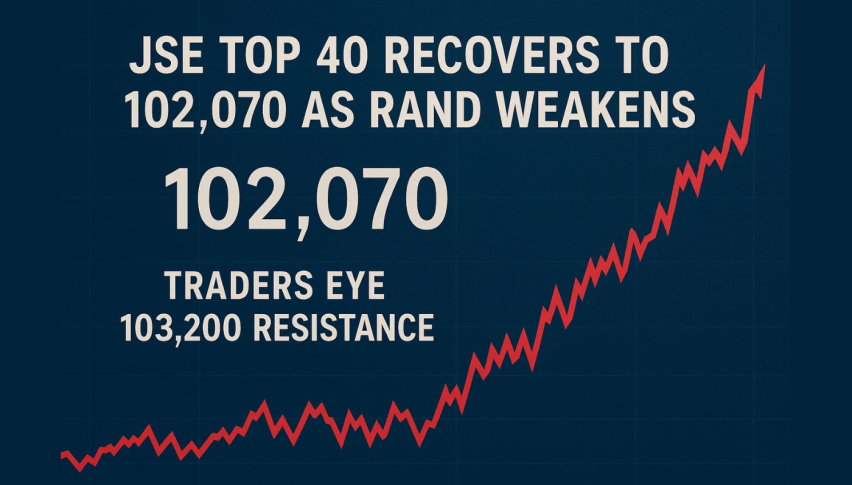

JSE Top 40 Recovers to 102,070 as Rand Weakens, Traders Eye 103,200 Resistance

The JSE Top 40 index started looking a bit more cheerful on Tuesday as it bounced up to 102,070, a 0.66% gain from earlier...

Quick overview

- The JSE Top 40 index showed a slight recovery, bouncing back to 102,070 after a recent decline.

- Investor caution is prevalent due to a stronger dollar and falling commodity prices, impacting riskier sectors like mining and energy.

- The rand weakened amid global market uncertainty, with attention on upcoming US inflation data and the FATF meeting's implications for South Africa.

- Technically, the JSE Top 40 is in a correction phase, but a bounce from key support levels suggests potential for a bullish reversal.

The JSE Top 40 index started looking a bit more cheerful on Tuesday as it bounced up to 102,070, a 0.66% gain from earlier, despite having slipped below its trend channel a few days earlier. The improvement came after a sharp drop from the 104,346 resistance zone – a level that had previously served up a few rejections, leaving many guessing that all is not well in the world of South African equities.

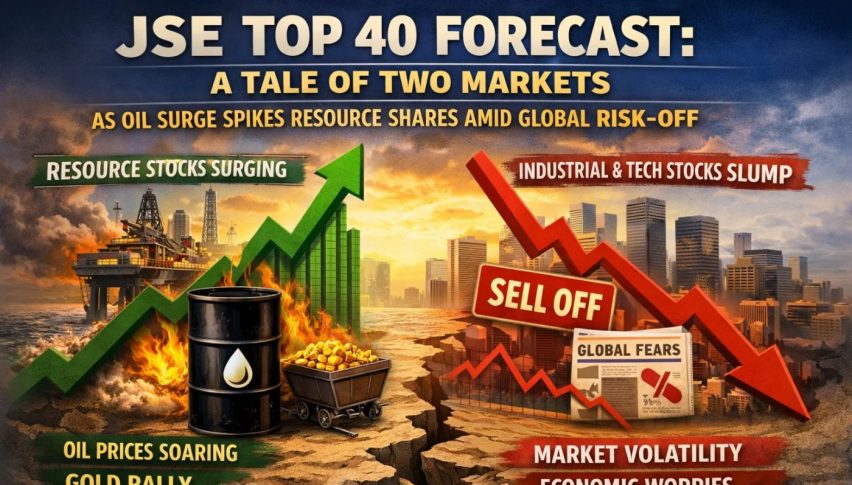

The market in general had been selling off, largely due to investors getting a bit more cautious in the face of a stronger dollar and falling commodity prices. The whole thing being that investors generally prefer to stick with safer assets when global markets are feeling uncertain, – which is why riskier sectors like mining and energy have seen a lot of liquidity pulled out.

According to Andre Cilliers, a currency strategist at TreasuryONE, ” Our stock market has a bit of a problem with resources. It’s probably just a correction.” Cilliers puts it pretty well, the whole idea being that the weakness in the market is more about the market adjusting to some changes rather than anything too out of the ordinary – though it does look like resource linked shares are under a bit of pressure from the global commodity market situation.

The Rand Takes a Tumble as the US Dollar Fights Strong

The rand took a hit alongside the rest of the market in the global risk-off move, with the US dollar index going up 0.4% on the expectation that the Federal Reserve will keep rates steady. People are also watching out for some key inflation data coming out of the US this week, which could have an impact on how emerging markets are seen.

There was a little bit of optimism earlier on in the week about South Africa possibly being taken off the FATF grey list – which had given the rand a bit of a lift – but that fizzled out pretty quickly as commodity prices began to fall off. A lot will depend on what comes out of the FATF meeting in October when it will have its say on South Africa’s progress in this area – and that is likely to have a big impact on local markets.

Market Highlights:

- Gold prices dropped 4% after some traders started taking their profits following the recent highs.

- The JSE Top 40 Index took a 2.5% tumble only to bounce back later in the day.

- The 2035 government bond yield came down 1.5bps to 8.91% which is a sign that people are looking to put some of their money into safer assets.

JSE Top 40 Index – From a Technical Perspective

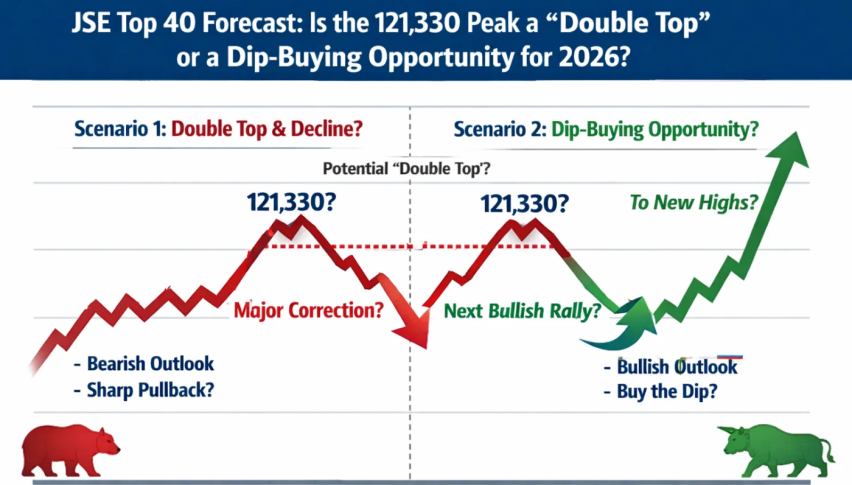

From a technical standpoint, the JSE Top 40 is in the middle of a bit of a correction after it broke below the mid-channel trendline. The 20-EMA going below the 50-EMA is a sign that the market is a bit bearish at the moment – but at the same time the bounce from 101,128 suggests the market may be starting to build a bit of a base.

If the price holds above 101,400, we might see it push on up to 102,889 (20-EMA resistance) and 103,211 and have a bit of a breakout on the cards back to 104,346. On the other hand, if it can’t hold support at 101,128, we could see the price drop down to 99,843 and 98,422.

Trade Ideas:

- Buy Zone: 101,100 – 101,400

- Targets: 102,900 and 103,200

- Stop Loss: Below 100,900

For traders, one of the keys will be a bullish engulfing candle or an RSI cross above 50 to confirm whether the market is really back on the mend – or if this is just a pause before the next drop. Overall, the trend is looking pretty cautiously positive, but we’ll need to see a bit more action over the next few sessions before we know for sure either way.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM