russian oil could reduce global supply. The Group of Seven finance ministers said they would intensify pressure on Russia, targeting buyers and intermediaries who were circumventing sanctions. US officials also confirmed they would provide Ukraine with intelligence for long-range strikes on Russian energy infrastructure, increasing the risk of supply disruption.

Chinese stockpiling added to the support, as Beijing – the world’s biggest crude importer – took advantage of the recent decline to buy barrels. But analysts said concerns over a US government shutdown and OPEC+ increasing output weighed on the market.

OPEC+ and US Inventories Pressure Prices

Supply dynamics are in focus after reports suggested OPEC+ may increase output by as much as 500,000 barrels a day in November, triple October’s hike. Saudi Arabia is keen to regain market share even as demand in the US and Asia is softening.

The latest US Energy Information Administration data added to the bearishness, with crude inventories up 1.8 million barrels last week to 416.5 million – well above the 1 million-barrel build forecast. Gasoline and distillate stocks also rose as refining margins narrowed.

Political turmoil in Washington has complicated the picture. President Donald Trump’s administration froze $26 billion earmarked for Democratic-leaning states, increasing the economic uncertainty tied to the government shutdown. Market participants fear that prolonged disruption could hit US growth and energy demand.

Technical Outlook: WTI Inflection Point

On the charts, WTI oil is defending a key support at $61.56, where multiple retests have created a potential double-bottom structure. Candlestick patterns show long-tailed wicks, indicating buyers are getting back in each time prices dip into this zone.

The RSI has bounced off 33, so we’re out of oversold territory. Both the 50- and 100-period moving averages are clustered around $63.50-$63.70. A sustained break above this zone could turn resistance into support and open up $64.75 and then $66.40.

For traders, patience is key. A close above $63.70 with volume is a safer long entry, targeting $64.75 and $66.40, with a stop-loss under $61.50. More aggressive players may buy dips around $61.90-$62.20 but that’s higher risk in a volatile market.

In short, oil is at a crossroads. Either WTI builds a base for a move back to the mid-$60s or sells back into the low $60s.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account