Is This Start of the Crash for Palantir Stock as PLTR Sinks 8% on US Army Security Worries?

Palantir shares tumbled sharply today as U.S. Army criticism and insider selling reignited investor doubts about the company’s prospects.

Quick overview

- Palantir's stock fell 7.5% due to criticism from the U.S. Army and insider selling, raising investor concerns.

- An internal Army memo highlighted significant security issues in Palantir's battlefield communications project, jeopardizing future contracts.

- Insider sales by Palantir Director Lauren Elaina Friedman added to market unease about the company's near-term performance.

- The combination of these factors has led to a sharp decline in Palantir's stock, which may struggle to recover without addressing security and contract stability.

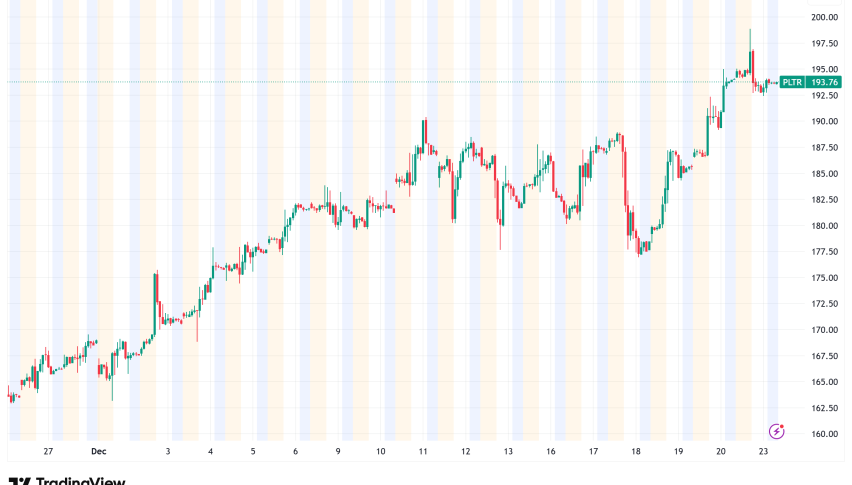

Live PLTR Chart

[[PLTR-graph]]Palantir shares tumbled sharply today as U.S. Army criticism and insider selling reignited investor doubts about the company’s prospects.

Palantir’s Sudden Downturn

Palantir Technologies (NYSE: PLTR) saw its stock slide by 7.5%, dropping from $187 to intraday lows near $170, as concerns mounted over the company’s reliance on its largest client—the U.S. Army. The decline underscores how vulnerable Palantir’s business remains to shifts in sentiment among its government partners.

U.S. Army Raises Red Flags

A recent internal Army memo cast a shadow over ongoing modernization projects, flagging “fundamental security” issues in the battlefield communications network being developed by Palantir, Anduril, and other contractors. The report described the vulnerabilities as a “very high risk,” raising doubts about the effectiveness and safety of these high-stakes initiatives.

The U.S. Army and federal government remain Palantir’s biggest customers, providing a substantial share of its revenue. This reliance, however, is proving to be a double-edged sword. The Army’s dissatisfaction not only threatens Palantir’s existing contracts but also dampens hopes for future defense-related growth.

Insider Sales Add to Pressure

Investor unease deepened after Palantir Director Lauren Elaina Friedman sold approximately $3.5 million worth of Class A shares on September 11 at prices between $164.26 and $167.25. The sizable insider sale, occurring amid heightened market volatility, stoked concerns about management’s confidence in near-term performance and the stock’s lofty valuation.

From Record Highs to Rapid Reversal

Palantir’s troubles come on the heels of a meteoric rally earlier this quarter. The stock had surged above $189 following strong Q2 earnings and upbeat guidance. Yet that optimism quickly faded as analysts flagged the company’s steep valuation—trading at more than 700 times trailing earnings with a price-to-sales ratio exceeding 100.

With the stock now hovering near $170, technical analysts point to potential support at the 50-day simple moving average, though persistent selling pressure suggests the downturn may not be over yet.

Conclusion: Clouds Gather Over Palantir’s Outlook

The combination of U.S. Army concerns, stretched valuations, and insider selling has jolted investor sentiment, transforming Palantir’s recent rally into a sharp pullback. Unless the company can reassure stakeholders on security issues and stabilize its defense contracts, PLTR may struggle to regain its former highs in the near term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account