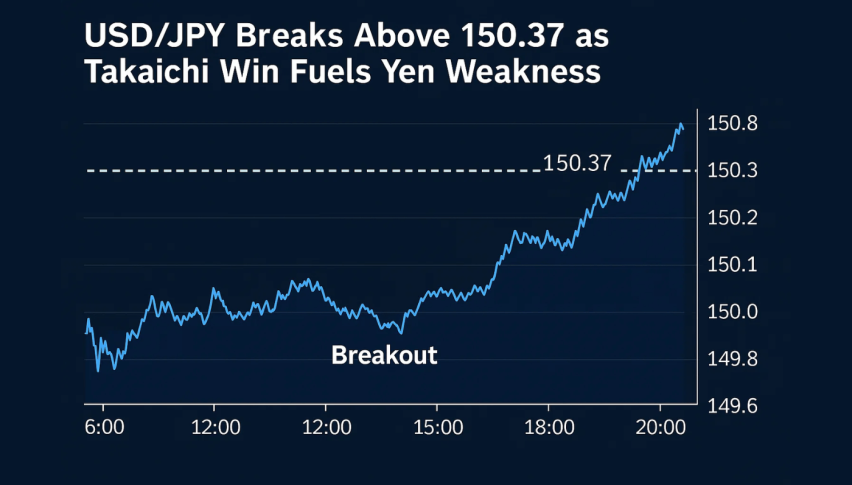

USD/JPY Breaks Above 150.37 as Takaichi Win Fuels Yen Weakness

USD/JPY blasted past 150.37 on Thursday, its highest since early August as the yen was sold heavily. The rally came after Sanae Takaichi...

Quick overview

- USD/JPY surged past 150.37, its highest level since early August, following the election of Sanae Takaichi as the new leader of Japan's LDP.

- Takaichi's pro-spending policies are expected to lead to increased fiscal spending and a delay in monetary tightening by the Bank of Japan.

- Despite strong demand for the US dollar, gains are limited by expectations of Federal Reserve rate cuts and the ongoing US government shutdown.

- Technically, USD/JPY shows bullish momentum with a potential pullback expected, and traders should watch for re-entry opportunities around the 149.90–149.10 zone.

USD/JPY blasted past 150.37 on Thursday, its highest since early August as the yen was sold heavily. The rally came after Sanae Takaichi was elected as the new leader of Japan’s Liberal Democratic Party (LDP), which reinforced expectations of more fiscal spending and ultra-loose monetary policy.

Takaichi, known for her pro-spending stance, will become Japan’s first female PM in mid-October. Her leadership boosted risk sentiment, sent Japan’s Nikkei 225 to new highs and weakened the yen as investors expect the Bank of Japan (BoJ) to delay any tightening.

This shift in political and policy outlook has driven demand for the US dollar, especially with widening US–Japan yield differentials attracting carry trades.

Fed Cut Bets Cap Dollar Gains

Despite strong dollar buying, gains are limited by Fed cut expectations and the US government shutdown. Markets now assign a 95% probability of a 25-bp Fed cut in October and another in December according to the CME FedWatch Tool.

The US shutdown has delayed major data releases including September’s nonfarm payrolls, leaving traders dependent on FOMC comments for short-term direction. Meanwhile BoJ Governor Kazuo Ueda reiterated last week that a rate hike is possible if inflation stays near projections – a statement that may slow but not reverse the yen’s weakness.

USD/JPY Technical Setup and Trade Idea

On the technical side, USD/JPY broke above 149.11 resistance and confirmed the bullish momentum with a bullish engulfing candle. The 4-hour chart shows an uptrend since late September with higher lows and the pair has crossed above both the 50-SMA (148.40) and 100-SMA (147.82) with a bullish crossover. The pair has also broken above the 149.00 zone.

However, the RSI is at 74 which suggests overbought conditions and a short-term pullback may occur before further gains. Watch for a retest of the 149.90–149.10 zone as a re-entry if the price stabilizes.

Trade Setup:

- Entry Zone: 149.00–149.90 (on dip)

- SL: 148.30

- T1: 150.90

- T2: 151.62

As long as above 149.00, trend is up. Momentum and higher lows. Buyers in control, may go to 151.60 soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account