GameStop Comeback: Investor Buzz and Roaring Kitty News Drive GME Stock Bounce

With fresh Reddit buzz, positive profits, and fan-driven shop visitation, GameStop's stock enjoyed a renewed jump in retail euphoria this...

Quick overview

- GameStop's stock rose over 5% this week, driven by renewed retail enthusiasm and a viral Reddit post from Roaring Kitty revealing a significant investment position.

- The company announced a warrant distribution, allowing investors to purchase additional shares at a price above current market levels, enhancing capital flexibility.

- In-store promotions, including a Pokémon event, have boosted foot traffic and engagement, contributing to the company's revival.

- GameStop's strong Q2 earnings report exceeded expectations, highlighting progress in its turnaround strategy and reinforcing retail investor sentiment.

With fresh Reddit buzz, positive profits, and fan-driven shop visitation, GameStop’s stock enjoyed a renewed jump in retail euphoria this week.

Roaring Kitty’s Return Sparks Renewed Frenzy

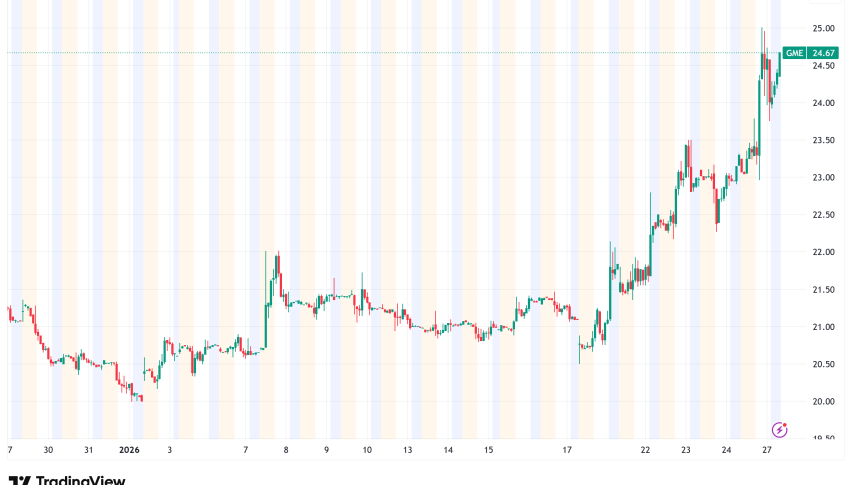

GameStop Corp. (NYSE: GME) climbed over 5% on Thursday, reaching $23.68, after repeatedly finding support around the $22 zone. The rally gained traction following a viral post by Roaring Kitty on Reddit’s Superstonk forum, revealing a massive position in the stock — $115.7 million in shares and another $65.7 million in call options with a $20 strike price expiring June 21.

The post ignited a wave of excitement across online trading communities, with Reddit users calling it a “historic” comeback. The surge in bullish options activity suggests retail traders are once again betting on GameStop’s next big move.

Warrant Distribution Adds Fresh Catalyst

Adding fuel to the rally, GameStop announced that it will issue one warrant for every 10 shares held, allowing investors to purchase additional stock at $32 per share — roughly 24% above current market levels.

This announcement followed GameStop’s October 3 filing of a “mixed shelf” registration with the SEC, granting flexibility to issue new shares, debt, and warrants. On the same day, the company executed an 11-for-10 stock split and distributed shareholder warrants, prompting a temporary halt in GME options trading as exchanges adjusted to the changes.

These moves underscore GameStop’s strategy to maintain capital flexibility while rewarding loyal investors.

Pokémon Event and Retail Revival

GameStop’s recent resurgence isn’t just about trading hype — in-store promotions have also helped lift engagement.

In late September, the company launched a Pokémon distribution event, offering exclusive codes for rare Pokémon, Shiny Miraidon and Shiny Koraidon, coinciding with the release of the Mega Evolution TCG set.

This marketing push attracted gamers, collectors, and casual shoppers, giving GameStop’s physical stores a surge in foot traffic and revitalizing brand buzz within the gaming community.

Financials Offer Real Support

Behind the retail excitement, GameStop’s Q2 2025 earnings provided a fundamental tailwind.

Revenue surged 21.8% year-over-year to $972.2 million, well above expectations of $823.2 million. Adjusted EPS came in at $0.25, crushing estimates of $0.16 and marking a sharp improvement from $0.01 in the prior year.

These results highlight progress in the company’s turnaround strategy, combining fan engagement with more disciplined cost management.

Technical Picture: Watching Key Resistance

GameStop’s latest move pushed the stock back above the 50-day Simple Moving Average (SMA) — a positive short-term signal. Traders are now eyeing whether GME can break above October’s high near $28, and potentially retest the 2025 peak at $36, as momentum builds around retail investor sentiment.

GME Stock Chart Daily – Rebounding Off Support

Conclusion: Retail Power Still Strong

GameStop’s latest rally blends fundamentals, fandom, and the unmistakable energy of retail traders rallying behind a symbol of the meme-stock era. With Roaring Kitty back in the mix, strong Q2 results, and clever marketing fueling interest, the company may have reignited a spark that’s part nostalgia — and part genuine turnaround story.

In short: GameStop’s revival may once again prove that in this stock, the line between fundamentals and fan passion remains unusually thin.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM