CoreWeave (CRWV) Crashes 20%: Meta’s $14B Deal Fails to Stem Bleeding as Losses Mount

CoreWeave (NASDAQ: CRWV) is facing downward pressure on its stock. Shares are currently trading between $104 and $105.

Quick overview

- CoreWeave's stock is under pressure, trading between $104 and $105, with a decline of over 20% in the past week.

- Investor enthusiasm for the company's $14.2 billion AI computing deal with Meta has diminished amid significant losses and high capital expenditures.

- Analysts warn that a drop below $100 could trigger further selling, while options traders anticipate a potential 16% decline post-earnings.

- Despite projected revenue growth, concerns about unsustainable growth, high debt, and capital expenditures remain prevalent.

CoreWeave (NASDAQ: CRWV) is facing downward pressure on its stock. Shares are currently trading between $104 and $105. The company has seen recent declines of over 20 percent in the previous week.

An article published in early November raised concerns that investor enthusiasm for CoreWeave’s substantial $14.2 billion long-term AI computing deal with Meta Platforms, announced in late September, has waned amid the company’s ongoing significant losses and high capital expenditures. On November 8, the stock dropped to a daily low of around $100 before slightly recovering, with trading volume reaching 25 million shares, compared to an average of 19 million.

Analysts and market commentators are indicating near-term risks, suggesting that a breakdown below $100 could prompt additional technical selling. Options traders are pricing in a potential 16 percent post-earnings drop, as the stock is trading below critical moving averages.

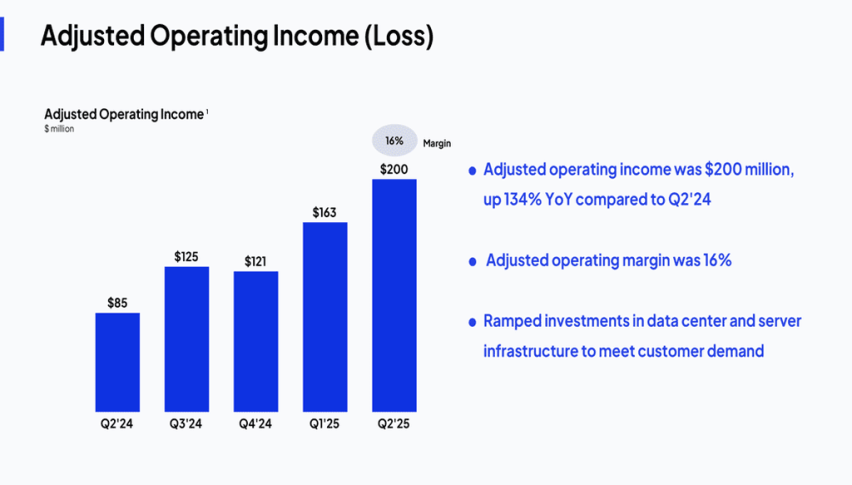

The announcement of the $14.2 billion contract with Meta, extending through 2031 with options for further extensions, initially led to a 12% increase in shares. This development is seen as a way to provide long-term revenue visibility and reduce reliance on Microsoft, which accounted for 71% of revenue in Q2. However, concerns about unsustainable growth persist. In Q2 2025, revenue tripled to $1.21 billion, but net losses rose to $290.5 million due to over $3 billion spent on capital expenditures for data centers.

Debt surged to $11 billion, raising worries about liquidity and reliance on Nvidia, compounded by negative free cash flow of -$11 million on a trailing twelve-month basis. The company’s price-to-earnings ratio stands at -41.77, reflecting these losses, and it currently trades at about 10 times forward sales. Some valuation models suggest it may be overvalued by as much as 628%.

Looking ahead to the Q3 earnings outlook, scheduled for November 10, revenue is projected to be between $1.26 billion and $1.30 billion, compared to analyst expectations of $1.25 billion. For the entire year, revenue guidance is between $5.15 billion and $5.35 billion. While strong top-line growth is expected due to demand for AI, attention will focus on reducing losses, managing capital expenditures (projected at $20 billion to $23 billion for 2025), and providing updates on financing following the Core Scientific deal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM