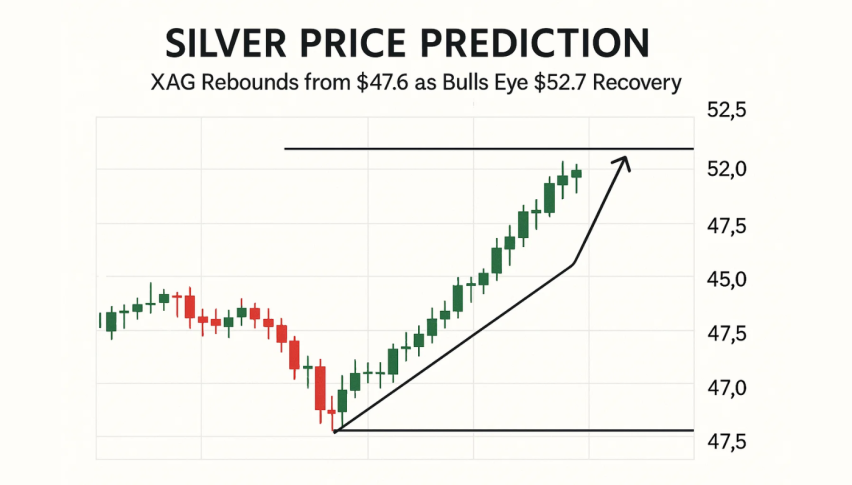

Silver Price Prediction: XAG Rebounds from $47.6 as Bulls Eye $52.7 Recovery

Silver (XAG/USD) stabilised around $49.04 following a near 10% drop from last weeks peak of $54.48 as US-China tensions Ease...

Quick overview

- Silver (XAG/USD) stabilized around $49.04 after a nearly 10% drop from last week's peak due to easing US-China tensions and profit-taking.

- Traders are awaiting the US CPI report, which could influence the momentum for silver and potentially lead to a rate cut by the Federal Reserve.

- Technically, silver is forming a potential base around $47.64, with signs that bullish sentiment may be returning if it can hold above $49.50.

- The medium-term outlook for silver remains positive due to strong industrial demand and expectations of interest rate cuts, despite reduced safe haven flows.

Silver (XAG/USD) stabilised around $49.04 following a near 10% drop from last weeks peak of $54.48 as US-China tensions Ease, & profit taking takes its toll on the precious metals market. even as gold stumbled below the $4,100 mark, silver still has a bit of oomph going for it thanks to growing industrial demand and optimism about the Federal Reserve chopping interest rates

Now traders are just waiting for the Fri US CPI report which is going to give a pretty clear idea of whats going on with near term momentum will a softer inflation number finally give the go-ahead for a rate cut and send non-yielding assets like silver soaring ?

Silver (XAG/USD) Technical Picture: Bulls Hold Firm on Key Support

On the 4hr chart silver has broken below its ascending Channel and is looking like its going to need a bit of a correction after months of steady gains. its forming a potential base around $47.64 – a spot where buying interest has popped up a few times already which is a good sign the bulls are maybe starting to accumulate some silver

Looking at the candlestick chart we can see long lower wicks and spinning tops which both suggest that the bears are starting to lose their grip on the market the RSI is rebounding off oversold levels with the 20ema and 50ema starting to flatten which is a hint that a bull crossover might be on the cards if silver can hold above $49.50

If silver can push above $50.34 it could be a big confidence booster and set the stage for a rally to $52.75 and then on to $54.48 but if it slips below $47.64 then the next supports kick in at around $45.88 and $44.70

Broader Outlook: Industrial Demand and Rate Cut Dreams

Beyond the technicals silver’s medium term outlook is looking pretty good thanks to it being a dual role precious and industrial metal which is positioning it nicely for the ongoing global manufacturing recovery.

With the Fed looking set to chop interest rates again (with a 97% chance per LSEG data) there’s a lot of underpinning of market sentiment for the moment even with the geopolitical calm starting to reduce safe haven flows the demand from sectors like solar panels and EV components is keeping silver’s fundamentals looking pretty strong through to 2025

Silver (XAG/USD) Trade Setup

- Buy Zone: $48.80 – $49.00 (need to see a break above $49.50 first)

- Targets: $50.70 and $52.75

- Stop Loss: below $47.40

For beginners look for a bullish engulfing or three white soldiers pattern near $49.50 to signal the correction is over and we’re back up to business as usual.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM