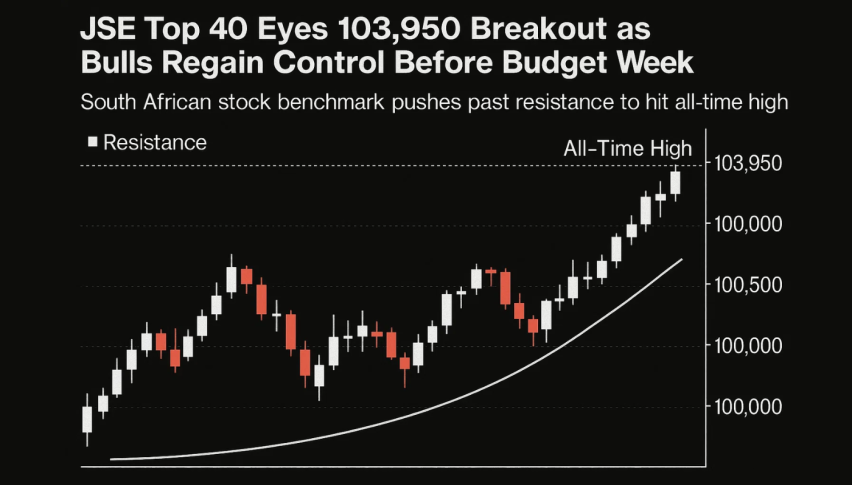

JSE Top 40 Eyes 103,950 Breakout as Bulls Regain Control Before Budget Week

The South Africa JSE Top 40 Index (J200) is trading near 102,390 ZAR, recovering modestly after opening the week lower on Monday.

Quick overview

- The South Africa JSE Top 40 Index is currently trading near 102,390 ZAR, recovering from an earlier decline due to global market corrections and domestic fiscal uncertainty.

- Investors are awaiting the upcoming 2025 Medium-Term Budget Statement for insights into government spending priorities and fiscal strategies.

- Economists project a slight improvement in the fiscal position, with the budget deficit expected to shrink to 4.4% of GDP for FY2025.

- Technical analysis shows the JSE Top 40 forming a symmetrical triangle, with potential breakout targets at 103,950 ZAR and 105,060 ZAR.

The South Africa JSE Top 40 Index (J200) is trading near 102,390 ZAR, recovering modestly after opening the week lower on Monday. The earlier decline came as investors weighed global market corrections, softening commodity prices, and domestic fiscal uncertainty, which briefly dragged the Top 40 down 1% in early trade.

Sentiment on South African equities has been hanging back, with people waiting to see what next weeks 2025 Medium-Term Budget Statement has to say. The fiscal update is going to give us a better idea of what the government are trying to do with its spending priorities, debt and trying to get the country’s finances back on track even though growth has been slow.

Fiscal Outlook: Treasury Seeks to Narrow Deficit

Economists at Nedbank anticipate a slightly improved fiscal position, projecting the consolidated budget deficit to shrink to 4.4% of GDP for FY2025, from 4.8% in the prior budget. Over the medium term, the shortfall is expected to stay above 3%, though a primary surplus of 2% of GDP could emerge by FY2028/29.

These projections suggest gradual recovery supported by lower borrowing costs, stabilizing inflation, and improvements in energy and logistics infrastructure, which may encourage private investment and consumer spending.

JSE Top 40 Technical Analysis: Symmetrical Triangle Takes Shape

On the technical front, the JSE Top 40 has been coiling within a symmetrical triangle, trading between 101,200 ZAR and 102,750 ZAR. The 20-EMA has turned upward, signaling a shift in short-term momentum, while the RSI at 58 suggests improving sentiment without entering overbought territory.

Recent Doji and spinning top candles indicate indecision, often a precursor to volatility. A successful breakout above the 102750 ZAR level could give us a chance to aim for 103950 ZAR and then onto 105060 ZAR – levels we saw previously that acted as swing highs. On the flipside, if the index is rejected, it could head back down to the line of trendline support at 101200 ZAR or 100140 ZAR.

Trade Setup:

- Entry: Above 102,750 ZAR (on volume confirmation)

- Stop-Loss: Below 101,200 ZAR

- Targets: 103,950 – 105,060 ZAR

Rand and Bonds: Calm Before Fiscal Clarity

The South African rand is just ticking along near R18.35 to the dollar, holding onto a bit of a gain after a slightly softer US dollar following that soft US jobs report. Meanwhile, the 2035 government bond yield has gone up by just 1 basis point to 8.775% – which is a pretty subtle sign that people are getting a bit cautious ahead of the budget update.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM