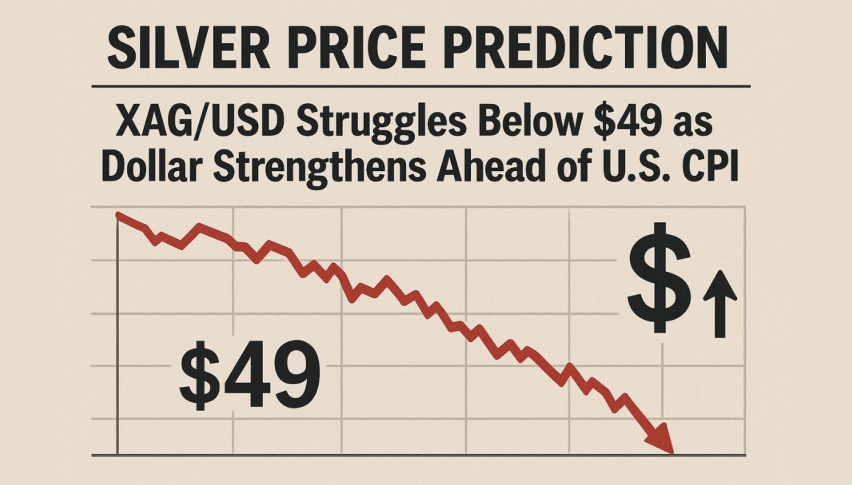

Silver Price Prediction: XAG/USD Struggles Below $49 as Dollar Strengthens Ahead of U.S. CPI

During the Asian trading session on Friday, silver (XAG/USD) just kept on sliding, closing out at $48.28 after a 0.58% dip.

Quick overview

- Silver (XAG/USD) closed at $48.28 after a 0.58% dip, influenced by a stronger dollar and reduced demand from India post-Diwali.

- Investor caution ahead of the U.S. CPI report and U.S.-China trade talks is putting pressure on precious metals like silver and gold.

- Technical analysis shows silver is struggling below key resistance levels, with a support zone at $47.50-$47.60 acting as a critical battleground.

- Traders are advised to adopt a 'wait and see' approach, with potential upside if silver breaks above $49.60 or downside risks if it falls below $47.50.

During the Asian trading session on Friday, silver (XAG/USD) just kept on sliding, closing out at $48.28 after a 0.58% dip. Stronger dollar and general wariness among traders was putting the squeeze on precious metals. It was a repeat of what we’ve seen with Gold, which fell below $4,150 and its been weighed down by Indian demand dropping off after Diwali, not to mention cautious investor sentiment ahead of some major events – the U.S. CPI report and key talks between U.S. and China.

Stronger Dollar and Fading Demand in India – Double Whammy for Precious Metals

The dollar index (DXY) had a bit of a revival, as traders were getting a little nervous ahead of those key inflation figures coming out. As a result, safe-haven assets like gold and silver have come under pressure. People are being a bit more cautious, not wanting to get caught out on the wrong foot after that nasty sell-off in the past week. And on top of that, India’s been one of the main drivers of demand for gold and silver – but that demand has been easing off now that the Diwali celebrations are over. Analysts point out that jewelers tend to ease off after the festival’s over, which means there’s a natural seasonal dip in bullion purchases.

Markets on Tenterhooks for CPI Figures and Trade Developments

Investors are still nervous about the upcoming U.S. CPI numbers – they’re expecting to see a 0.4% month-on-month increase and 3.1% annual rise. If those numbers come out stronger than expected, it could solidify expectations that the Fed will hold off on any serious rate cuts. But if the numbers come out softer, that might boost dovish sentiment and actually send silver prices up.

At the same time, trade officials from the U.S. and China are getting together in Malaysia to talk about tariffs and export restrictions. Next week’s APEC summit is where things might get really interesting – Presidents Trump and Xi are due to meet, and any agreements or disagreements that come out of that meeting could send shockwaves through the markets.

[[XAG/USD-graph]]

Silver (XAG/USD) Technical Analysis – Sellers Still in Charge

Silver’s recent drift downwards is pretty much a continuation of that downward move after it failed to break the descending trendline from the high of $54.48 back in October. Right now, the metal’s still trading below both its 20-day and 50-day EMA’s, and any attempts to push past $49.40-49.60 have been met with sellers.

RSI’s down at 37, which is bearish but also suggests that the metal may be getting a bit oversold – which could open the door for a bit of a bounce if momentum starts to flatten out. But for now, the picture’s pretty clear – each time silver tries to mount a recovery, it’s getting capped by sellers, and that suggests they’re firmly in control.

The support zone at $47.50-$47.60 is looking like it’s going to be a key battleground – if silver breaks below that, then it could expose some serious downside targets – but if it can somehow manage to hold above $49.50, then it might get another chance to test $50.67.

Silver (XAG/USD) Trade Setup and Outlook

For now, most traders are saying “wait and see” before taking a position. If you do decide to go long and you get a break above $49.60, then you can target $50.67 with a stop-loss below $48.50. On the other hand, a close below $47.50 could mark the start of a deeper slide towards $45.88.

Overall, silver’s still got a bit of a weight on it due to the strong dollar and weak industrial demand – but those oversold technical conditions do suggest that buyers may be about to get another chance to get back into the game – particularly if inflation data or trade outcomes suddenly turn a bit more positive.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM