Signs of Life in QUBT Stock After 48% Crash, but Can Earnings Justify Valuation?

Despite brief gains before earnings, Quantum Computing Inc. (QUBT) remains weighed down by staggering losses and fading investor confidence

Quick overview

- Quantum Computing Inc. (QUBT) experienced a brief rebound of over 11% but remains burdened by significant losses and declining investor confidence.

- Despite recent technical advancements, the company's financials are concerning, with only $100,000 in revenue against a $19.5 million loss in the first half of 2025.

- QUBT's valuation is excessively high at a 10x price-to-book ratio, raising concerns about future growth potential amid disappointing fundamentals.

- Recent small contracts have not significantly impacted QUBT's financial situation, highlighting the gap between operational progress and revenue generation.

Despite brief gains before earnings, Quantum Computing Inc. (QUBT) remains weighed down by staggering losses and fading investor confidence in its long-term viability.

A Weak Recovery Amid Heavy Selling

After weeks of relentless selling, Quantum Computing Inc. staged a mild rebound on Friday, climbing over 11% to $16.70. Yet the uptick follows a near 50% collapse from its early October peak, when speculative enthusiasm in AI and quantum stocks sharply reversed. The slide, which found temporary support above the 200-day moving average, reflects growing fatigue among investors tired of betting on companies with promise but no profits.

QUBT Chart Daily – Too Early to Call the Crash Off?

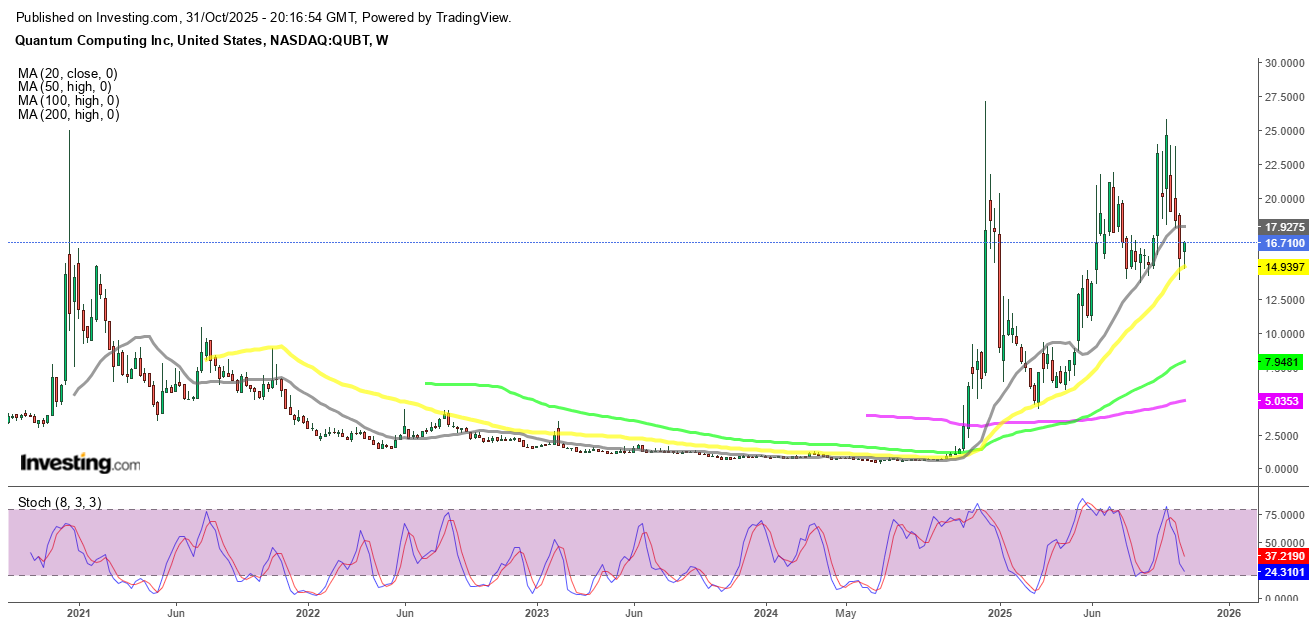

The weekly chart also appears to be holding the QUBT technical setup. The 50-day SMA near $15 is the last line of defense after the 20-day simple moving average (gray), a crucial short-term support, was firmly broken. The 50 SMA (yellow) remained strong for two weeks, so it’s possible that the stock will rise from here. Prior to the company’s quarterly earnings report on Friday, this increase was driven by early-morning momentum and market mood.

QUBT Chart Weekly – The 50 SMA Held Again

Valuation Stretched to the Limit

Even with the latest bounce, QUBT’s valuation remains dangerously inflated. The company trades at an eye-watering 10x price-to-book ratio — far above both industry and peer averages. Such a premium implies massive growth expectations, yet little in the firm’s fundamentals supports them. If the upcoming Q3 report disappoints, the stock could face a sharp re-rating as reality catches up with hype.

Bleak Financial Picture Overshadows Progress

Despite technical breakthroughs in photonic chips and quantum optics, QUBT’s financials remain bleak. In the first half of 2025, it generated just $100,000 in revenue against a staggering $19.5 million loss. Analysts expect less than half a million in annual revenue — a drop in the ocean compared to projected losses nearing $40 million. Even with a healthy cash reserve of $349 million, relentless R&D spending continues to erode margins and delay any path to profitability.

Small Contracts, Big Expectations

Recent wins — including a small government contract with the National Institute of Standards and Technology and a chip order from a Fortune 500 client — have done little to shift the narrative. While these deals showcase technical credibility, they barely move the financial needle. For now, they serve more as headlines than real revenue drivers.

Operations Improve, But Revenue Doesn’t

The completion of QUBT’s photonic chip foundry in Tempe, Arizona, marks genuine operational progress. The facility has started fulfilling limited orders and broadened the company’s visibility through partnerships with research bodies, defense contractors, and automakers. Still, without recurring income or scalable production, QUBT remains far from commercial viability.

Conclusion: Fragile Hope Before Earnings

Quantum Computing’s rebound feels more like a pause in selling than a genuine turnaround. Despite strong technology and institutional ties, its weak financial base and unrealistic valuation leave little room for error. Unless Friday’s earnings deliver a clear path toward sustainable revenue, QUBT’s fragile momentum could quickly unravel again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM