JSE Top 40 Index Eyes 105,000 as Rand Strengthens and Fed Rate Cut Looms

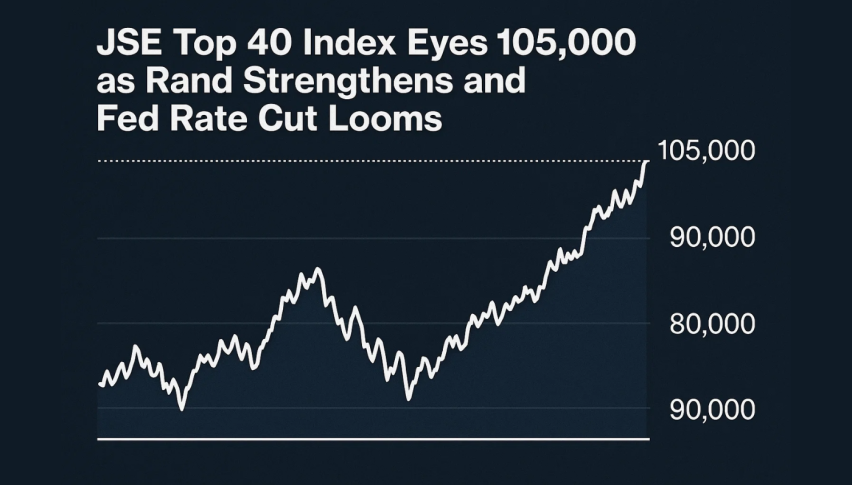

JSE40 has had a strong reversal from the 102,000-102,500 range, reclaiming its footing within a very distinct ascending price channel...

Quick overview

- JSE40 has reversed from the 102,000-102,500 range, indicating renewed bullish momentum within an ascending price channel.

- The 20-period EMA has crossed above the short-term pivot at 102,700, signaling bullish potential as long as higher lows are maintained.

- The rand has strengthened to 17.13 ZAR/USD amid expectations of a US Federal Reserve rate cut, boosting risk appetite in emerging markets.

- Domestic factors, including stable bond yields and strong credit conditions, are supporting the market's positive outlook.

JSE40 has had a strong reversal from the 102,000-102,500 range, reclaiming its footing within a very distinct ascending price channel that has been guiding the market since mid-September. This upswing follows two weeks of pretty steady consolidation, with a big bullish candle last week, which confirms that renewed momentum is afoot.

Recently, the 20-period EMA crossed above the short-term pivot at 102,700, which is a bullish sign as long as buyers keep defending higher lows. Meanwhile, the Relative Strength Index (RSI) has climbed to 62, a good sign that momentum is growing but not yet suggesting we’re in overbought territory.

If you take a closer look at the charts, there are several bullish engulfing formations along the channel’s lower boundary—pretty clear signs of institutional buying. If JSE40 can push beyond 105,000, we might see further gains towards 106,300, provided it keeps support above 102,000 intact.

The Rand Getting a Boost and Global Catalysts

The rand (ZAR) started the day stronger at 17.13 ZAR/USD, up 0.1% from Tuesday, amid optimism that the US Federal Reserve will cut rates at the policy meeting. And markets are largely expecting a 25-basis-point rate cut, which could boost risk appetite in emerging markets.

A key Treasury specialist, Adam Phillips, noted that while the US dollar remains pretty firm, sentiment is shifting toward risk assets—traders are preparing for potential developments in US-China trade talks and further easing from global central banks.

Local Factors Still Driving The Market

Domestic fundamentals are still looking very supportive for SA equities. The 2035 government bond yield has eased by 1.5 basis points to 8.87% – a sign of investor confidence growing. Rising money supply and private sector credit growth are making a supportive domestic backdrop.

Just a few key drivers keeping momentum going at the moment are-

- The stability of bond yields offering a safe haven in global uncertainty.

- Strong domestic credit conditions that are definitely supporting business expansion.

- A firmer rand that’s reducing its impact on inflation and import costs.

Trade Outlook

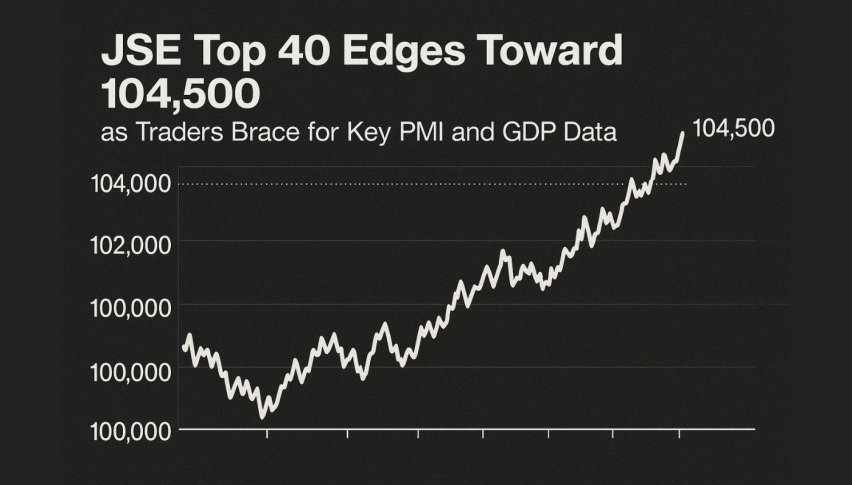

For traders, the setup is looking pretty constructive. A long entry near 103,000 ZAR is looking to target 104,140 and 105,063 ZAR, with a protective stop below 102,000 ZAR. As long as that channel structure holds up, JSE40 looks pretty well set for further upside – a sign of some technical resilience in the face of all this shifting global sentiment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account