Can Solana Hold $200 as Institutional Accumulation Clashes with Weakening Network Activity?

Solana (SOL) is at a very important turning point right now. The token is hovering at $203 after dropping 3% in the last 24 hours. SOL/USD

Quick overview

- Solana is currently at a critical price point of $203 after a 3% drop in the last 24 hours, facing challenges from worsening on-chain metrics and increased competition.

- Despite these challenges, 76% of retail traders remain long on Solana, historically correlating with positive future returns.

- Institutional investors are accumulating SOL at discounted prices, indicating confidence in its long-term potential, while whale activity is rising ahead of an upcoming ETF decision.

- Technical analysis shows a bearish breach below $190, with critical support at $200; a breakdown could lead to further declines, while holding this level may allow for a bounce back.

Solana SOL/USD is at a very important turning point right now. The token is hovering at $203 after dropping 3% in the last 24 hours. The cryptocurrency has historically had a positive retail sentiment, but it is now facing more and more problems as on-chain metrics go worse and competition from other blockchains gets stronger. This makes it hard to believe that any recovery will last.

SOL Flashes a Rare Retail Bullish Signal That Could Drive Recovery

The on-chain analytics platform Hyblock shows a very optimistic setup: 76% of retail traders are still long on Solana, which is the biggest percentage among major cryptocurrencies. In the past, this level has been in line with positive future returns. Backtesting shows that when retail long percentages go beyond 75%, SOL’s seven-day mean returns go up from about 2.25% to over 5%, and average drawdowns go down. The risk-reward ratio almost doubles in these situations, which means that upward swings are more likely to happen and downward volatility is less likely to happen.

In addition to this story, expert Darkfost points out that a broader altcoin capitulation could be a time to buy more. Only 10% of the altcoins listed on Binance are above their 200-day moving average. This is a sign that people are scared and uninterested in alternative assets, which usually happens before big market bounces. Darkfost said, “The best time to get into altcoins is when no one else wants them.” He compared this to past cycles where similar settings led to big short-term recoveries.

Institutional Players Accumulate at Discounts

The action of corporate treasuries shows that institutions have faith in the current pricing levels. Solmate (Nasdaq: SLMT) bought $50 million worth of SOL from the Solana Foundation at a 15% discount, and ARK Invest revealed fresh 11.5% ownership shares. More importantly, the treasury company SOL Strategies (Nasdaq: STKE) bought 88,433 more SOL, including 79,000 locked tokens from the foundation, at an average price of $193.93. This brought their total holdings to 523,433 SOL. These coordinated attempts by institutional investors to buy SOL show that they believe in its long-term potential.

Whale Activity and Solana ETF Catalyst Provide Short-Term Support

Pelin Ay, an analyst, said that whale orders on SOL have started to rise again, which has happened before when prices rose by 40% to 70%. The timing is important since these whales seem to be getting ready for the October 16 spot SOL ETF decision. If the verdict is good, it might lead to stronger spot demand and possibly tighter supply, putting SOL back on track to go above $200.

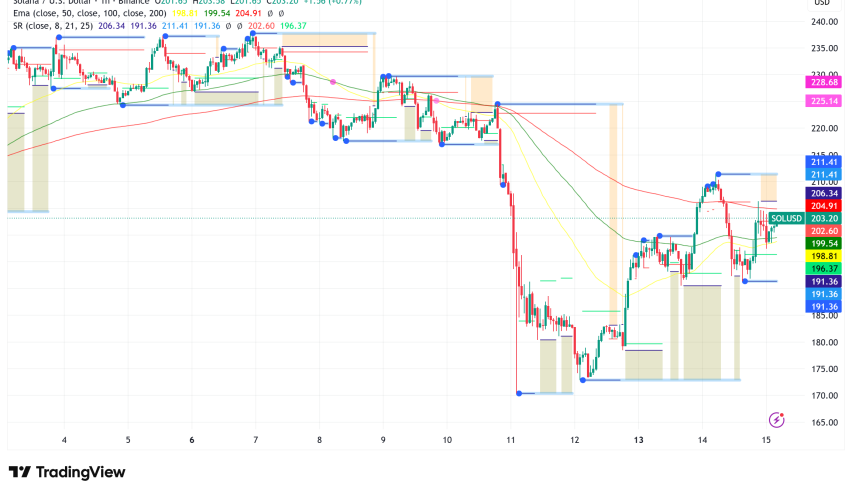

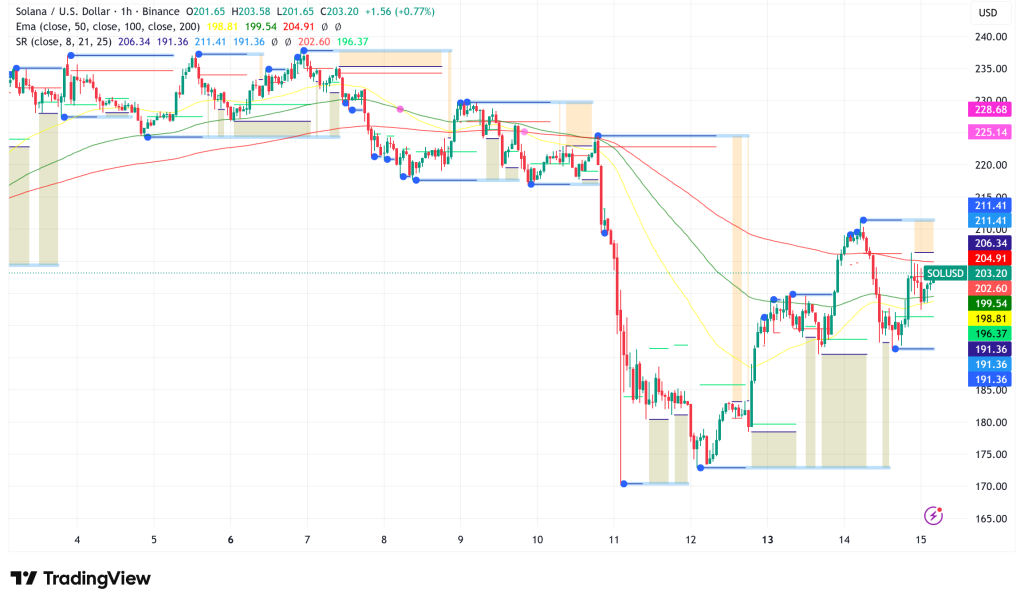

SOL/USD Technical Analysis: The Rising Wedge Dilemma

Even while the basics are good for SOL, the technical arrangement is worrying. On the daily timeframe, SOL marked its first bearish breach of structure since February with a close below $190. The coin presently trades between the 50-day and 100-day exponential moving averages—a compression zone often signaling indecision between short-term weakness and medium-term support.

The one-hour chart shows a very important rising wedge pattern that could mean the trend is about to change. Recently, SOL was turned down at the wedge’s upper resistance level, which is close to $211.25. This caused a pullback toward the $202 support level. If this important support level breaks down decisively, it would indicate the failure of the rising wedge and might push SOL down to $175.80, which would be in line with previous demand zones set up earlier this month.

Solana Price Prediction and Outlook

$200 is a very important technical level for SOL. If bulls are able to hold this support, the price could bounce back to $218. However, it doesn’t look like there will be a clean breakthrough over $211 because the perpetual futures financing rates are low, which means there isn’t much demand for leveraged bullish bets. On the other hand, if support breaks, SOL might drop to about $160 to consolidate if bearish momentum picks up.

The way forward depends on three things: the verdict on the spot ETF on October 16, whales staying in the market, and whether institutional buying can make up for weak network fundamentals. Retail traders and institutions are confident, but Solana needs to fix its on-chain problems and get back on its feet versus rival platforms that are getting smarter to justify a long-term climb above $200.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM